Analyst: ‘Deflationary forces’ present an optimistic outlook for BTC, ETH in 2022

Consider the hypothesis: deflation could swap inflation next year. Well, if that’s the case, cryptocurrency can prevail over other asset classes. This is the hypothesis based on which Bloomberg Intelligence analyst Mike McGlone is bullish on the outlook for Bitcoin and Ethereum in 2022. He says “deflationary forces” will take the crypto assets to new heights.

Cryptos, Fed, and the 2022 End Game

McGlone in his December edition of Bloomberg’s Global Cryptocurrency Outlook published bullish cases for both Bitcoin and Ethereum. He expects the U.S to embrace cryptocurrencies in 2022 with proper regulation and related bullish price implications. Given the proliferation of revolutionary technologies such as crypto dollars and non-fungible tokens (NFTs) – the possibilities are endless.

The current global financial system is passing through tough times, to say the least. Mainly due to the COVID-19 pandemic. It led to immediate disruptions, crippled productivity. Although, built a solid base for future monetary issues.

Numerous central banks started printing vast amounts of fiat currencies to alleviate some of the short-term pain. Result? the inflation rates have surged to unseen levels in decades. In the USA it stands at over 6% – the highest it has been in nearly 40 years.

National currencies, such as the U.S dollar, are slowly losing their purchasing power.

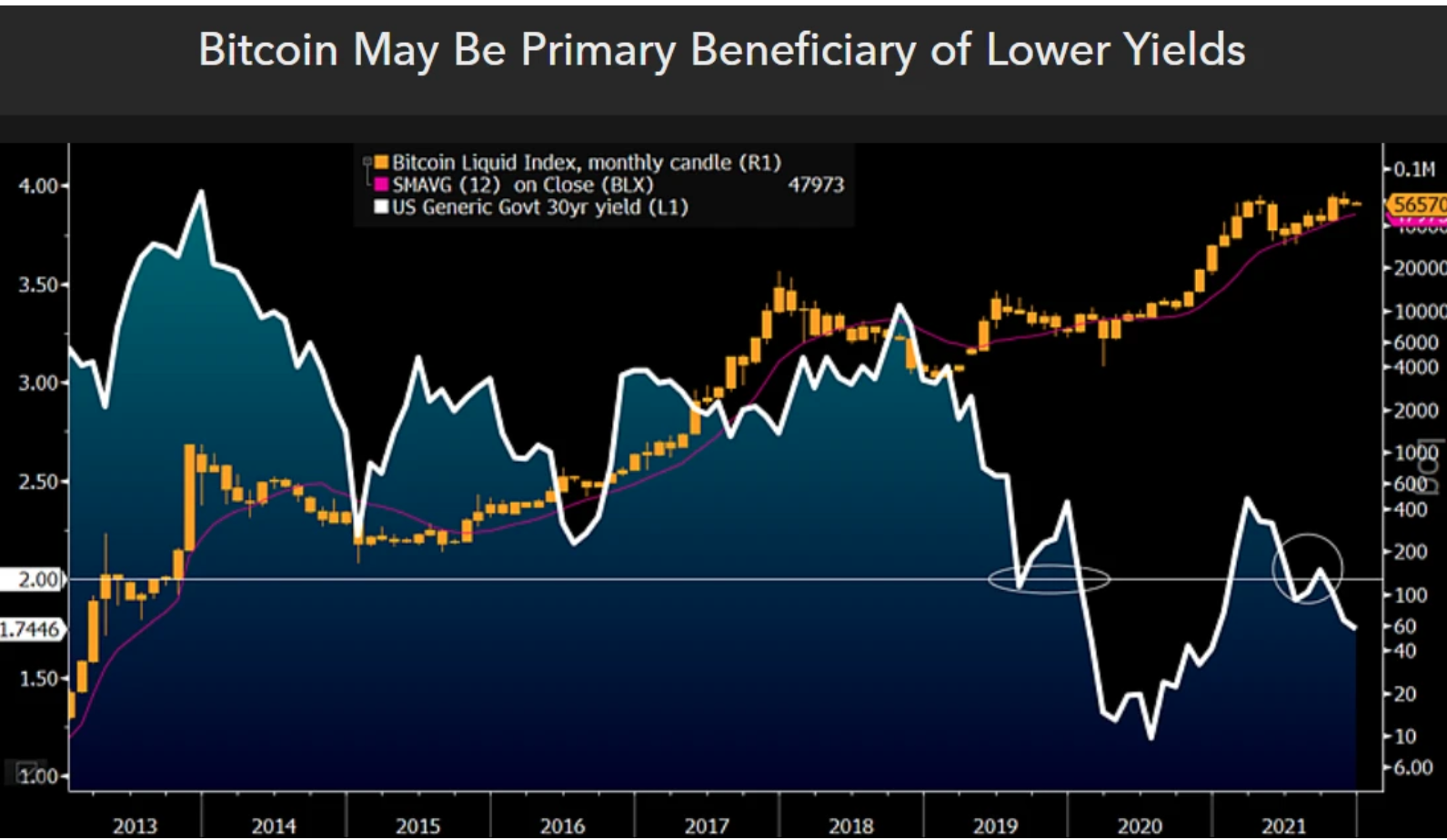

“Renewed impetus from the Federal Reserve to take away the punch bowl, and declining bond yields may point to a macroeconomic environment in 2022 that favors top cryptocurrencies Bitcoin and Ethereum,” the report added.

Well, the declining yield on the Treasury long bond did point to risks of reviving deflationary forces in 2022.

(Context: Benchmark 10-year yields fell two basis points to 1.48%, after early rising as high as 1.52%. The move was mostly driven by a decline in inflation expectations, with the 10-year breakeven rate slipping four basis points to 2.45%. The real yields, or rates on Treasury Inflation-Protected Securities, rose above minus 1%.)

Crypto assets show divergent strength versus equities near the end of 2021 may portend continued digital-asset out-performance in 2022. The report noted,

“A primary force to reverse expectations for Federal Reserve tightening in 2022 is a drop in the stock market, which may be a bit of a win-win for Bitcoin.”

Consider the graphics below that depicts the one-year-out Fed funds future pricing for higher rates in 2022.

Source: Bloomberg Intelligence

The failed attempts, as shown above, by the Federal Reserve to sustain tightening cycles – hints at the US “following Japan and Europe toward negative yields.”

Having said that, BTC remains in a price-discovery mode and is a risk asset, and has been rising with the equity tide.

“Bitcoin will face initial headwinds if the stock market drops, but to the extent that declining equity prices pressure bond yields and incentivize more central-bank liquidity, the crypto may come out a primary beneficiary.”

Transition period

As mentioned above, U.S Treasury long bond has consolidated below the 2% mark despite widespread consensus for higher yields.

“This may be the primary indicator of a transition back to a more deflationary environment in 2022 favoring Bitcoin.”

Look at the graph below, the U.S yields have taken a downturn into negative territory. The upcoming digital reserve asset may be a top standout to benefit.

Looking at the graph, the Senior Commodity Strategist asserted:

“Funds have been moving away from old analog gold and toward Bitcoin and Ethereum. The question for 2022 centers on reversal or acceleration of these flows. With bond yields in decline, our bias is toward the latter.”

Portfolio allocations risks

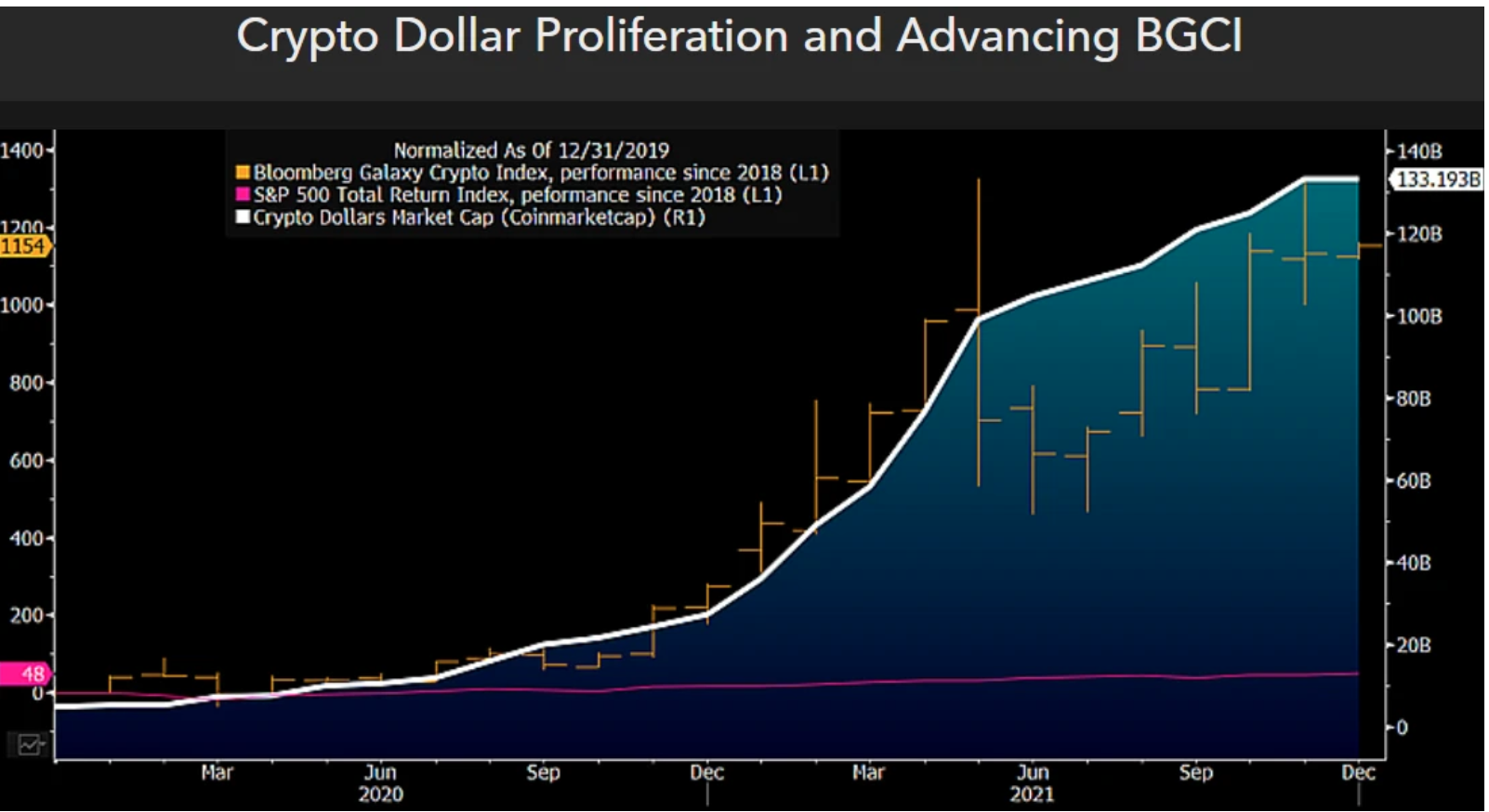

According to McGlone, money managers are now facing “greater risks” by continuing to have portfolios without crypto, showing that Bloomberg Galaxy Crypto Index (BGCI) is up 1200% since 2019 versus 90% for the S&P 500:

“Past performance is no indicator of future results, but when a new asset class outperforms incumbents, naysayers have little choice but to join in. We see this process playing a primary role in 2022, as money managers may face greater risks if they continue to have no portfolio allocations to cryptos.”

Here’s why: The graph showcases the immense rise of the crypto dollar market cap. It stands above $130 billion.

Source: Bloomberg Intelligence

Overall, the “deflationary forces” will prevail next year and inflation will stop spreading across the globe. This could help Bitcoin, even Oil and Gold to reach a significant mark.

$100,000 #Bitcoin, $50 #Oil, $2,000 #Gold? 2022 Outlook in 5 Charts – Peaking commodities and the declining yield on the Treasury long bond point to risks of reviving deflationary forces in 2022, with positive ramifications on Bitcoin and gold. pic.twitter.com/j3VNAOCwuz

— Mike McGlone (@mikemcglone11) December 9, 2021

Overall, reports such as this-indeed injects some optimism amidst the growing concerns regarding the digital asset market.