Aave’s foray into the zkEVM space- Evaluating the nitty gritty of it all

– Aave ventures into the zkEVM space through the zkSync Era protocol.

– Despite surging prices, indicators suggest a bearish future for AAVE.

Aave [AAVE], a decentralized lending and borrowing protocol, has been making large improvements to its protocol to survive in the highly competitive DeFi space.

In a 14 April tweet, the protocol said that its governance made progress on various fronts, including venturing into the zkEVM space, Risk Stewards, and whitelisting new protocols.

A [Temp Check] is currently running to deploy Aave V3 on the @zksync Era Mainnet, expanding Aave’s presence and tapping into the growing zkEVM ecosystem.https://t.co/ps1RMl7Sva

— Aave (@AaveAave) April 14, 2023

Read Aave’s Price Prediction 2023-2024

Aave is set to enter the zkEVM space via the zkSync Era protocol after launching on the zkSync’s V2 testnet. With zkSync Era Mainnet’s release, the protocol can now capitalize on previous development efforts, making it a central hub for mainnet activity and liquidity.

The motivation behind the decision to launch on zkSync is to attract more users to the protocol. It also wants to be seen as the premier borrowing platform within the growing zk ecosystem.

Aave is also set to whitelist liquidity transport protocol Stargate on its ecosystem. This will enable users to reliably and safely access assets on a variety of chains.

In terms of governance, the Aave protocol has proposed a 2-month trial of shielded voting. Shielded voting is a mechanism that allows voters to keep their votes private throughout the voting process, only revealing their choices and the outcome after the vote has ended.

The current state of Aave

The protocol’s health continued to decline even with the work being done to make improvements.

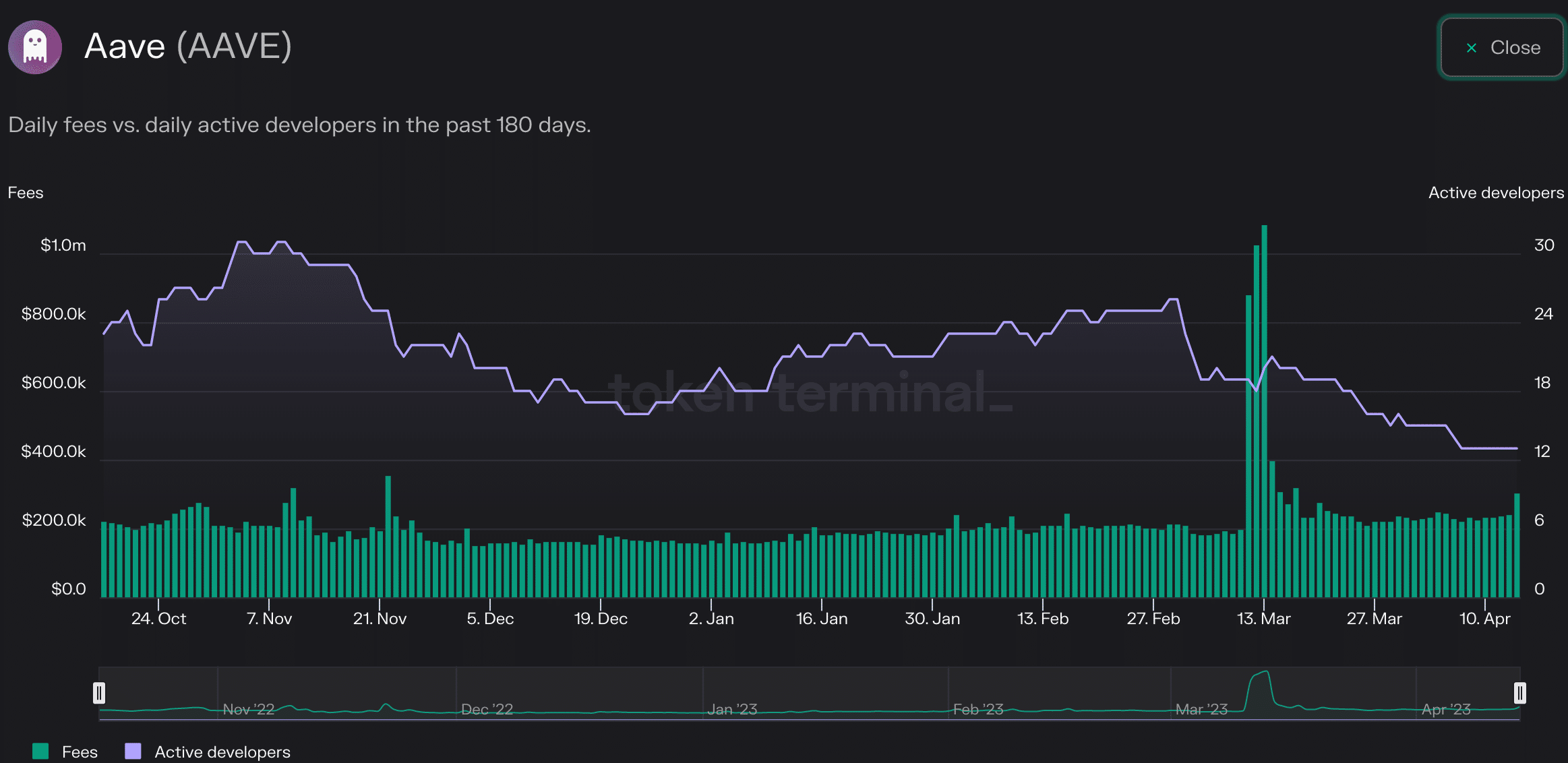

According to Token Terminal’s data, the fees collected by the network fell by 17.7% over the last month. Additionally, the number of active developers working on the protocol fell by 35% during the same period.

A decline in active developers suggests that new upgrades and updates could take longer than usual to go live.

Realistic or not, here’s AAVE’s market cap in BTC terms

Should holders worry?

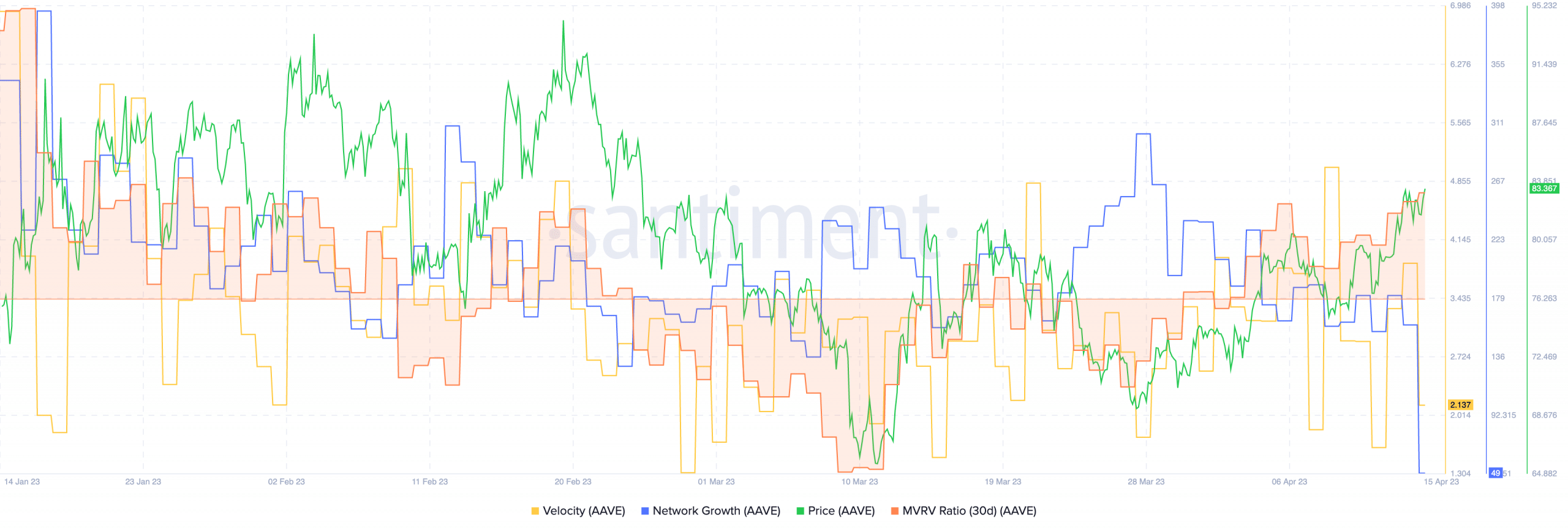

AAVE’s network growth started to fall despite the soaring prices of the token. This showed that new addresses were not as interested in the token. Its velocity also declined materially.

Due to the rising prices, AAVE’s MVRV ratio also jumped, implying that there was a higher chance of a sell-off in the future.