Uniswap v3 on BNB Chain: A month on, examining performance and metrics

-Uniswap v3 launched on the BNB chain generating high expectations.

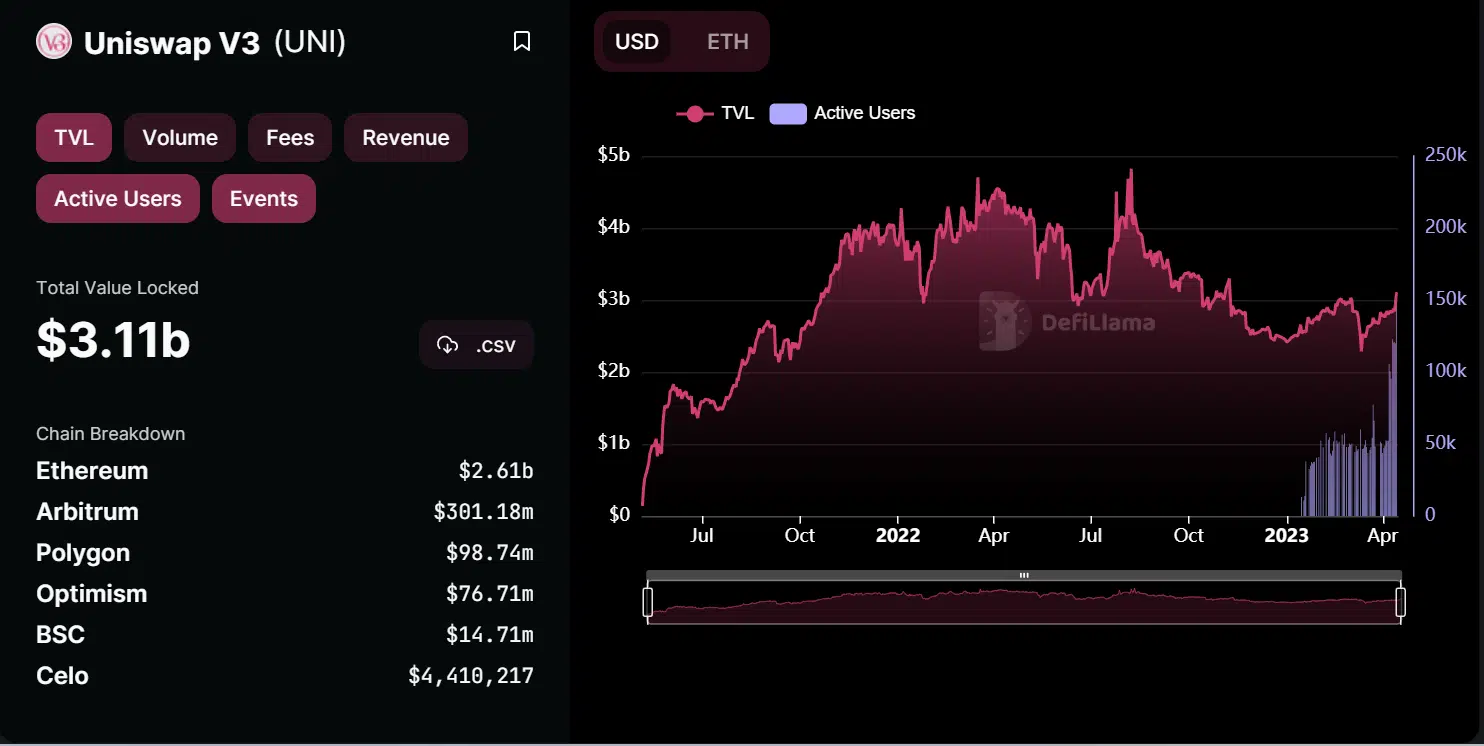

-TVL and active addresses showed an uptrend after launch, but MVRV has declined.

Exactly a month ago, the Uniswap V3 debuted on the BNB chain, generating high expectations for the decentralized exchange (DEX). But the question is- How has the platform performed since then, and what is its current state?

Read Uniswap (UNI) Price Prediction 2023-24

Uniswap v3 lands on BNB chain

In February, a controversial proposal by 0x Plasma Labs to bring Uniswap version 3 (v3) to BNB Chain was approved by more than 55 million UNI token holders.

0xPlasma Labs, a DeFi platform, first presented their plan to launch v3 on BNB Chain in December 2022. Uniswap governance approved the proposal on 22 January with 80% support.

0xPlasma estimated that deploying v3 on BNB Chain would increase Uniswap’s TVL by $1B. After months of internal conflict, the leading decentralized exchange went live on BNB Chain on 15 March.

Uniswap’s v3 version introduced concentrated liquidity, a feature that greatly enhanced the efficiency of capital usage for DEXes.

In Uniswap v3, liquidity providers’ positions are no longer interchangeable because they can now provide liquidity within specific price ranges.

This means that LP holdings in Uniswap v3 cannot be represented in the underlying protocol as ERC20 tokens, unlike in Uniswap v2.

Uniswap v3 volume and TVL post-BNB launch

According to DefiLlama, an analysis of the Total Value Locked (TVL) and trading volume on Uniswap v3 revealed a surge in volume and a decrease in TVL leading up to the launch on BNB.

On 11 March, trading volume spiked to over $13 billion, while the TVL was around $2.5 billion. However, following the launch on the BNB chain, the TVL has been steadily increasing and was over $3 billion, at press time.

Active user surges as MVRV declines

Examining another on-chain metric of Uniswap v3, an upward trend was observed. The DefiLlama active user metric revealed that the number of active users on the platform had steadily grown.

The metric surpassed 155,000, which marked a substantial increase from the 50,000 figure recorded earlier in April.

How many are 1,10,100 UNIs worth today

On the other hand, the 30-day Market Value to Realized Value ratio (MVRV) for UNI suggested that despite the positive on-chain metrics, the asset had not been performing well.

As of this writing, the MVRV was over -19.2%. The current state indicated that UNI was significantly undervalued at its present price range. However, it also suggested a possibility of a price correction to the upside.