Analyzing returns on DeFi ETFs v. SUSHI, UNI, COMP, AAVE

Among the market’s top-50 altcoins, the following DeFi tokens – SUSHI, AAVE, UNI, COMP, and MKR – are positioned for double-digit growth in the near-term based on their price action YTD. In fact, the 24-hour trade volume for these tokens seemed to be indicative of the hike in liquidity too.

According to top-tier trade volume data from CryptoCompare, among the altcoins that have made double-digit gains over the last few trading sessions, DeFi protocols made up over 50%. However, investing directly in protocols may not be as ideal as investing in ETFs considering metrics such as an increase in valuation and returns.

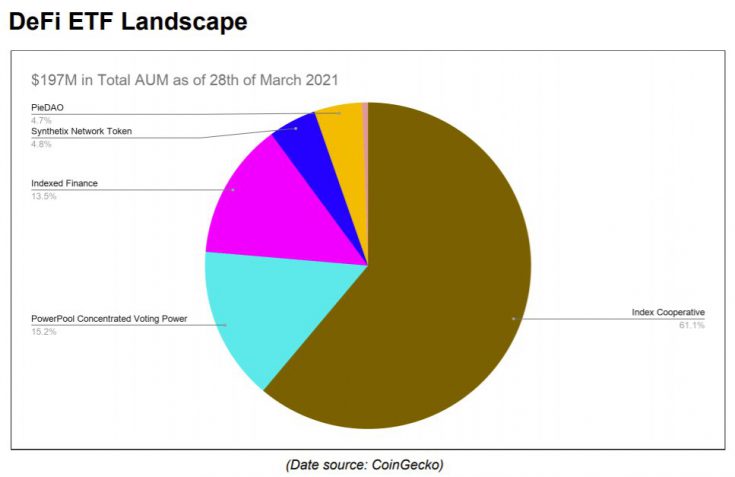

There has been an upward trend in the investment inflows into DeFi protocols and ETFs, however, the hike in total AUM has been relatively slower than it was back in January or February 2021.

Data Source: CoinGecko

The activity of traders in DeFi protocols and ETFs is up, especially since Elon Musk’s tweet on DeFi less than a week ago. Here, it’s important to note that the volatility of returns on DeFi protocols is a double-edged sword to the retail trader. Returns can either push an asset north by double digits or drop it below its previous ATH within a week or over an even shorter time frame.

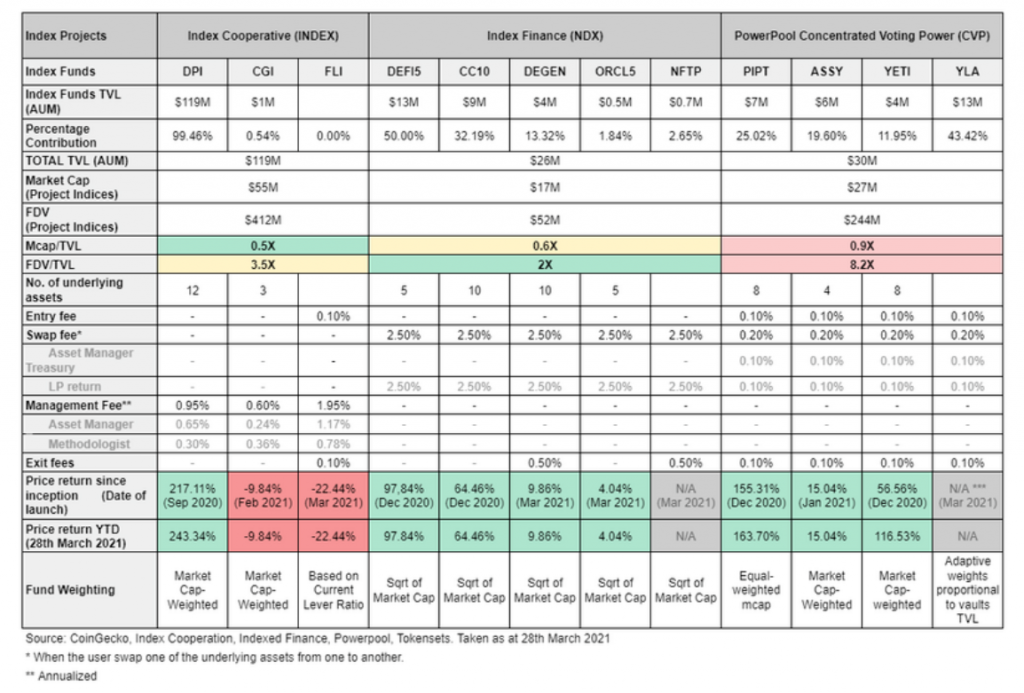

The most effective to navigate this volatility and its impact on unrealized profits and losses is to invest in ETFs. The performance of top DeFi ETFs relies on the following metrics,

Source: CoinGecko

The performance of the top three DeFi indices is indicative of the 10x growth of DeFi that is expected over the following weeks as investment inflows increase and Bitcoin remains rangebound below $60,000.

Besides, Ethereum’s increasing correlation with Bitcoin, which has exceeded 80% of late, is conducive to the rangebound price action of both assets and allows room for DeFi protocols and ETFs to offer higher returns with high volatility. For over 14 DeFi index tokens, there are $204M in AUM in DeFi currently. Besides, the said figure is only 0.5% of the TVL.

Based on the market barometer and data on top-3 indices, the key metrics are valuation, fund fees, and fee structure. Though the DeFi market cap has grown by over 5000% in the past year, not all traders care to watch their portfolio at all times. The strategy of passive DeFi investing, investing in a fund instead of the protocols, is relatively cheaper for an ETF like DEFI5.

Exposed to DeFi Blue chips, it is relatively cheaper and profitable to buy Uniswap rather than minting it, and the same goes for other assets in DEFI5. These popular DeFi ETFs are set to explode if the activity in high volume markets on spot exchanges continues following the same trend.