ApeCoin nears $4 once again, but can the bulls keep up the pressure?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ApeCoin reclaimed a bullish market structure

- Despite recent gains, a move into the $4.5 zone could see a strong wave of selling

Bitcoin had a bearish November. Its ascent to $21.5k was brutally ended, and BTC bulls fought to hold on to the $16k-$16.2k area of support. To the north, $16.7k and $17k posed some resistance. In these conditions, ApeCoin can be forgiven for seeing dramatic losses on the price charts as well.

Read ApeCoin’s Price Prediction 2023-24

It seemed that it could offer another shorting opportunity in the next few days. A move upward into a zone of resistance could see a sharp reaction from APE, especially if Bitcoin also tumbled beneath the $16k mark.

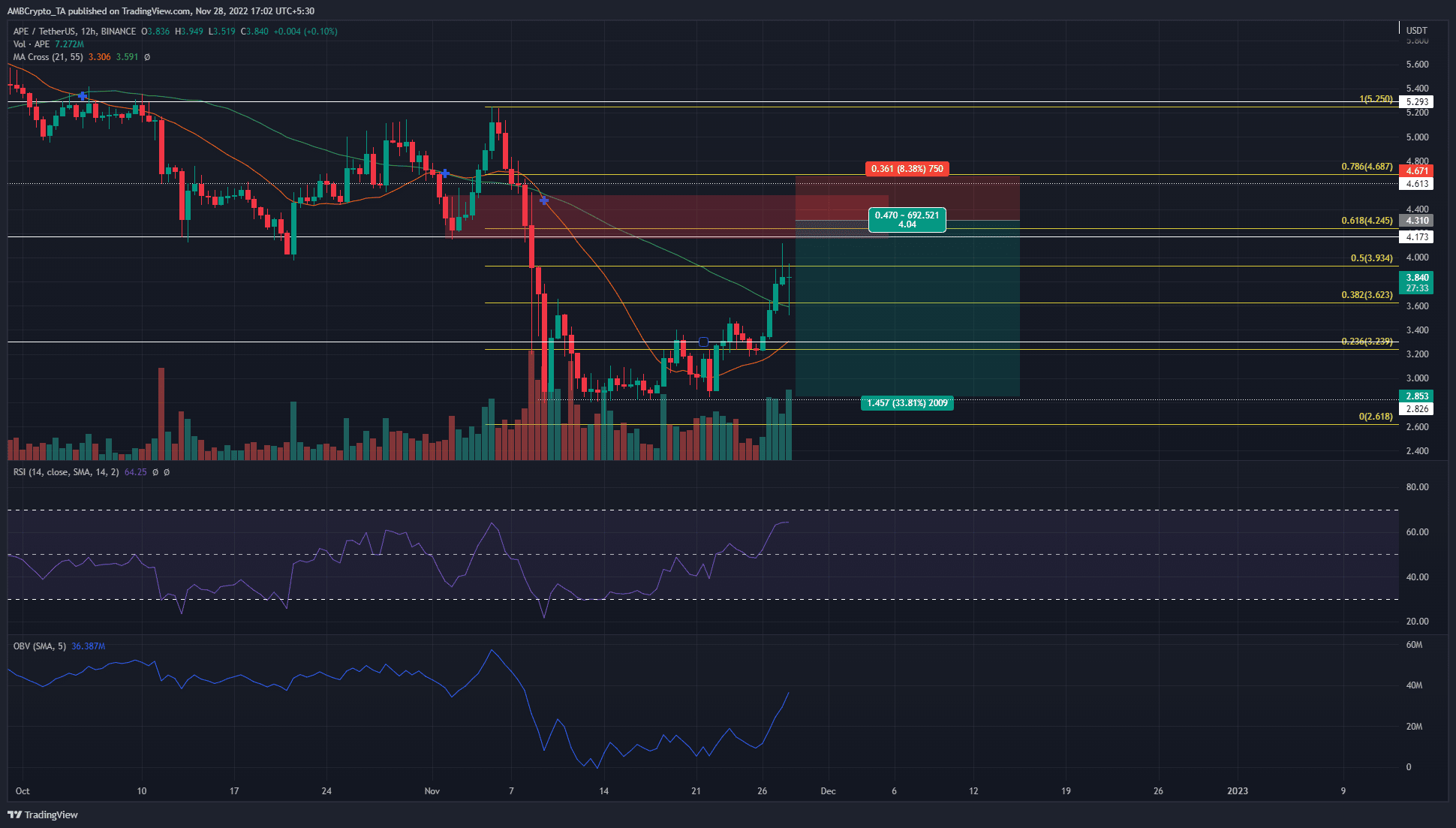

A bearish breaker from early November could see APE rejected

ApeCoin saw a sharp drop in price in early November alongside the rest of the market. The plunge took it from $5.2 to $2.3, a drop of 46%. APE meandered for some time at $2.85-$2.9 before climbing toward $4.

This recovery began on 16 November and looked to be in continuation at the time of writing. The RSI climbed back above neutral 50 while the OBV has also made some gains in the past two weeks.

On 2 November, the price formed a bullish order block at the $4.5 mark. Highlighted in red, this area has since been broken as a support zone. Now, it was a bearish breaker and could act as a firm resistance zone.

The price had a bullish market structure on the 12-hour timeframe as it broke above the previous lower high and has registered higher highs in the past week. However, the market sentiment was not in favor of the bulls yet. Short-term rallies were possible but a market-wide trend shift to bullish could take months to materialize.

The confluence on the bearish breaker with the 61.8%-78.6% retracement levels meant that the $4-$4.5 area was likely to see APE rejected sharply. Therefore, a shorting opportunity targeting the $2.8-$3 zone can be attempted. A move above $4.5-$4.6 would invalidate this bearish notion.

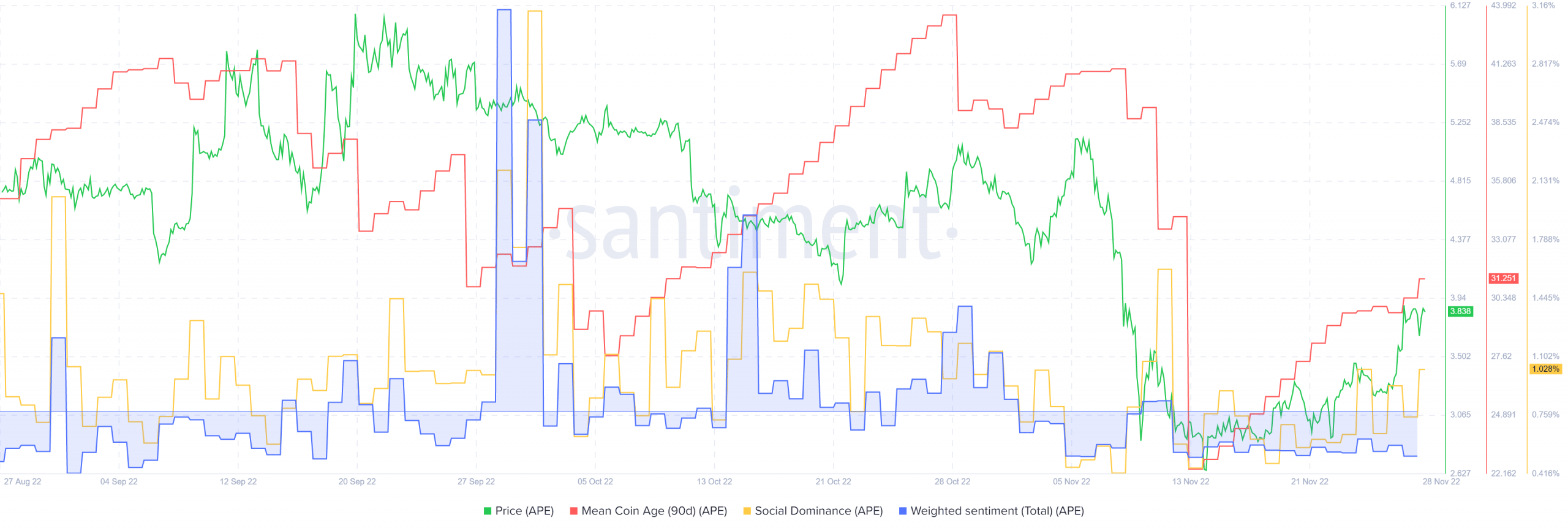

Weighted sentiment remained negative as social dominance fared poorly for ApeCoin

Source: Santiment

The weighted sentiment was negative behind ApeCoin. This was a little surprising because APE has rallied by nearly 35% from the lows at $2.8. Meanwhile, the mean coin age metric has also climbed up the charts to show some accumulation across the network. Social dominance, alongside sentiment, was weak. ApeCoin did not capture the imagination of market participants recently.

A sharp drop in the mean coin age metric could be indicative of a lot of ApeCoin changing hands and could reflect a wave of selling in the market. Hence, apart from the price action, traders can also keep an eye on on-chain metrics.