ApeCoin’s [APE] +50% rally – Can it really keep it up?

ApeCoin, the native token for the BoredApeYachtClub NFT project, was the best-performing cryptocurrency over the past week. In just a week, it surged by more than 50% as the platform’s developer community hinted at a major metaverse project. Following the same, APE rallied close to a high of $18, even surpassing Decentraland’s MANA to become the market’s largest metaverse token.

That being said, a few on-chain metrics observed significant divergence for the flagship token. Something that might prompt a sell-off soon.

Trend change for the worse?

? #Apecoin is up +52% in the past 7 days, and has revealed some key divergences to pay attention to. A massive movement of dormant $APE tokens occurred right at today's local top, active addresses are fluctuating, and MVRV is high. Read our latest! ? https://t.co/XevJhqBQwb pic.twitter.com/rSelUsrdkS

— Santiment (@santimentfeed) April 23, 2022

For instance, a recent Santiment report cautioned users who might be completely bullish on the trending APE coin. Given the previous rally, the report questioned the sustainability of this rally by highlighting a few divergences in APE’s on-chain data.

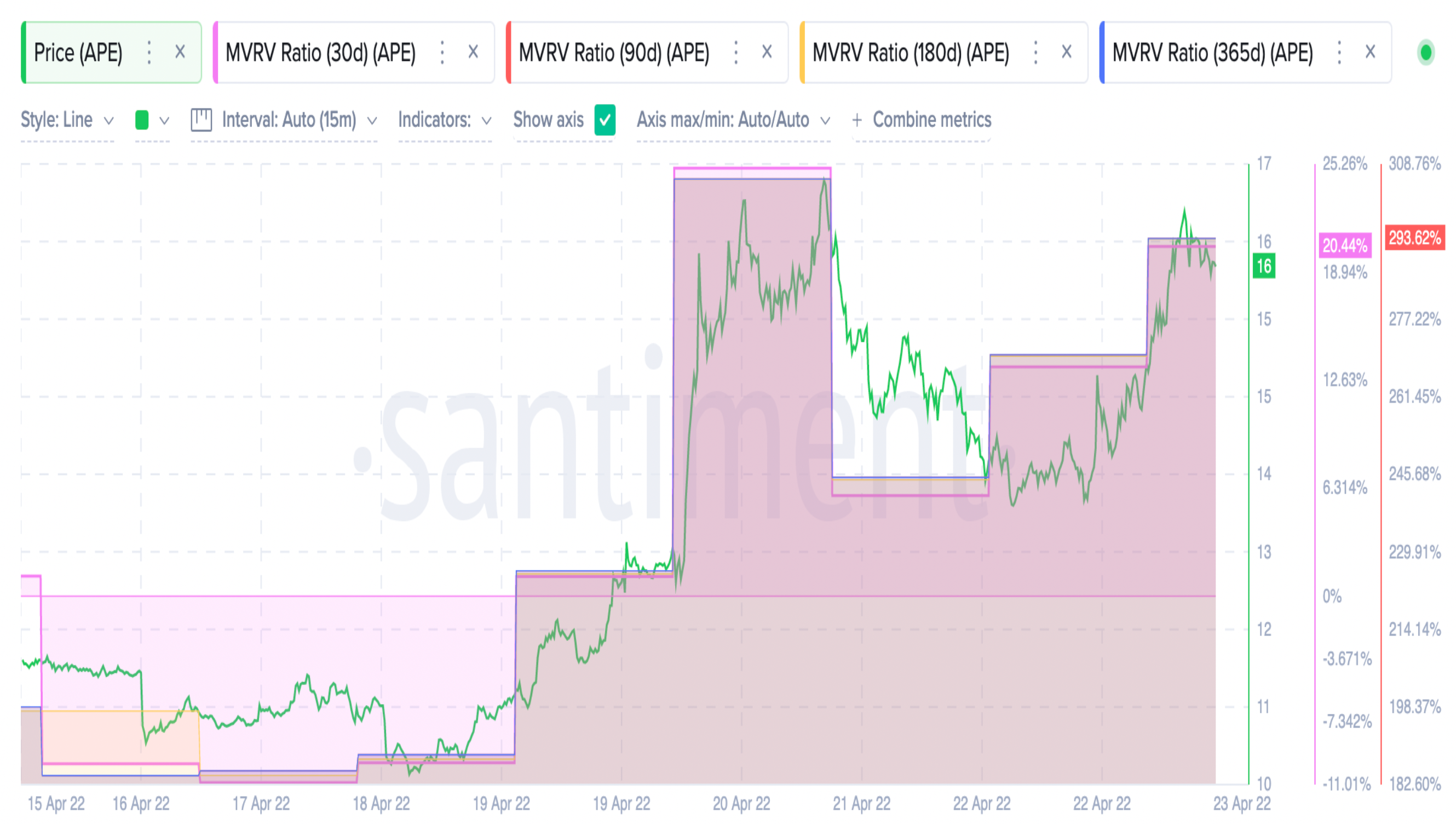

Perhaps, the most widely used and equally significant on-chain metric for APE’s price is the Market Value to Realized Value (MVRV) model.

The MVRV ratio over the given period remains HIGH. Values above one indicate that the market cap is larger than the realized one. Very high ratios here showcased an overvalued market. This could incorporate the increasing risk of a potential sell-off.

Additionally, the token’s Network Growth was stagnant, as per the report. In fact, it even declined at press time. Post-achieving a high of 2000+ on 20 April, it seemed to be somewhere around the 900-mark.

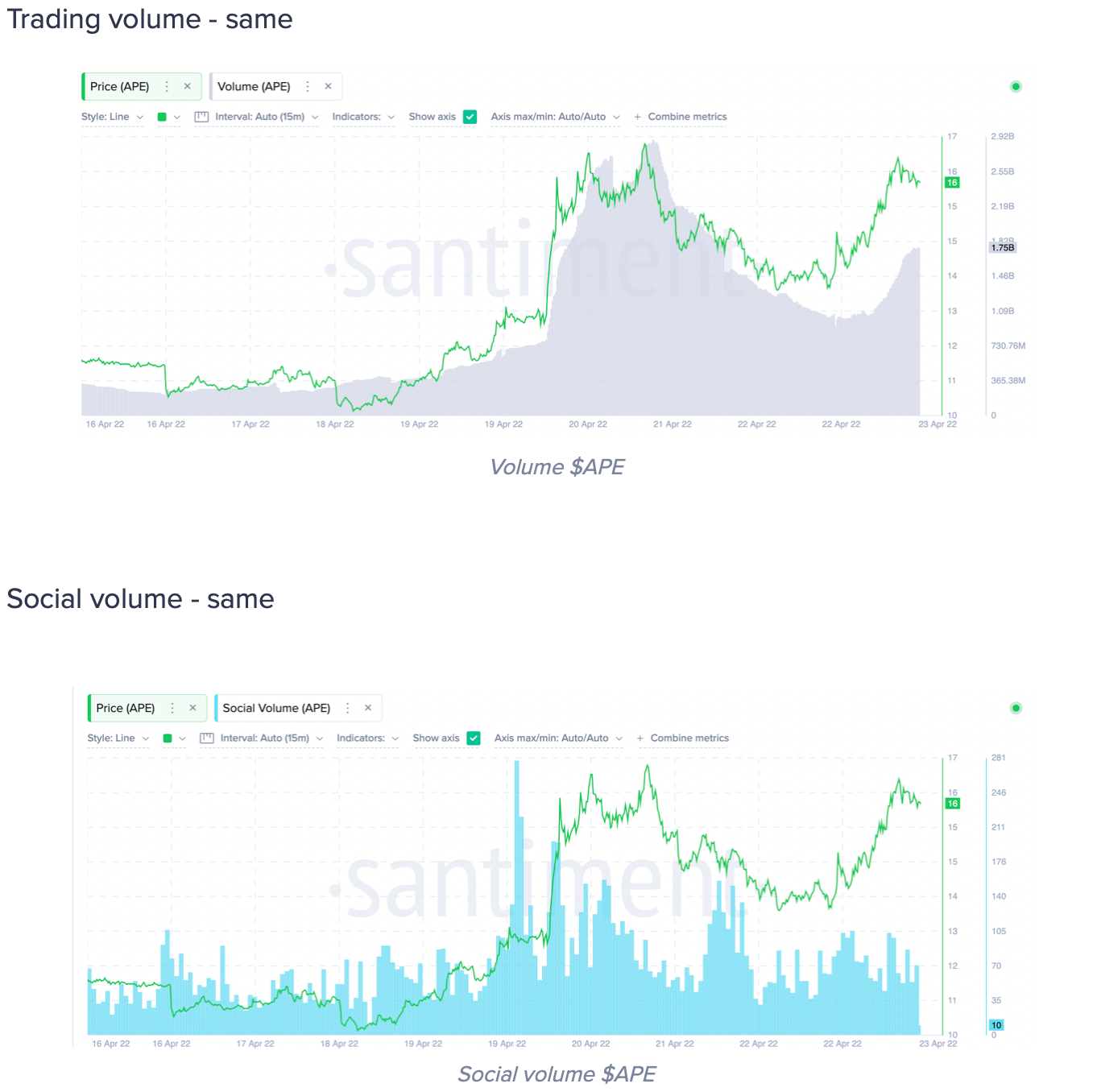

Now, to make things or rather metrics worse, APE’s trading and social volume couldn’t reciprocate the same bullishness that accompanied APE’s 50% rally. Both these metrics kept consolidating, as shown in the graphs below.

Taking a jibe

The token, at the time of writing, had suffered a 2% price correction as it traded around the $16.2-mark.

Even so, different renowned investors have reiterated some concerns about the project. Popular crypto-influencer Cobie opined that the governance proposal for ApeCoin staking might not be the best way forward for the affiliated token. In a blog post titled “the death of staking,” Cobie took a swipe at the concept of the Bored Ape affiliated token.

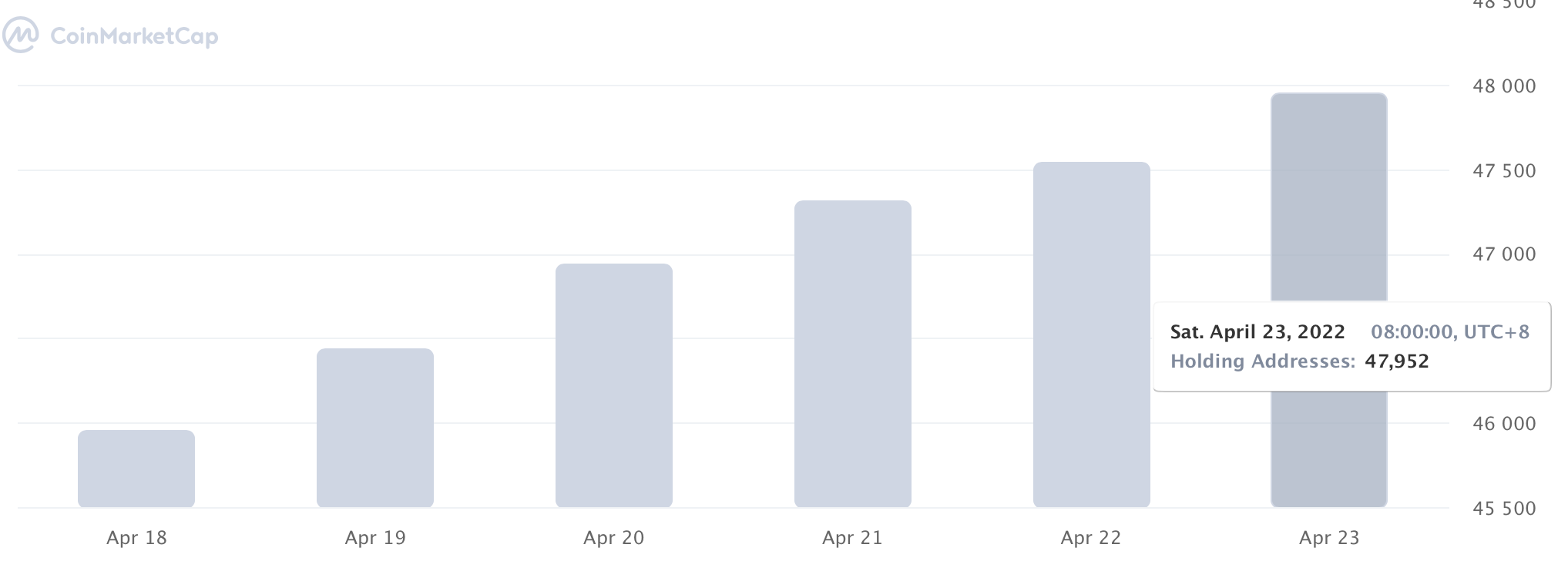

Nevertheless, it didn’t quite deter investors’ morale as the number of unique addresses that hold assets in the network kept increasing.

Source: CoinMarketCap