Are DeFi platforms Fantom, Avalanche scoring points over Ethereum

The world of DeFi ruled by Ethereum is a relatively new space when you look at the crypto space. Ethereum’s blockchain has been host to a multitude of Dapps and NFT platforms which have given it the prime rank.

But with the emergence of multiple L1 and L2 scaling solutions, could some blockchains overthrow Ethereum from its leading position?

Both Fantom and Avalanche recently launched incentive programs for rewarding developers who build on the networks. Ever since, the total value locked (TVL) on both the chains rose significantly.

While at the same time Ethereum’s TVL dropped by almost $30 billion. There is a good chance that Fantom and Avalanche have been pulling in users and liquidity since both the chains are Ethereum Virtual Machine (EVM) compatible.

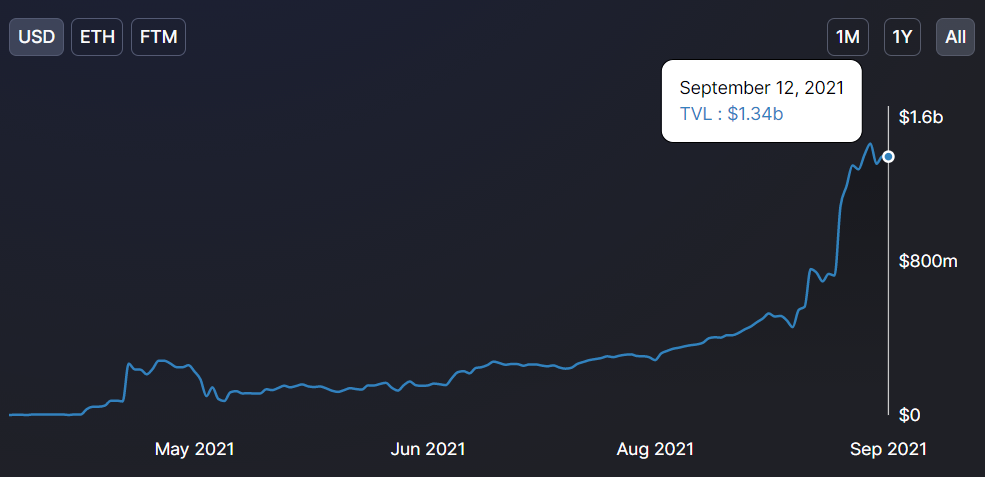

Since Fantom’s announcement, its TVL has gone from $755 million to $1.34 billion.

Fantom’s TVL has peaked to $1.34 billion | Source: DeFiLlama – AMBCrypto

The network has been growing at a rapid pace and more people were becoming a part of it. Active addresses on Fantom peaked at 3.2k when its average used to be around 200. Additionally, transaction volumes reached $633 million, as daily transactions touched 1.7 million.

Fantom network stats are at their peak as well | Source: Santiment – AMBCrypto

Similarly, Avalanche launched a $180 million incentive program as well. This was done to provide liquidity and support to the likes of AAVE and Curve which had launched on the network initially. Now, it also has Sushiswap and Paraswap on the list.

Avalanche’s TVL since rose by 676%, up from $311 million to $2.41 billion. Its EVM compatibility allows faster and 5 times cheaper transfer of ETH assets to AVAX. This may have incentivized many people to move to Avalanche which boasts of a transaction speed of 10,000 transactions per second.

Avalanche’s TVL has peaked to $1.34 billion | Source: DeFiLlama – AMBCrypto

What about their prices?

The price of their tokens observed a significant growth, as FTM rose by 163% since then. Similarly, AVAX has risen by 164%, in fact, 70% just in the last 4 days.

However, given FTM’s 56% whale domination, it seems like a riskier asset, susceptible to whale dumping. But since both coins have risen so significantly, their high volatility also puts them on the path to corrections.

Avalanche rallied by 164% | Source: TradingView – AMBCrypto

So investors, make sure to do your research thoroughly before making any investment decisions.