Are Ethereum whales selling their holdings?

![Are Ethereum [ETH] whales selling their holdings? Here are the details..](https://ambcrypto.com/wp-content/uploads/2023/06/ETH.png)

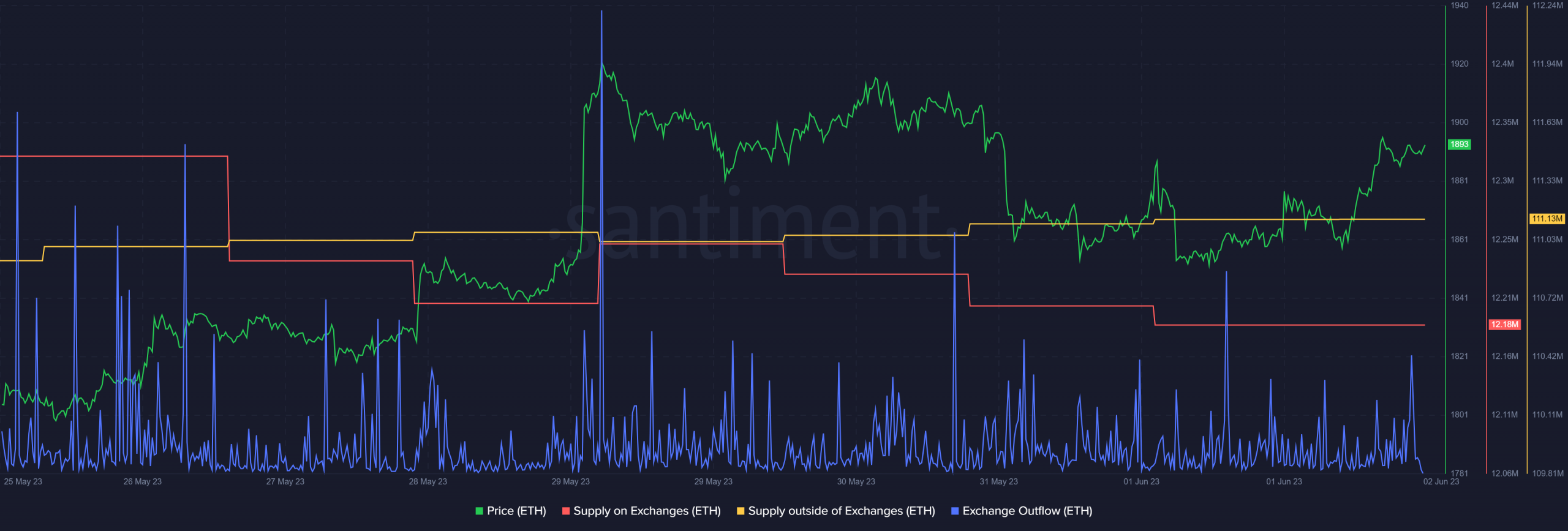

- Ethereum’s supply on and outside of exchanges changed little over the last week.

- ETH’s price increased by over 1.5% in the last 24 hours, and indicators were bullish.

After crossing the $1,900 mark, Ethereum’s [ETH] price has once again settled under that zone. Glassnode’s data revealed that a reason behind this could be a sell-off by the big players in the crypto space. Should ETH investors be concerned about another price correction in the near term?

Ethereum’s supply on exchanges is stagnant

As per Glassnode Alerts’ tweet, Ethereum’s number of addresses holding over 100 coins just reached a one month low of 46,417. The previous 6-month low of 46,418 was observed on 30 May. A decline in the metric suggested that the big players in the crypto space were actually selling their assets.

? #Ethereum $ETH Number of Addresses Holding 100+ Coins just reached a 6-month low of 46,417

Previous 6-month low of 46,418 was observed on 30 May 2023

View metric:https://t.co/FbjiMG3uFX pic.twitter.com/JVofA3Ta8D

— glassnode alerts (@glassnodealerts) June 1, 2023

As the whales were selling the token, the probability of ETH witnessing increasing selling pressure from shrimp and sharks increased substantially. Interestingly, Santiment’s data revealed that ETH’s supply changed little over the last week.

The token’s supply on and outside of exchanges was both flat, suggesting that it was not under selling pressure. However, its exchange outflow spiked, which is a positive signal.

Ethereum investors are happy

ETH investors had a comfortable week as the token’s price registered an uptick. As per CoinMarketCap, ETH’s price increased by nearly 5% in the last seven days. In the last 24 hours alone, its price went up by 1.8%. At press time, it was trading at $1,895.18, with a market capitalization of more than $227 billion.

Can ETH maintain the pump?

Though the uptrend was encouraging, the real question is whether ETH will maintain the trend. CryptoQuant’s data revealed that ETH’s net deposit on exchanges was low compared to the last seven days, which is bullish.

Read Ethereum’s [ETH] Price Prediction 2023-24

ETH’s Coinbase Premium was green, suggesting that US investors’ buying pressure is relatively strong on Coinbase. Another positive metric was its taker buy/sell ratio, which revealed that buying sentiment is dominant in the derivatives market.

A further uptrend is likely

Ethereum’s Exponential Moving Average (EMA) Ribbon displayed a bullish crossover. Its MACD revealed a bullish upper hand in the market. ETH’s Relative Strength Index (RSI) also registered an uptick, further increasing the chances of a continued price uptick in the days to follow.