Are Uniswap’s [UNI] high fees threatening the popularity of the DEX

![Are Uniswap's [UNI] high fees threatening the popularity of the DEX](https://ambcrypto.com/wp-content/uploads/2023/01/1674541367942-80766f5e-f979-49f1-af0d-d30ddc83a614-3072-e1674624531560.png)

- High fees on Uniswap could lead to users searching for cheaper alternatives.

- Order flow toxicity and a decline in organic transactions on Uniswap could cause disinterest in the DEX.

Uniswap [UNI] ranked third in the crypto space in terms of fees charged to users. According to Token Terminal’s tweet on 25 January, the cumulative fee generated by Uniswap was $30.4 million at the time of writing.

Protocols that generated the most fees during the past 30d ⤵️

? Ethereum

? OpenSea

? Uniswap

4⃣ Lido

5⃣ BNB Chain

6⃣ Convex

7⃣ GMX

8⃣ Bitcoin

9⃣ dYdX

? PancakeSwap

11. Flashbots

12. Aave

13. SynFutures

14. Lyra

15. Optimism

16. Blur

17. LooksRare

18. Filecoin

19. SushiSwap pic.twitter.com/FM8FsmdpKa— Token Terminal (@tokenterminal) January 24, 2023

This high fee structure, even though it could be because of the high trading volume occurring on the DEX, could lead users to shy away from using the platform and turn to other cheaper alternatives.

Read Uniswap’s [UNI] Price Prediction 2023-2024

Things get toxic

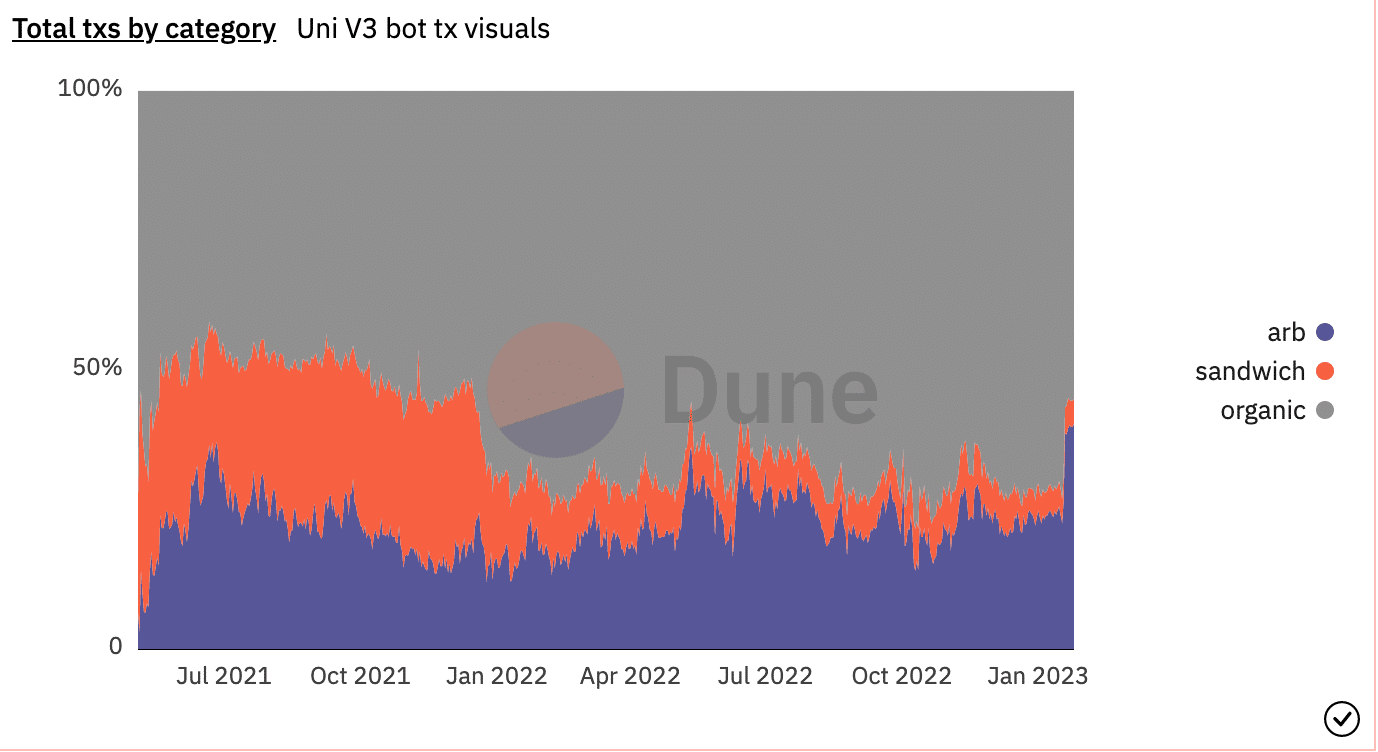

According to Dune Analytics, Order flow toxicity on Uniswap also increased. Order flow toxicity refers to the negative impact on liquidity caused by market participants placing large, aggressive orders that push prices away from fair value.

This can lead to a negative experience for other traders and can ultimately lead to a decline in trading volume on the platform.

In addition, Dune Analytics’ data showed that the number of organic transactions on the protocol declined. For the uninitiated, organic transactions refer to normal trades made by regular users.

On the other hand, the growth of arb and sandwich transactions increased. Arb transactions refer to trades that take advantage of price discrepancies between different markets, while sandwich transactions refer to a specific type of trading strategy that aim to profit from the spread between two different markets.

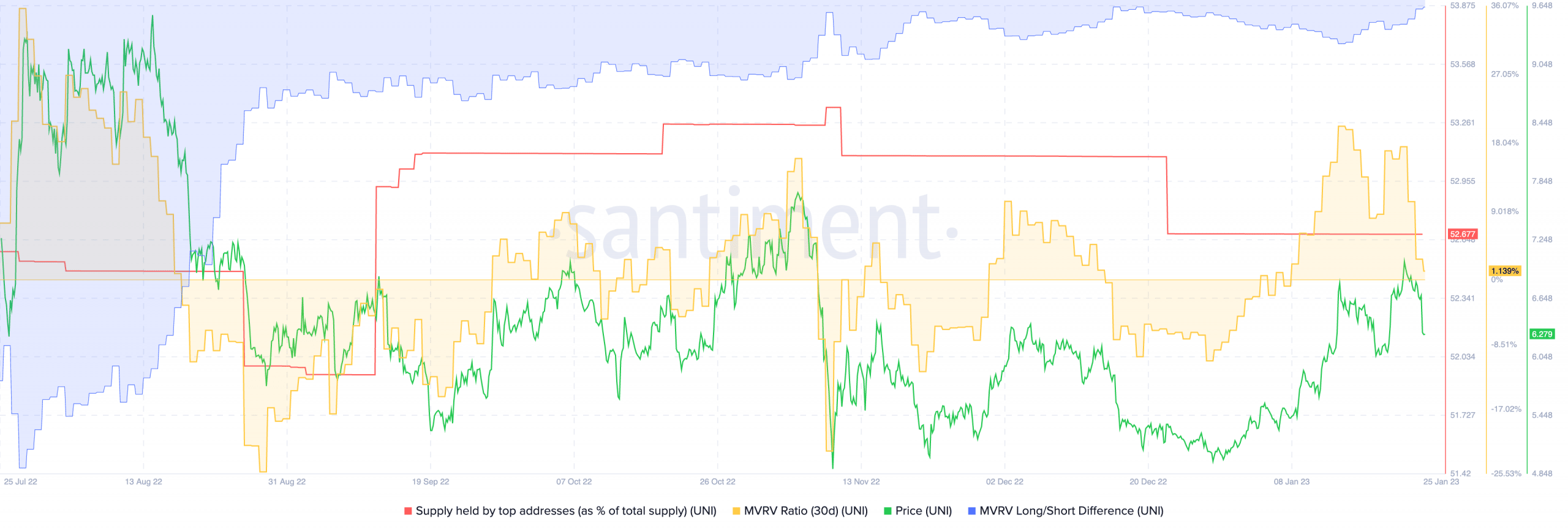

Whales shy away from UNI

These factors could be the reason why whales became disinterested in the Uniswap token. As they exited their positions, the price of UNI fell. This also affected the MVRV ratio, which declined along with the price.

The declining MVRV ratio suggested that the UNI holders sold their positions for a profit. The negative long/short ratio implied that the sell-off was primarily done by short-term holders.

How many are 1,10,100 UNI worth today?

Whether Uniswap’s high fees will ultimately lead to its detriment remains to be seen. The platform’s popularity and trading volume will probably play a significant role in determining its future success.

At the time of writing, the price of UNI was $6.29. It increased by 7.12% in the last 24 hours, according to CoinMarketCap.