Are you looking at Bitcoin, Ethereum, and the market’s altcoins all wrong

A few years back, there was chatter about Bitcoin only at the forefront of any cryptocurrency discussion. Prices and rallies revolved around the king coin’s movement and it commanded a high market dominance. Since 2019, however, the dynamic has largely changed.

With greater adoption, piquing interest, and the growth of other digital asset projects, the industry has been classified into different sectors. What’s more, their performances have varied significantly over the last few bullish/bearish trends too.

Meet the Sectors

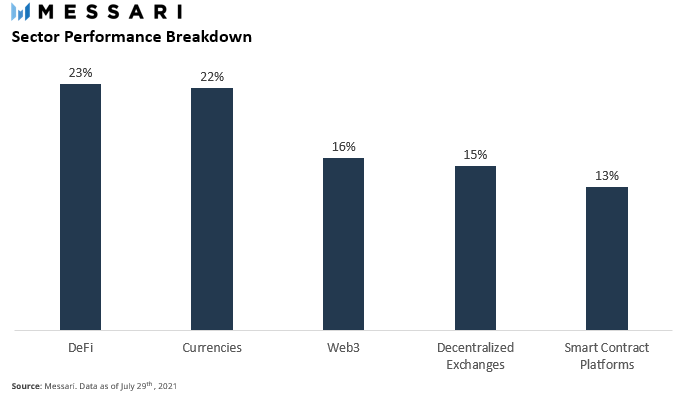

According to a recent report by Messari, the digital asset sectors are currently divided into DeFi, Currencies, Web3, Decentralized Exchanges, and smart contract platforms.

Source: Messari

According to the attached chart, DeFi and Currencies had a huge week in terms of market growth. The DeFI sector nicked the top spot by 23%, supported by Terra (+50%), Amp (+77%), and THORChain (59%). Bitcoin led the way for Currencies, with a 22% price hike over the past week.

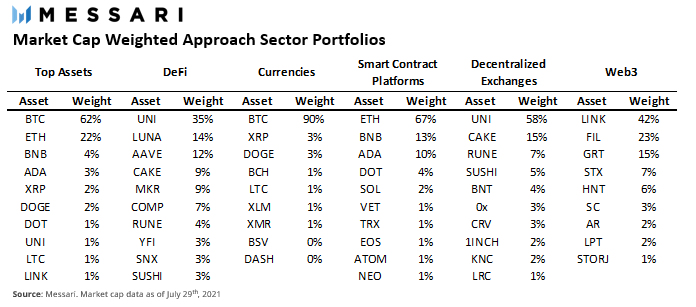

The sector classification has been done by keeping the root functionality in mind. In the chart below, it can be observed that the likes of Ethereum, Binance Coin, and Cardano are under the smart contract platforms category, whereas Bitcoin, DOGE, LTC, XRP, etc are more currency-like assets.

Source: Messari

Does sector evaluation allow a better understanding of development?

Possibly. The advantage of such a comparison is that investors can identify the popularity of similar projects and whether their objectives are translating into consistent market cap growth.

For example, the growth of Decentralized Exchanges or DEXs is fairly known due to Uniswap’s rise but the DEXs sector incorporates PancakeSwap, SushiSwap, RUNE, Curve among other projects, and their collective growth has been 15% over the past week. So, a combined evaluation as such may allow us to better estimate the interest in DEXs assets overall.

According to the same, smart contract platforms and Web3 portfolios were the least performing. Now, this might come across as surprising since major assets such as Ethereum, BNB, Cardano are all under that category. Yet, it is a good evaluation and sheds light on a greater picture, one where smart contract platform assets saw a period of reduced interest too.

Does it carry weight for changes in trends?

There is not a clear answer since some of the projects defined under particular sectors such as DeFi and Web3 are relatively new entities in the digital asset market. So, sector portfolios might not lead or trigger an overall trend, but the control does remain with the Currencies sector. And that too, only because of Bitcoin.

Its market cap dominance remains key to bringing capital into the ecosystem. This will allow the general liquidity of the collective space to improve as well.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)