Are you shorting Litecoin [LTC]? You could profit from these levels

![Are you shorting Litecoin [LTC]? You could profit from these levels](https://ambcrypto.com/wp-content/uploads/2022/11/matt-palmer-qUsVYeuxLIQ-unsplash-e1669365653843.jpg)

- LTC was in a price correction mode but in a bullish market structure

- Short-term LTC holders have made massive profits in the last two days

Litecoin [LTC] put on a massive mid-week rally, reaching $83.6, its highest level since mid-May. At the same time, BTC regained the psychological $16K mark. However, at the time of writing, BTC had lost 1.5% in the last 24 hours, setting LTC for a price correction.

At press time, it was trading at $75.26 and seemed determined to fall further. The next new supports could be at the 61.8% and 50% Fib retracement levels if LTC maintains the downtrend. Buybacks from these levels could allow you to lock in profits.

78.6% Fib support is about to be broken: will it go further down?

The 78.6% Fib level was an important support zone and a bullish order block line. It was tested several times on the 4-hour chart and could be breached. At press time, the bears threatened a bloodbath just below this level.

Technical indicators also suggest the possibility of an extended bloodbath as the bears slowly take control. The Relative Strength Index (RSI) has pulled back from the overbought territory with an extended downtick. It indicates a massive drop in buying pressure that is slowly allowing sellers to gain momentum.

In addition, the On Balance Volume recorded a downward trend, indicating a decrease in trading volume and buying pressure. Overall, the indicators suggest that sellers will gain ground within a few hours or a day.

In this case, LTC prices could fall further and find new support zones between 61.8% ($69.9) and 50% ($65.66). The downtrend of LTC could extend if BTC loses its support at $16K and falls further.

However, a candlestick close above the current support ($75.96) would invalidate the above bias. In such a case, LTC could trade sideways along the 78.6% and 100% Fib pocket levels or break through resistance.

Short-term LTC holders are enjoying massive profits, but….

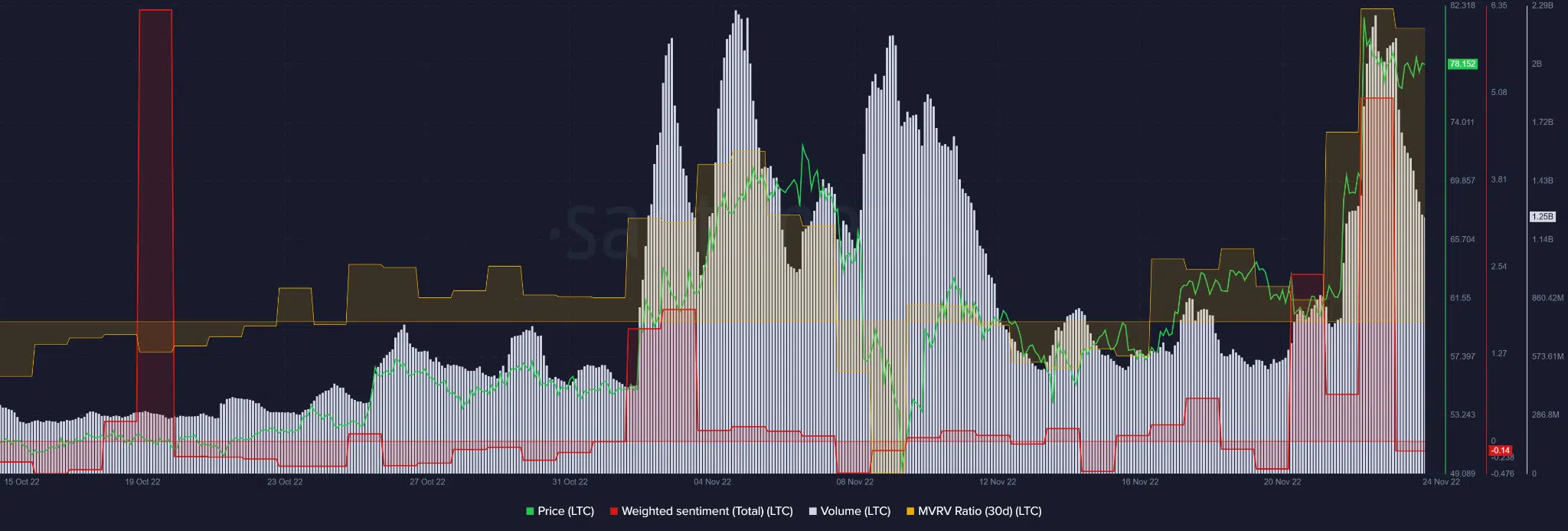

The 30-day Market Value to Realized Value (MVRV) is positive, as per Santiment data. This means short-term LTC holders have posted record gains since Tuesday, 22 November. This period also coincides with a positive weighted sentiment.

However, trading volume declined, and weighted sentiment slipped into negative territory as of press time. This could indicate that a price reversal is imminent, and LTC could head south.

Short-term LTC investors should therefore monitor BTC’s performance and LTC’s sentiment before trading.