Argo Blockchain’s shares rise by this number as it regains Nasdaq listing

- The shares of U.K.-based Bitcoin mining company Argo Blockchain rose as the company gained listing compliance with Nasdaq.

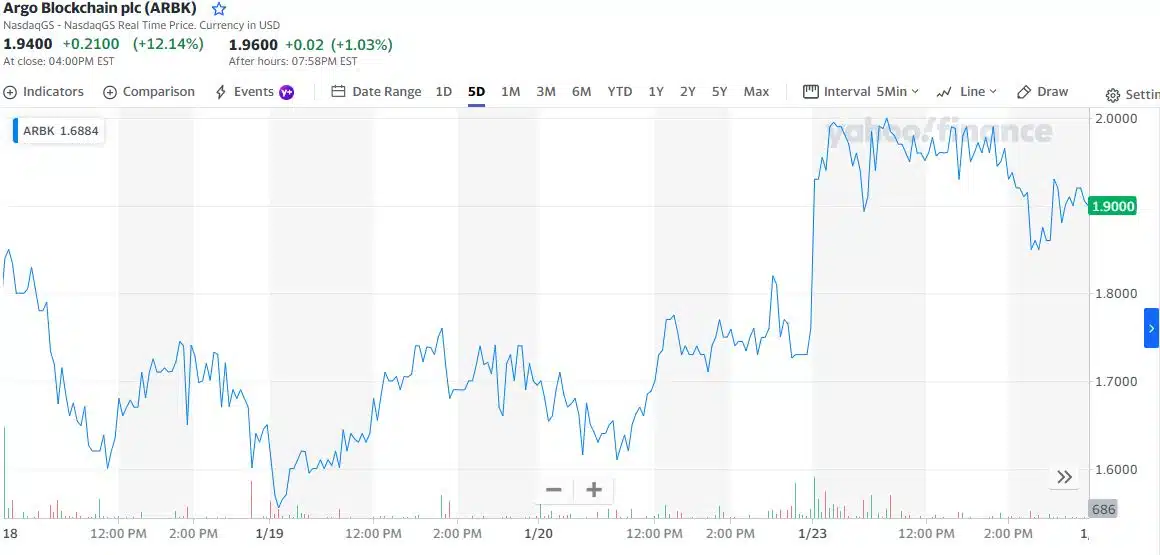

- Since its 0.38 low on December 16, the miner’s stock has rose by 400% to $2.03.

The shares of Bitcoin [BTC] mining company Argo Blockchain rose as much as 18% on 23 January after the company regained listing compliance with Nasdaq. The development came on the heels of a December 2022 agreement with Galaxy Digital to avoid bankruptcy, which was accompanied by a rise in BTC.

Source: CNBC

On 13 January, the United Kingdom-based company announced that it had met the requirement to continue listing its shares on Nasdaq after bids for its shares remained above $1 for 10 consecutive days.

What went wrong with Argo Blockchain?

In December, Nasdaq notified Argo that its shares did not comply with exchange rules because closing bid prices for its stock were below $1 for 30 consecutive days. Nasdaq gave Argo a deadline of 12 June to reclaim its listing privileges, else it risked being delisted from the exchange.

The miner’s shares had become a penny stock in the latter half of last year, with its share price dropping as low as $0.38 on 16 December following the crypto winter. Argo, among other crypto companies, was on the verge of declaring bankruptcy because of rising energy costs and a sharp drop in BTC prices.

The mining enterprise avoided bankruptcy last month when it agreed to sell its Helios mining facility in Texas to the crypto-based financial services firm Galaxy Digital for $65 million and a $35 million loan.

The transaction assisted Argo in bolstering its balance sheet and avoiding bankruptcy after it found itself in a precarious situation when a deal for $27 million in funding fell through in October last year.

Evidently, Argo Blockchain could benefit from the lower debt load after its previously disclosed equity raise with a strategic partner fell through. The firm could have more money to buy additional miners and increase hash rate faster with less capital expense dedicated to mining facility development.

Since its low ($0.38) on 16 December last year, the miner’s stock has rose by over 400% to $2.03.