As Bitcoin [BTC] struggles to stay above $30k, investors turn towards…

![As Bitcoin [BTC] struggles to stay above $30k, investors turn towards...](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_A_masculine_bull_looking_at_a_crowd_in_an_arena._ultr_0bb9a88f-5a12-4f6a-a5d2-b710d6c79ea5_1200x900-2.png.webp)

- Bitcoin’s bullish bias attracted short-term profit-taking, leading to a narrow price range.

- BTC whales stepped in, reviving hopes for yet another $30k retest.

If you are like most crypto investors, chances are that you expect another retest of Bitcoin’s [BTC] $30,000 range and perhaps an extended upside this time. Those expectations could be logical, based on the fact that Bitcoin has somehow recovered and had avoided further downside until press time. But here’s something you need to know.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Though Bitcoin has stayed afloat, it is not out of the woods yet. The upside is not looking as strong, and recent findings revealed that traders have shifted their strategy in favor of short-term gains.

When comparing the absolute value of both realized profits and losses throughout both breaks above $30K:

1⃣ $2.54B realized during the inaugural breakthrough?

2⃣$289M realized during the recent ascent?

The current throughput is significantly lower than the initial breakout. pic.twitter.com/Uvw3LefSva

— glassnode (@glassnode) April 30, 2023

According to Glassnode, there has recently been a surge in profit-taking near the $30,000 range. This explains the resurgence of sell pressure every time the price pushes into this zone. However, Bitcoin buyers may eventually get exhausted, at which point sell pressure may resume. There is also a substantial likelihood that the whales might push up the price.

What’s Bitcoin’s next course of action?

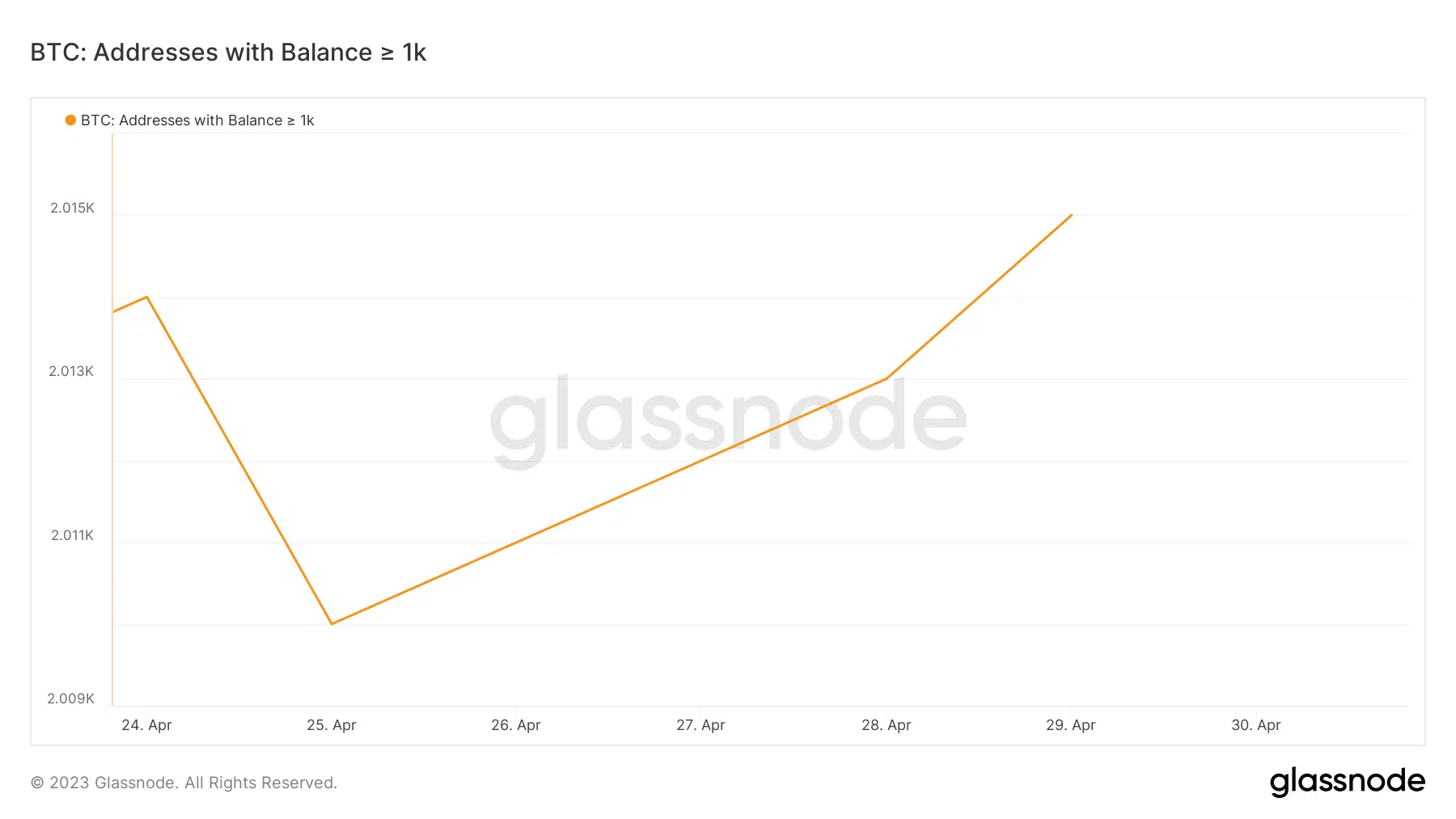

Since Bitcoin’s next move hinges so much on whale activity, let’s look at what the whales have been up to. Addresses holding an amount equal to or greater than 1000 BTC pivoted on 25 April and have been re-accumulating for the last five days. This means the bulls may receive yet another boost back above $30,000.

We observed a significant rise in the amount of leverage in the market just before the previous crash, which occurred after the $30,000 range retest. The high leverage was an easy target for short sellers and whales looking to take profit. This time, the market has a notably lower amount of leverage due to the higher level of uncertainty in the market.

How much are 1,10,100 Bitcoins worth today?

The lower leverage may not necessarily encourage whales to push for liquidations. The fact that whales are also contributing to the bullish momentum means it might be easier for the cryptocurrency to push back above the $30,000 range. However, this is subject to whether the market conditions will remain favorable.

At the time of writing, the metrics pointed to a market recovery, which might continue to gather momentum if conditions allowed. Another FUD event may trigger the return of sell pressure and the aforementioned short-term profit-taking may once again hinder BTC’s potential upside. However, a new month may bring forth a different outlook, but that remains to be seen.