As Bitcoin oscillates close to $60K, here’s a lowdown on market conditions right now

The last week has been nothing short of a roller-coaster ride for Bitcoin marking yet another ATH, peaking close to $69,000. However, with the market currently consolidating, the majority of participants seem to be holding on to the gains as BTC finds new lower support.

Nonetheless, with the activation of the Bitcoin Taproot upgrade, the long-term prospects of the coin appear to be glimmering. However, as Bitcoin’s price slumped by 7.42% in 24-hours and by 10.63% over the last week, clarity about BTC’s move ahead seemed to be missing. Thus, it would only seem wise to analyze the current state of the market.

Buying pressure MIA

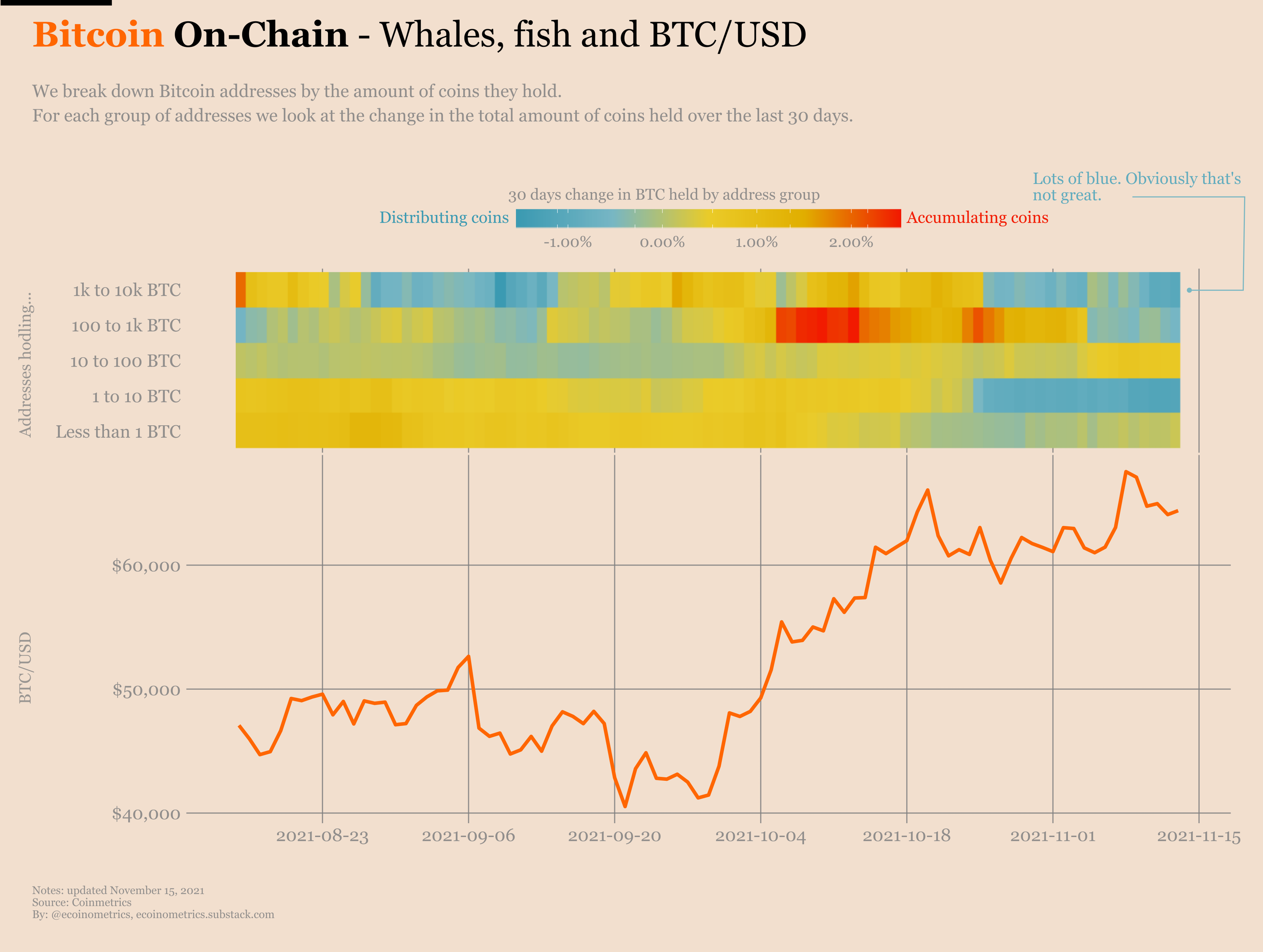

A look at BTC’s on-chain accumulation highlights how addresses aren’t accumulating coins over the last month. Therefore, it looks like the buying pressure coming from the people who stack ‘sats’ on-chain was not present at the moment.

Notably, the aforementioned trend isn’t ideal to support a rally. Moreover, in terms of net exchange flows, coins are still flowing out of exchanges at a pretty fast rate. In the last month alone, 100,000 BTC moved from known exchange addresses to hodlers’ addresses. It seems like the supply shock narrative is still intact.

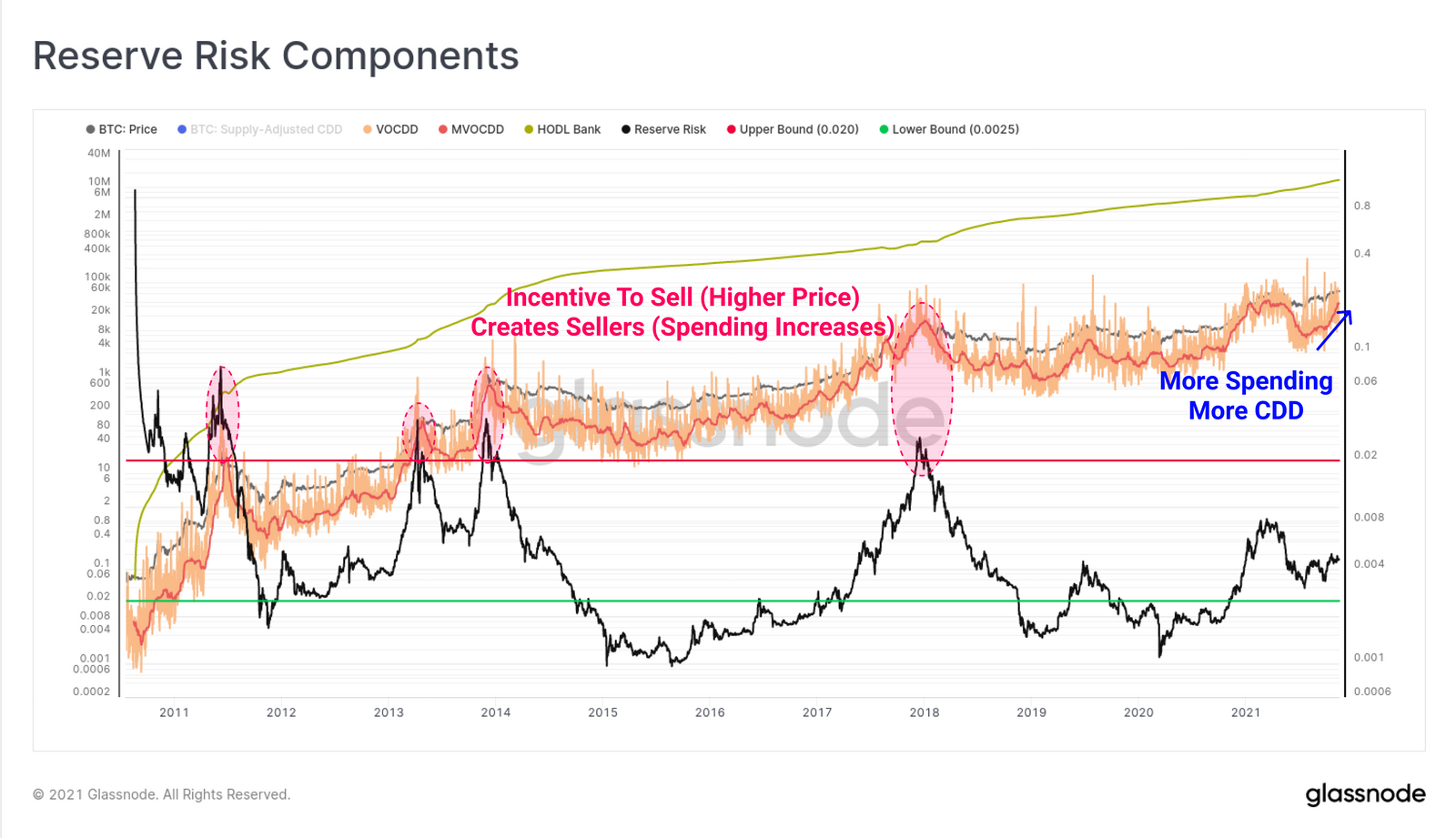

That being said, the Reserve Risk metric, which tracks the risk-reward balance relative to the confidence and conviction of long-term holders still presented high hopes for the coin. Given the remarkable accumulation that occurred over the last six months, Reserve Risk was still impressively low at the moment. Even though the recently elevated CDD is starting to resume the uptrend, there’s still a lot of room for growth.

Source: Glassnode

So, what’s next?

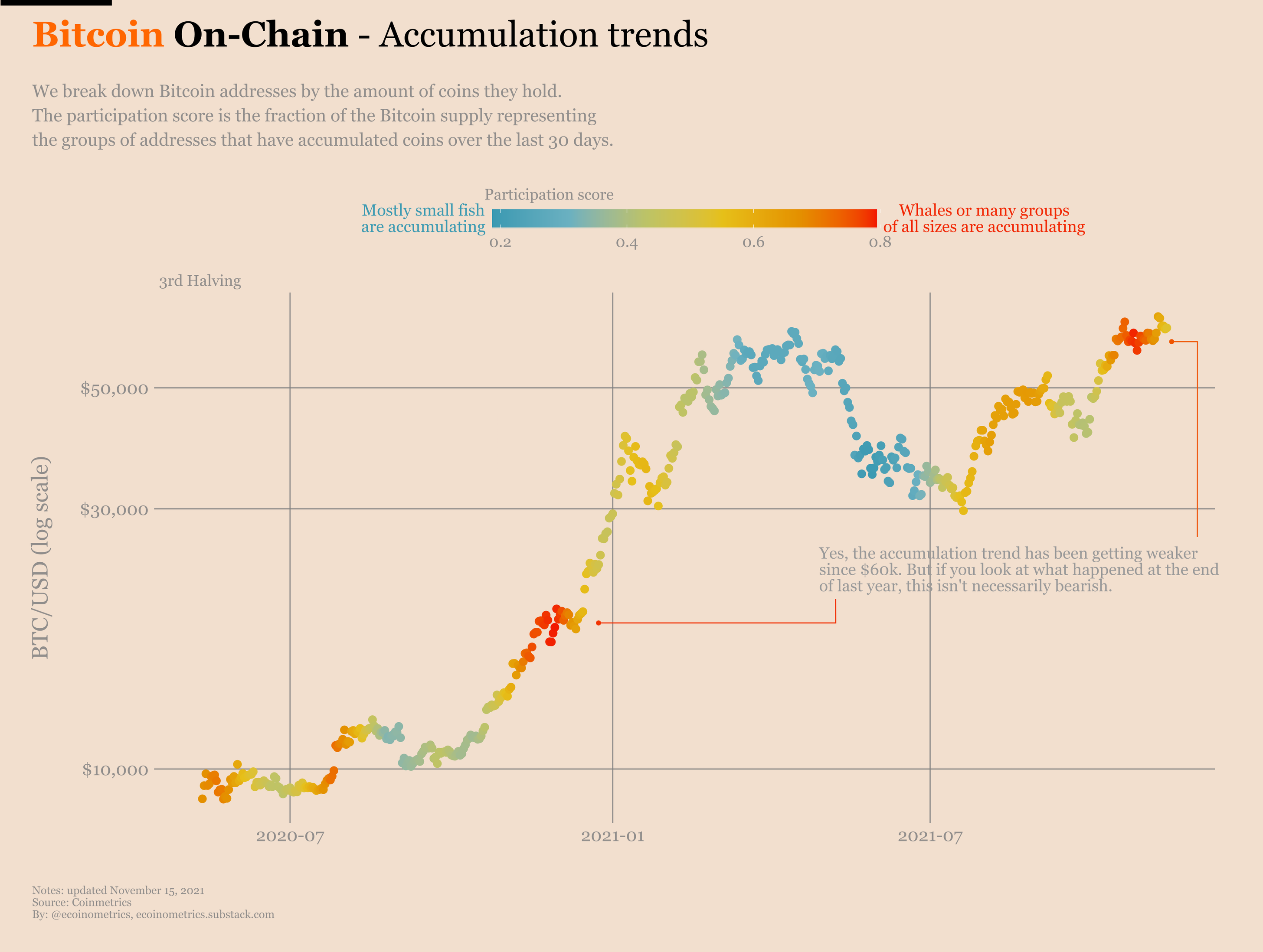

Interestingly, this slowdown in the accumulation trend isn’t necessarily bearish in fact the same happened towards the end of last year too, as seen in the chart below. Notably, BTC’s price saw a 100% spike in the last two months, despite the slowing accumulation rate.

Curiously, it seems like with accumulation slowing down, the same would need to build up for BTC’s next leg up. However, the median Bitcoin price target for 8 December still remains $84K as per Ecoinometrics. Further, the coming week would further direct the top coin’s movement.

Besides, another assuring factor was that Miners’ Position Index or MPI was in an area that has historically coincided with bear markets. Miners were not taking profits at the rate they were, in the previous bull markets. In fact, they expected higher prices, which again is a good sign.

For now, however, as BTC was bouncing off $60,659, its next support if the price falls under the $60K mark lies at $58,443, which is also the daily 55 EMA.