Assessing Bitcoin’s [BTC] chances of a bullish comeback after…

![Assessing Bitcoin’s [BTC] chances of a bullish comeback after…](https://ambcrypto.com/wp-content/uploads/2022/11/po-2022-11-04T100200.204.png)

Bitcoin’s [BTC] 7-day performance has left the cryptocurrency with an uptick of 1.78% on the charts. In fact, at press time, the crypto was priced at $20,900. What this suggested is that while BTC has been on the up lately, it has struggled to build on its recent price appreciation. Needless to say, there’s still the looming risk of the crypto falling below $20k again. Ergo, the question – Can BTC bulls finally retain some semblance of control?

Here’s AMBCrypto’s Price Prediction for Bitcoin for 2023-2024

An analyst’s take

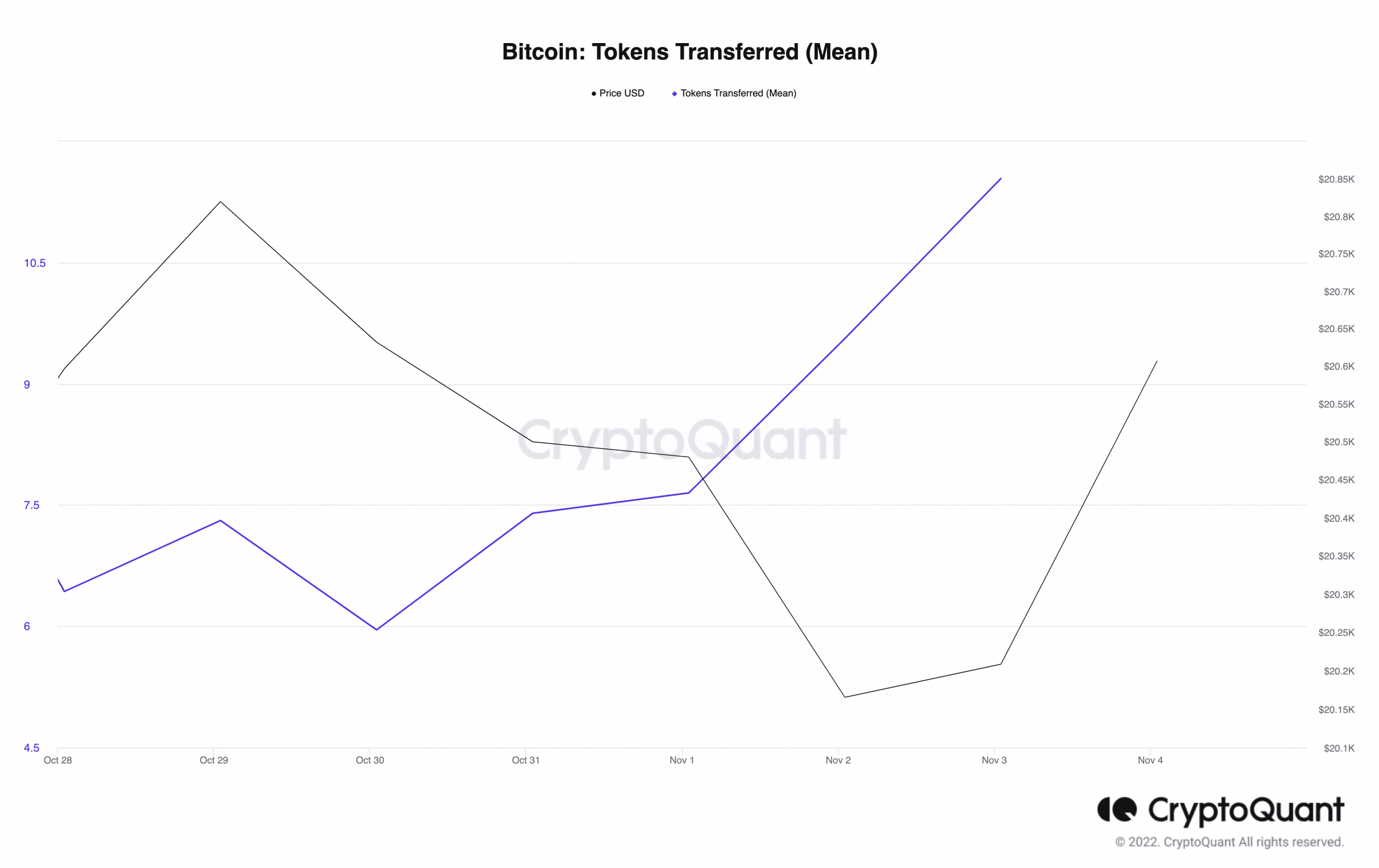

CryptQuant analyst TariqDabil recently pointed out that BTC token transaction count has been showing signs of significant accumulation. According to him, the indication is that Bitcoin has been switching from weak-hand holders to holders who have strong cover. This exchange implied that a sustenance of the switch is a long-term bullish sign for Bitcoin.

Interestingly, the one-week mean token transfer reading of 11.54 could be interpreted as being in agreement with this opinion.

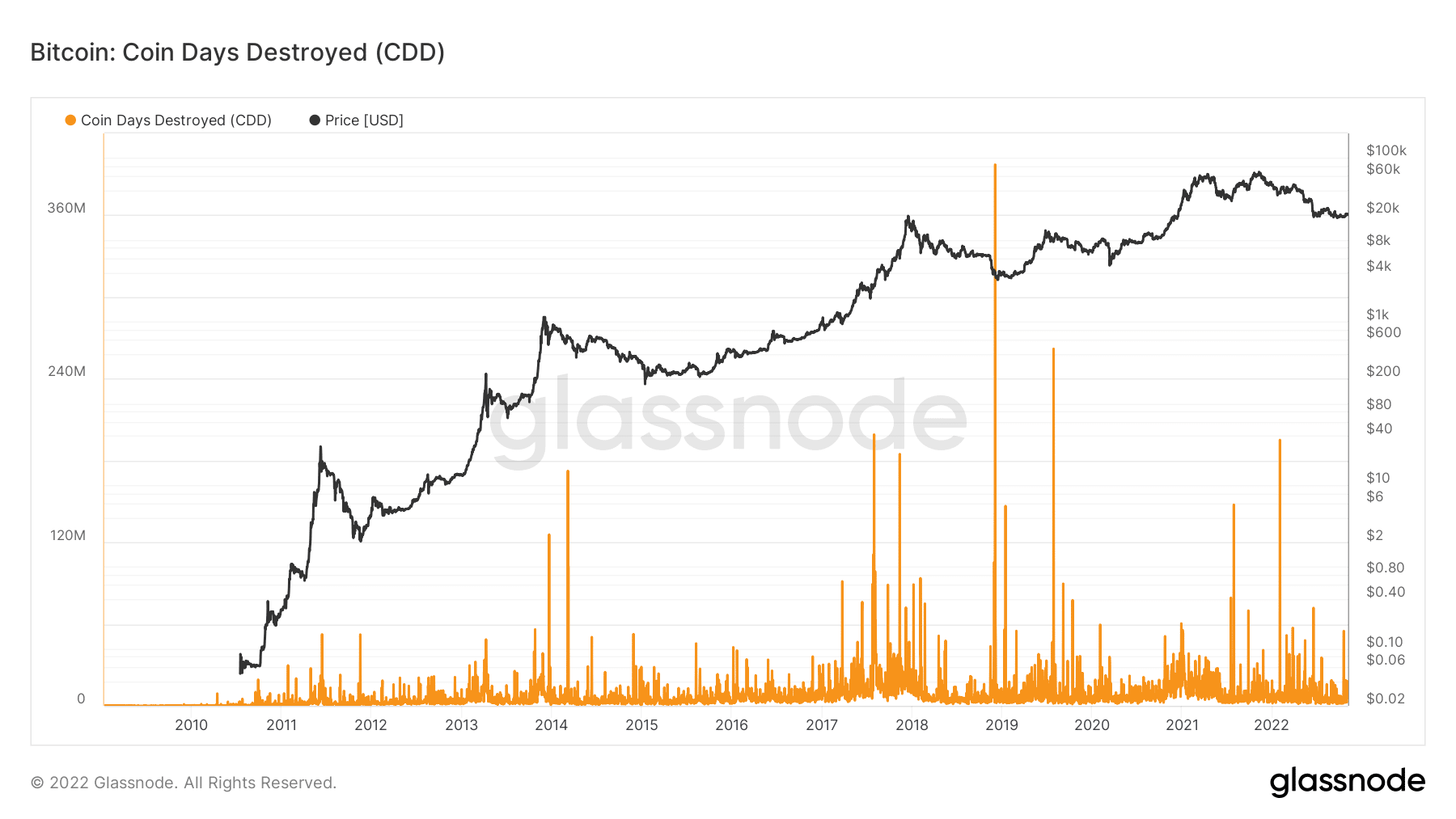

Additionally, TariqDabil opined that the derivatives market might also be contributing to its position. According to the revelations, the derivatives market Coin Days Destroyed (CDD) inflows spiked more than usual over the last few days.

Glassnode’s data revealed that the Bitcoin CDD was 4.63 million. This implied that an impressive number of coins have been used for transactions since the fall in August and September. Hence, short-term investors have the opportunity of a likely price increase.

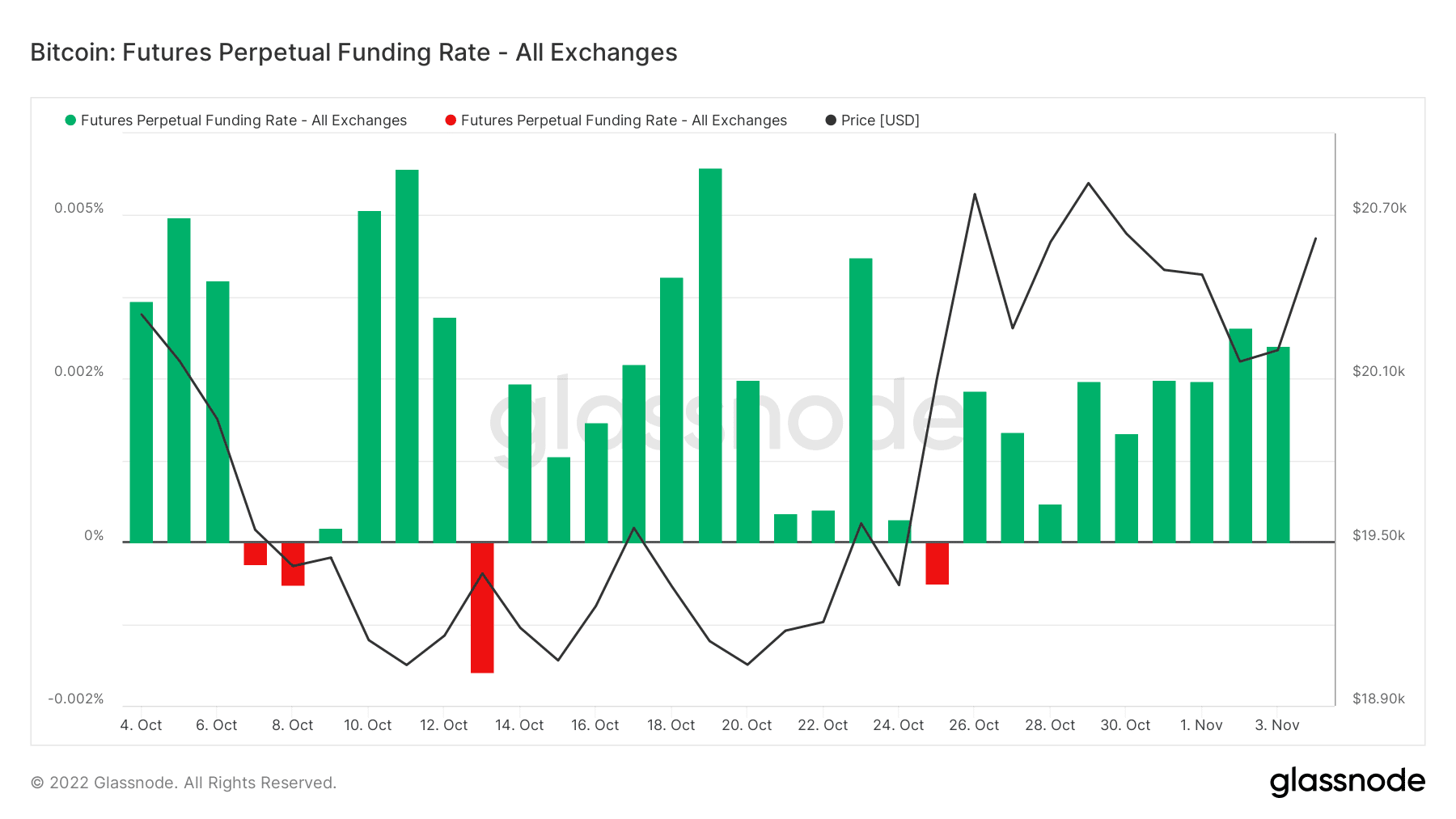

In other parts of the derivatives market, the Futures funding rate has revived. Recollect that Bitcoin traders had opted against a massive involvement in the Futures market. However, Glassnode revealed that these traders have gotten back into the market as the Futures perpetual funding rate across all exchanges was at 0.003%.

At this rate, it seems to be obvious that there is an enormous amount of Open Interest. Also, opting for long positions might be favorable over going short.

Will BTC remain in upbeat spirits?

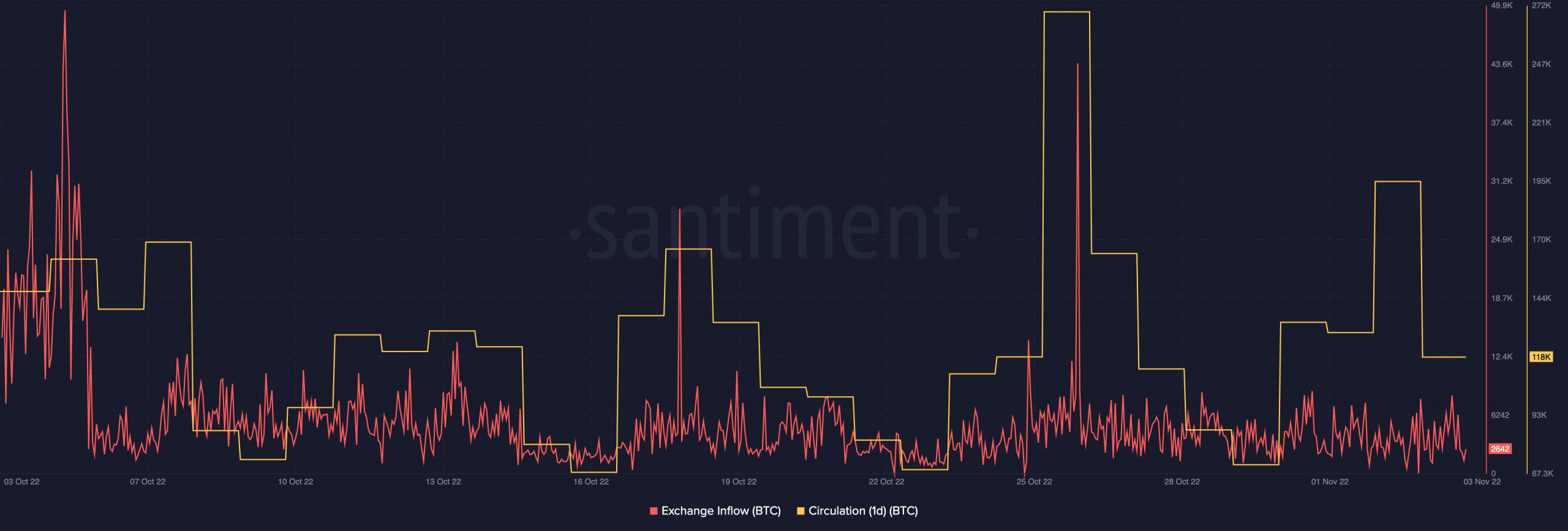

Furthermore, it seemed that BTC’s chances of reclaiming the bullish momentum had the support of other metrics. According to Santiment, Bitcoin’s exchange inflow was 2,642. This value meant that fewer investors were willing to sell, compared to the reading of 8,672 recorded on 3 November. So, it is less likely that there would be high selling pressure that could draw down BTC’s price.

On a different note, the one-day circulation has not been able to match up to the exchange energy. With its value at 118,000 at press time, investors might need to do more per coin circulation to be assured of a bullish comeback. Despite the fall, ergo, Bitcoin is well-positioned to withstand any antics of sellers and maintain its green status quo.