Decoding ATOM’s stern resistance despite this pending Cosmos rejection

Cosmos [ATOM] co-creator Jae Kwon’s proposal to develop “one constitution” might not result in a favorable outcome for the founder. On 31 October, Kwon had proposed an interchain hub to foster the security of the Internet of Blockchain ecosystem. According to the proposal, the Cosmos Hub would provide a much-needed checks and balance economic mode for Cosmos.

Here’s AMBCrypto’s Price Prediction for Cosmos [ATOM] for 2023-2034

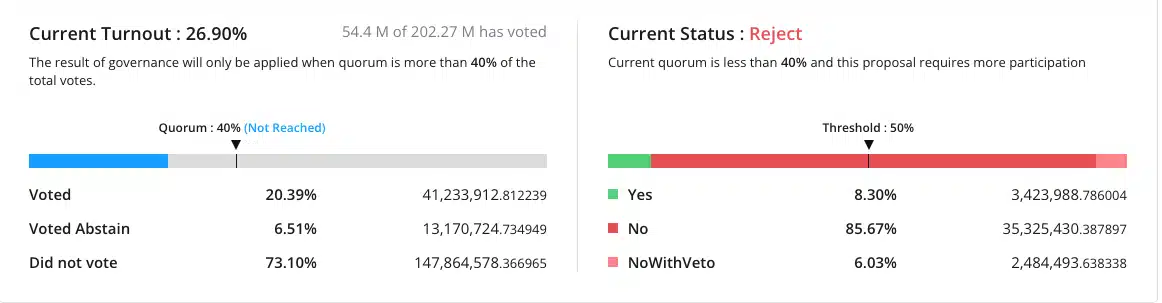

While Kwon might have thought that he was pushing a goodwill message, the Cosmos community seemed to believe otherwise. This was because voting at press time showed that over 85% of the voters rejected the proposal. A look at Mintscan, a Cosmos-based block explorer, 54 million out of the 202 million members of the community had voted.

A force to reckon with

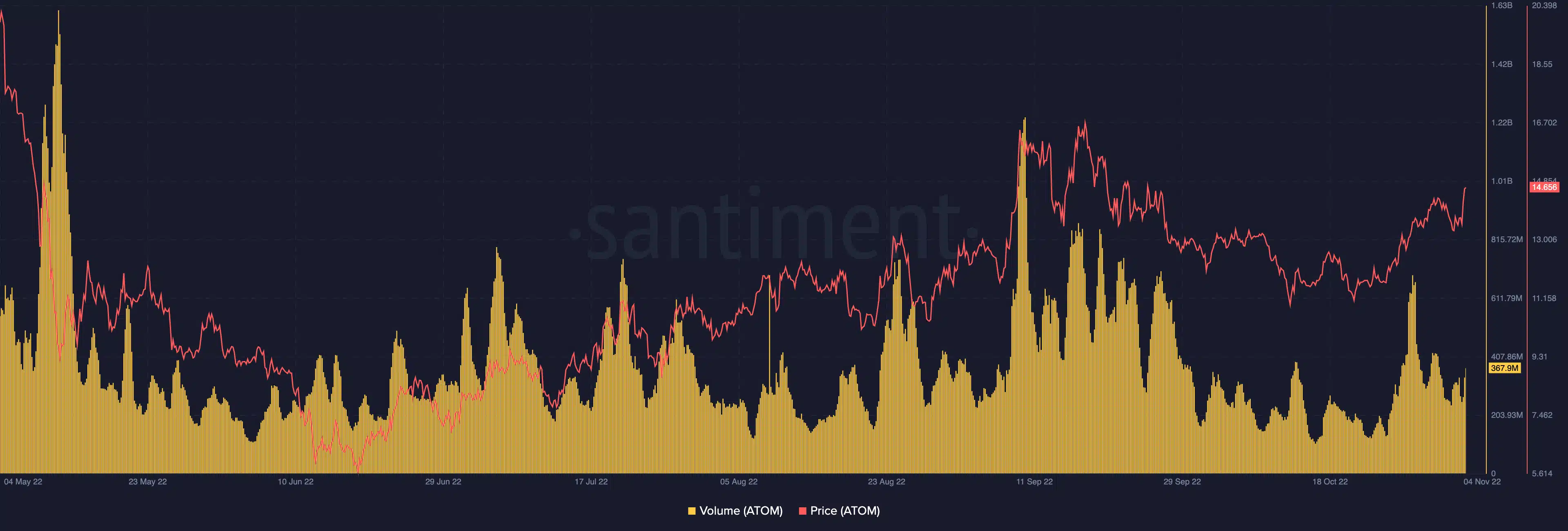

Despite the rebuff, ATOM failed to follow a decreasing trend. According to CoinMarketCap, ATOM’s value had increased 7.09% between 3 and 4 November. Although the increase might be a good development for its investors, the volume showed that these same investors were not committed to seeing out a longer timeframe rally. This was because the 14.67% volume increase might not be enough to sustain the current uptick. As of 4 November, ATOM’s volume was 367.9 million based on Santiment data.

However, it was worth noting that the reaction of ATOM was different from other proposals. For the ATOM “zero constitution” which was almost certain of rejection, the ATOM price declined for most of the period. Additionally, ATOM had a similar response to the proposed validator incentive when it exchanged hands with an 11% price increase. In light of this, it might be considered necessary to assess the price action.

Per the four-hour chart, ATOM had gained an excellent buying momentum against the United States Dollar (USD). As of 4 November, the Relative Strength Index (RSI), at 67.01, signaled massive buying power. However, closing in on an overbought RSI of 70 or more was most likely bound to reverse the ATOM price trend.

The indications from the Directional Moving Average (DMI) showed that ATOM’s capability to maintain the greens was low. Although the buyers (green) positioned above the sellers (red), the Average Directional Index (ADX) in yellow, did not support a strong movement up the charts.

Developments and socials had this to tell

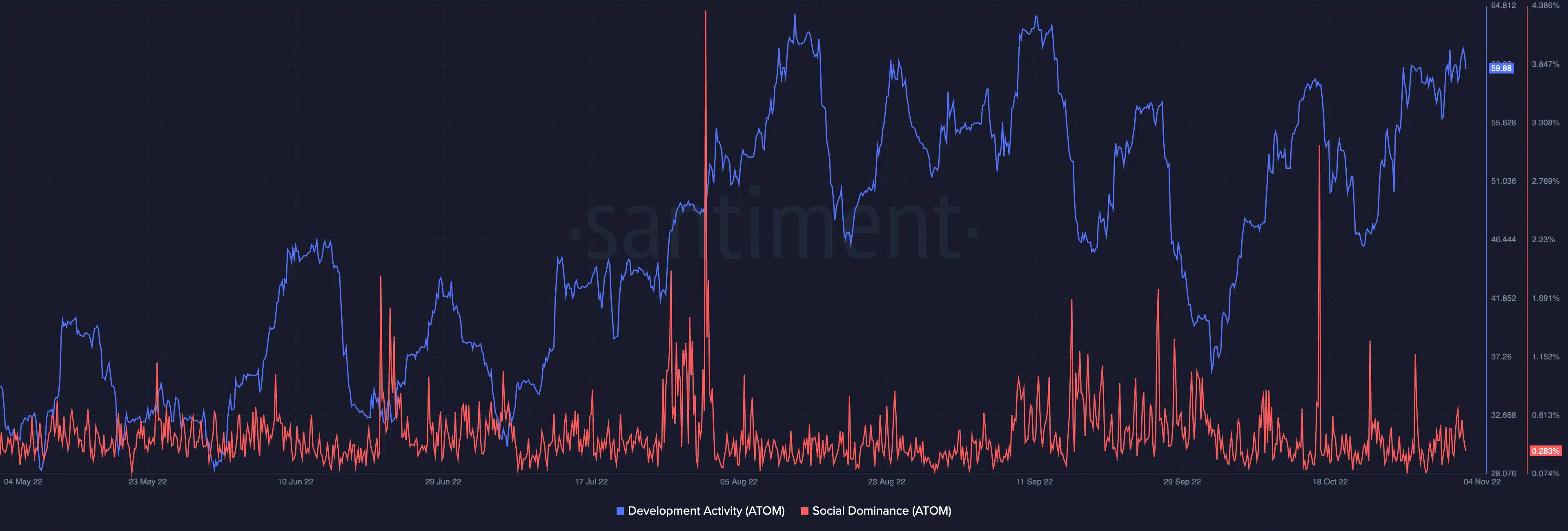

As for the development activity and social dominance, it was a clear contest of contrast. According to Santiment, developments in the Cosmos ecosystem had increased. At a value of 59.88, it was certain that the Cosmos team were integrating upgrades to the network.

As for the social dominance, it was a case of declining interests in the cryptocurrency. Santiment data showed that, at 0.283%, ATOM was nowhere near the top of search discussions on social networks. Finally, the proposal discussed above was relatively at its early stages. With voting to close on 14 Novembers, there could still be a change of heart.