Assessing how Bitcoin’s market will REALLY do if an ETF is approved

A Bitcoin ETF has been long denied to U.S investors. In recent times, countries such as Canada and Brazil have authorized BTC, ETH ETFs. And yet, the SEC continues to refrain from doing so in the United States.

However, such optimism has grown significantly over the last few weeks after SEC Chair Gary Gensler’s comments at the Aspen Security Forum. Gensler discussed crypto in detail, and one of his comments was,

“Given these important protections, I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded Bitcoin futures.”

Now, many speculated that this was an indirect suggestion to Wall Street about the kind of Bitcoin ETF the SEC will be willing to accept. A Futures-based ETF without direct exposure to spot markets.

Hypothetically, let us assume a Bitcoin ETF does become official by the end of the year. How will Bitcoin’s market would react post-approval?

A path like Gold or better?

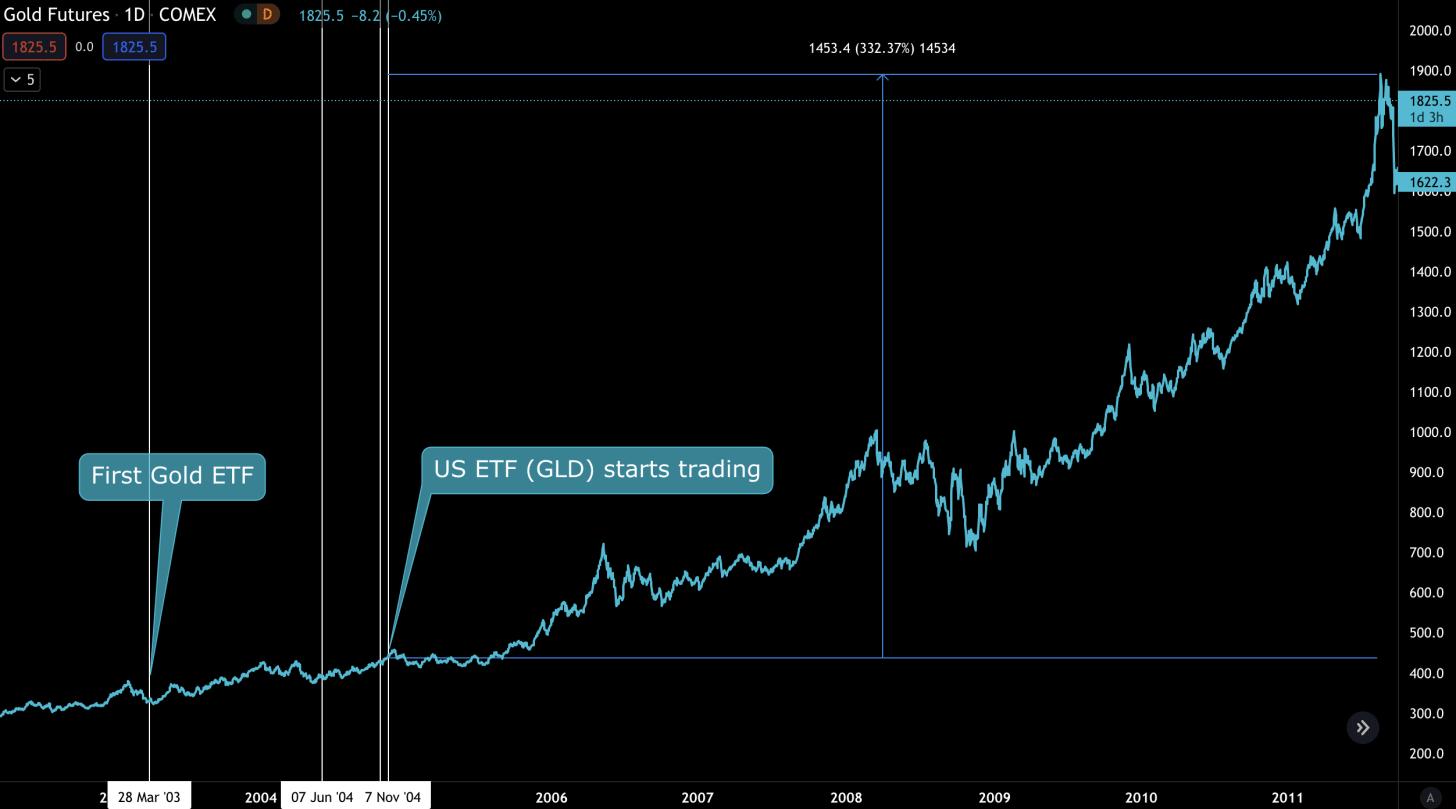

In order to draw a realistic comparison, the case study of Gold can be taken to address a possible path for Bitcoin after its ETF launch. The first Gold ETF was approved in Australia back in 2003, following which the SEC approved one in 2004, with trading commencing on November 2004.

Now, between a yearly low in 2001, to right before the ETF approval in 2004, Gold’s value rose by 76%. However, right after the ETF, the market started to thread sideways and dropped down by 9% in one month.

It was almost a year later that the ETF’s impact was felt on the charts.

Over the next 5-6 years, Gold went on a parabolic rise, hitting a high of $1900 from $420-$440 – A straight 330% hike from the time Gold ETF started trading.

It was a clear fractionalization of assets, according to statistics. Gold was made easily accessible and fresh institutional interest emerged for the asset during the 2008 financial crisis. Gold was already considered a hedge against inflation.

That remains one of the best periods to have invested in Gold.

How is Bitcoin expected to react?

An official Bitcoin ETF will obviously improve the credibility of the digital asset as a legitimate investment vehicle. If it emulates Gold like-for-like, BTC will be valued at over $200,000 within the next 5 years.

However, a few difficulties may arise as well.

A Bitcoin ETF regulated by the SEC is possibly going to have a weekend off period. Right now, the trading desks for both BTCC and EBIT are from Monday to Friday. That is a problem when BTC’s spot market is 24×7.

Any Bitcoin ETF would be subject to extraordinary volatility during off-market hours, and investors will not be able to exit their positions during off-hours.

In order to tackle such a scenario, a U.S ETF would need to offer 24-hour trading on OTC exchanges. This will ensure investors do not have a blind spot with these Bitcoin products.