Assessing Lido’s [LDO] status post-Ethereum [ETH] merge

![Assessing Lido's [LDO] status post-Ethereum [ETH] merge](https://ambcrypto.com/wp-content/uploads/2022/10/markus-winkler-IrRbSND5EUc-unsplash-1.jpg)

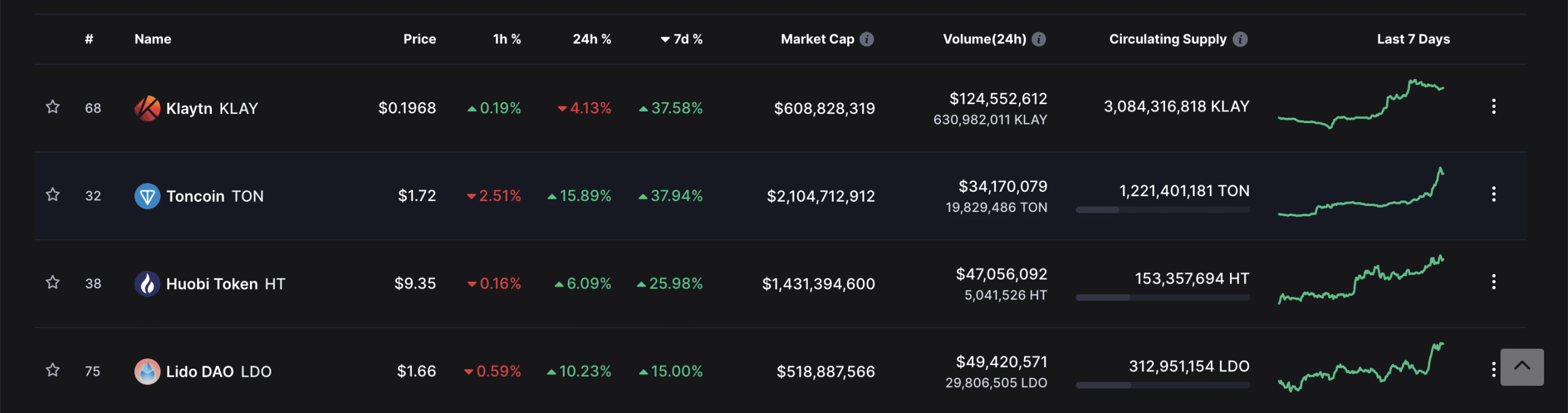

LDO, the native token of leading Ethereum [ETH] staking platform Lido Finance ranked high on the list of best-performing cryptocurrency assets in the last week.

According to data from cryptocurrency price-tracking platform CoinMarketCap, the asset’s price rose by 14.96% behind KLAY (37.58%), TON (37.94%), and HT (25.98%).

Ranking as a top performer in the last 24 hours, LDO’s price was up by 11%. With over $48.26 million worth of LDO traded within the same period, its trading volume was up by 78% at press time, as per data from CoinMarketCap.

Lido Finance continues to grow

According to data from blockchain analytics platform Glassnode, with 4.31 million ETH staked through Lido Finance, the staking platform continues to control 30% of the entire ETH staking market share.

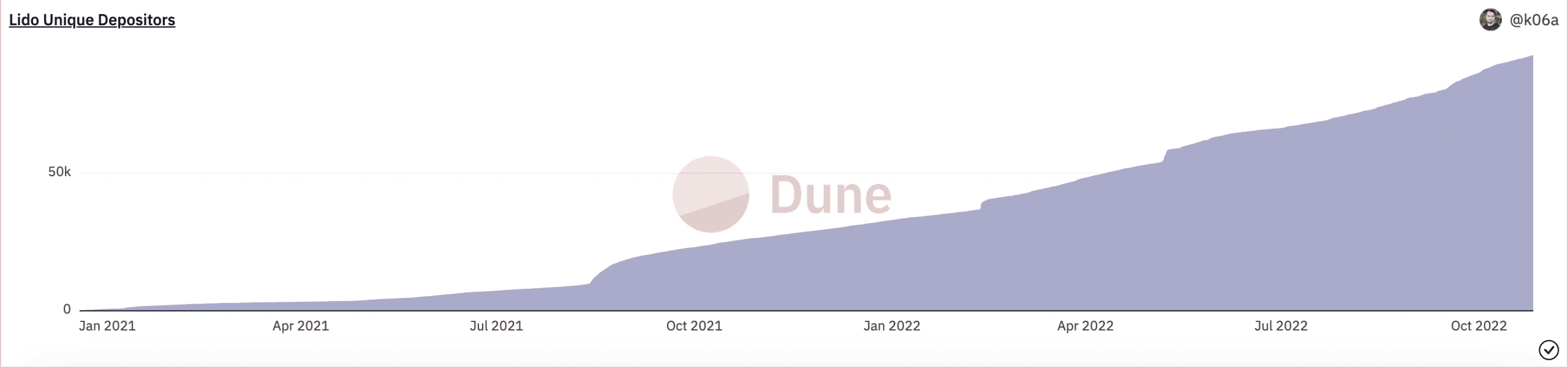

Between 17 October and 24 October, over 34,000 ETH were staked on Lido. This led to an increment in the count of unique depositors on the platform.

As per data from Dune Analytics, Lido had 92,822 unique depositors, at press time. According to Lido, it expects “to see 100,000 unique depositors in the next 1-2 months.”

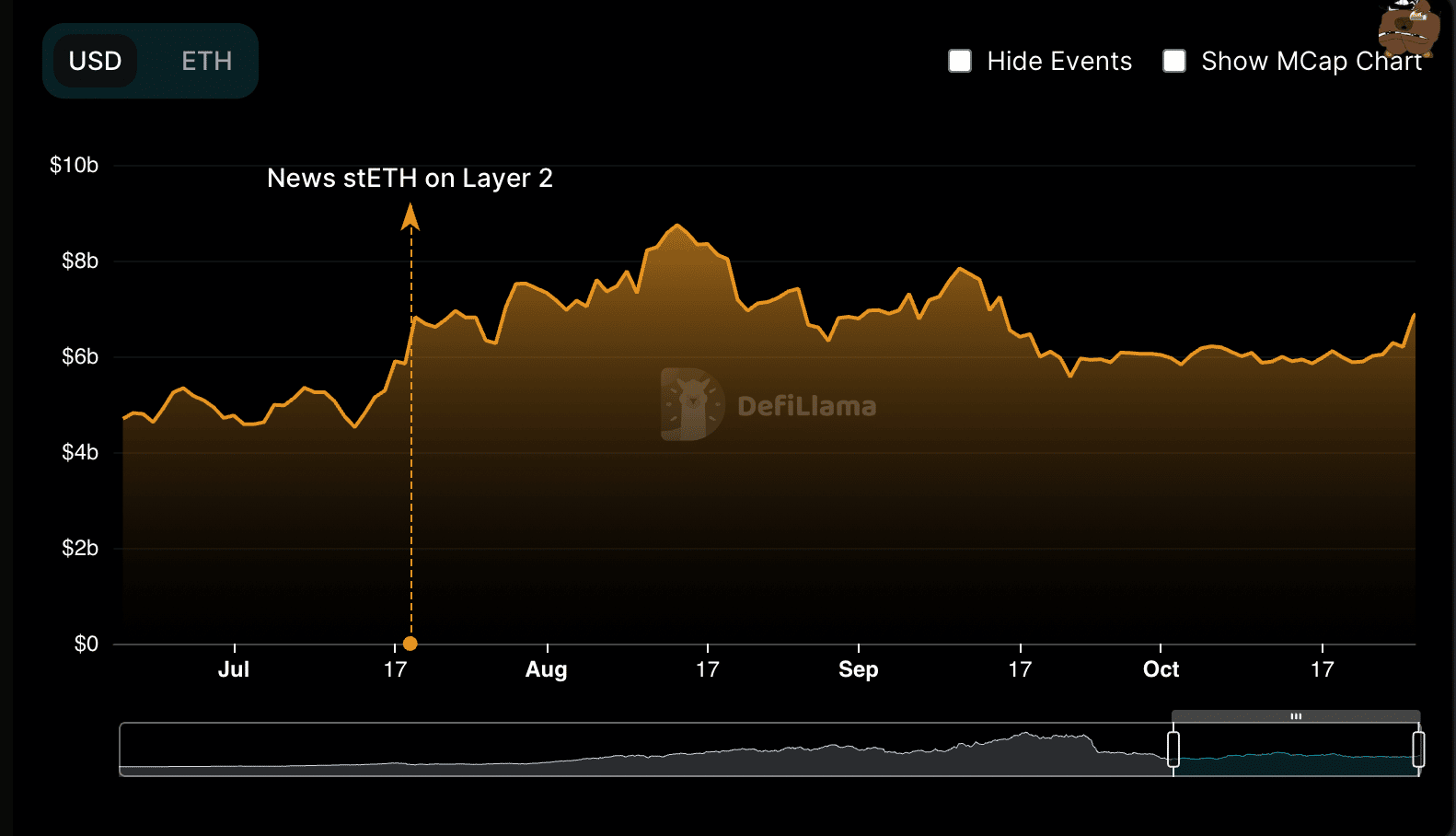

Per data from DefiLlama, Lido’s total value locked (TVL) sat at $6.89 billion, at the time of writing. However, the FUD surrounding the merge led to a decline in Lido’s TVL immediately. Between 17 September and 26 September, Lido’s TVL declined by 8.2%.

Things, however, took a different turn since the beginning of October. So far this month, TVL on Lido rallied by 14%.

In the last seven days, TVL on Lido went up by 3.25%. According to the protocol, “the main contributions to Lido TVL growth were an increase in ETH price (7d +2.86%) and a rise in Ethereum staking deposits (7d +0.80%).”

In addition to a growth in TVL, the price of stETH has remained “fairly stable” since the Ethereum merge. According to data from Dune Analytics, the price of the liquid derivative of ETH stood at $0.99 at press time. Since the merge, the token’s price has grown by 1%.

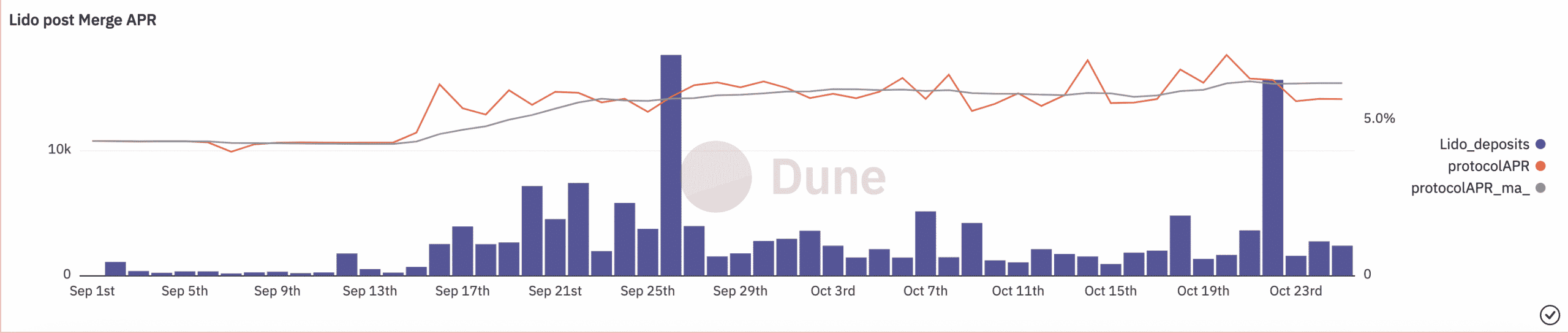

Lastly, as regards post-merge MEV rewards on the liquid staking platform, with average daily rewards of 204 ETH restaked by Lido, the cumulative MEV rewards, in addition to priority fees, have exceeded 8,104 ETH.

This led to a spike in the APR offered by the protocol. In the last week, APR increased from 5.7% to 6.2%, per data from Dune Analytics.

![Story [IP] price prediction - Traders, look out for this key divergence!](https://ambcrypto.com/wp-content/uploads/2025/06/Story-IP-Featured-400x240.webp)