Assessing points of entry for AAVE’s long-term investors

AAVE’s price has been quite volatile over the past few days. At one point yesterday, for instance, the token’s valuation climbed to as high as $448. However, at press time, it was trading at $381.01. Usually, long-term HODLers keep an eye on such dips and use them as opportunities to enter the market.

So, is this the right time for participants to set foot into the market? Or, would the downtrend further continue?

Assessing the market’s condition

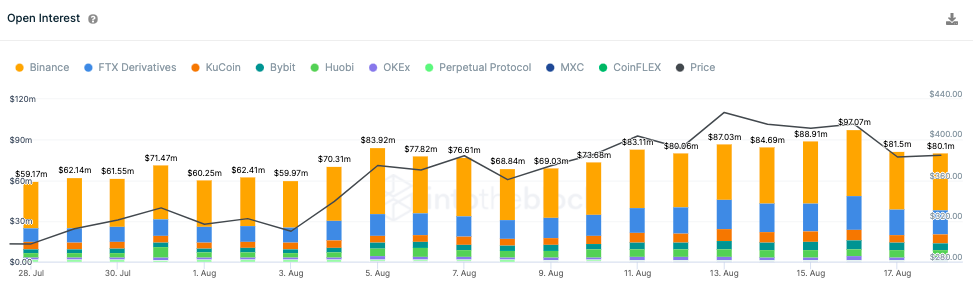

Binance, FTX Derivatives, and KuCoin continue to be the most popular exchanges on which market participants deal with the AAVE token. The funding rate on all these exchanges remained fairly neutral (o.01%, 0.11%, 0.08%, respectively), at the time of writing.

Usually, a high positive funding rate implies that market participants are bullish. However, the aforementioned bland numbers did not support that narrative.

Source: IntoTheBlock

The Open Interest, on the other hand, has been clearly been diminishing of late. The total value of all the open orders stood at $97.07 million on 16 August, but projected a value of only $80 million at press time.

By and large, this implies that money has been flowing out of the AAVE market over the last couple of days. Furthermore, traders have been exiting the AAVE market as well. In fact, only 8.5k traders seemed to be active.

A ray of hope

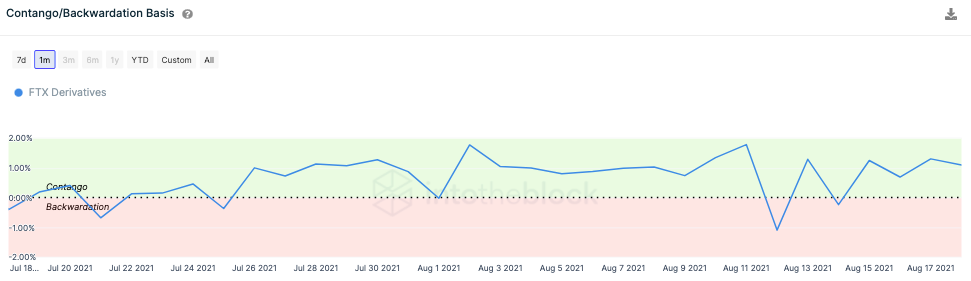

FTX Derivatives’ forward curve pictured a contradictory trend. As can be seen from the attached chart, AAVE slipped into Backwardation on 11 August but managed to climb above the same by the 13th. It, however, visited the same zone for a brief period on the 14th too.

Nonetheless, the curve has remained in Contango over the last couple of days. Contango is a situation where the Futures price of an asset is higher than its spot price. Going forward, if the curve heads north, the bearish narrative will eventually become redundant.

Source: IntoTheBlock

Even though not much can be said with surety about where AAVE’s price is heading at this stage, it should be kept in mind that the trend has been changing.

If the price oscillates in the same zone for the next couple of days, long-term HODLers can consider entering the market.