Assessing Tether’s [USDT] health as whales and sharks take a bullish stance

![Assessing Tether's [USDT] health as whales and sharks take a bullish stance](https://ambcrypto.com/wp-content/uploads/2023/01/tether.jpg)

- USDT recently witnessed increased activities from sharks and whales.

- Tether inflow to exchanges also saw a bump.

Since an 11 January report revealed Tether’s [USDT] plans to delist from the Canadian market, the stablecoin has become the subject of Fear, Uncertainty, and Doubt (FUD). Tether, however, continued to attract interest from sharks and whales despite the latest update until press time.

Is your portfolio green? Check out the USDT Profit Calculator

Tether: Sharks and Whales at play

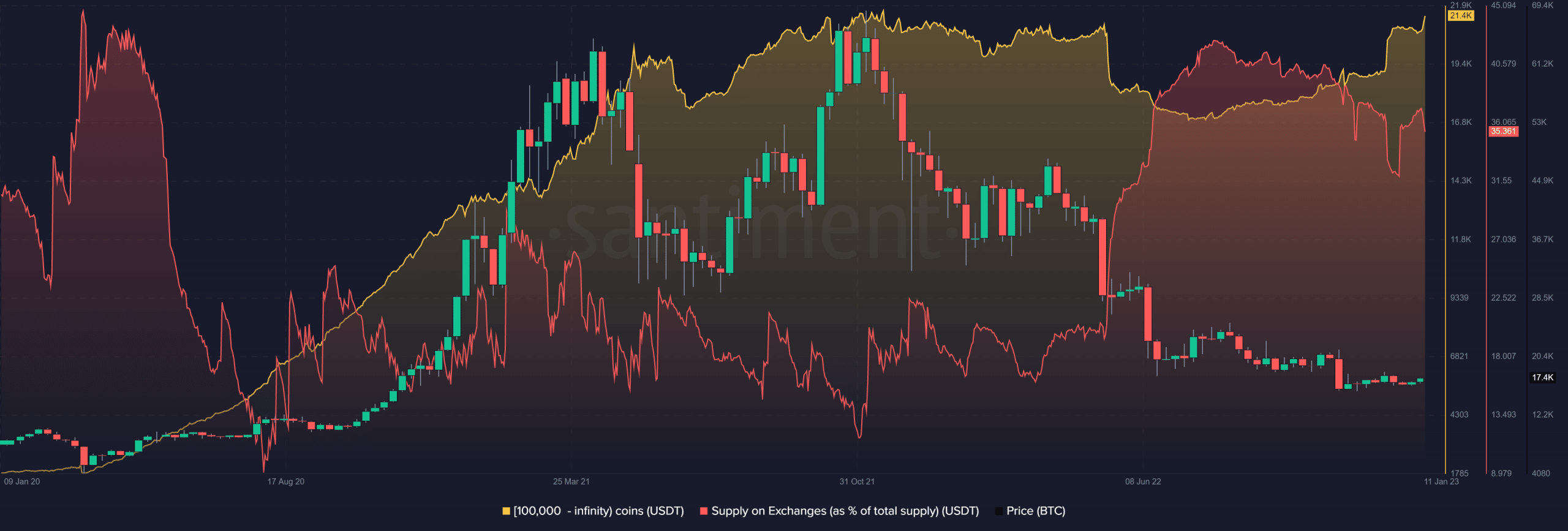

Sharks and whales have increased their accumulation activities, according to a chart by Santiment. The figure pointed out that there have been an increasing number of addresses holding 100,000 USDT or more in recent weeks.

At the time of writing, almost 21,000 addresses held 100,000 USDT or more. This number was 1% away from setting a new all-time high (ATH) at the present level.

The chart also revealed that at press time, over 35% of the total USDT supply was available on exchanges. According to data from CoinMarketCap, the stablecoin’s current total circulating supply was above $66 billion, and the market cap was in the same ballpark.

USDT is the largest stablecoin globally, and USDT was the third-largest cryptocurrency at the time of writing.

Realistic or not, here’s USDT’s market cap in BTC’s terms

Exchange Inflow gathers steam

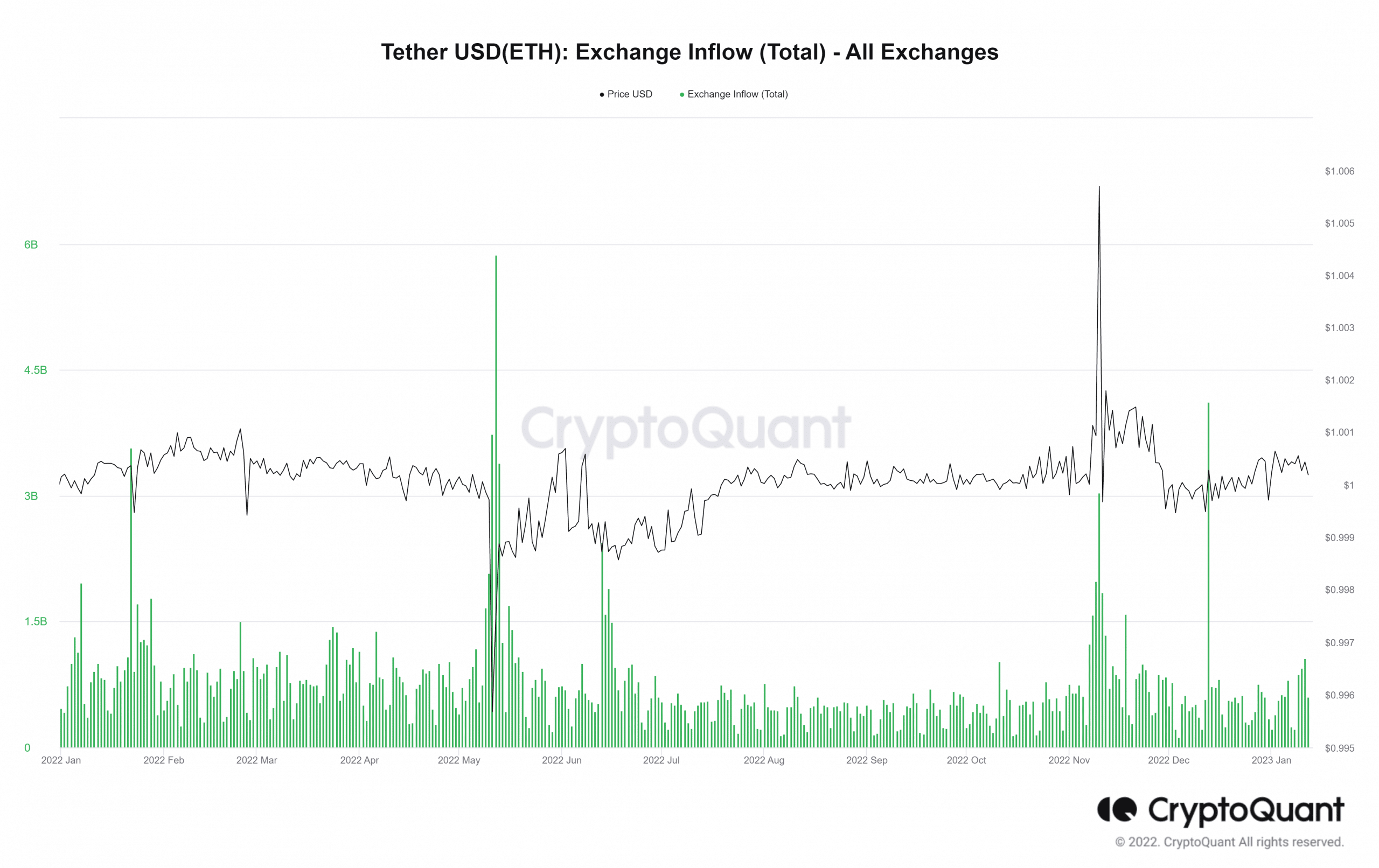

Moving on, CryptoQuant’s exchange inflow indicator showed that USDT was experiencing significant inflows at press time. The influx was already over $500 million during this period and was continuing to grow. As of 11 January, the total exchange inflow on the chart was more than $1 billion.

Finally, the above charts could be representative of the fact that whales and sharks must be on a practice run for the crypto market’s upcoming bull run. As accumulation continues, the number of addresses holding 100k or more USDT may eventually reach an ATH.