Assessing the impact of Ethereum’s price trajectory

Ethereum is considered the “leader of altcoins.” But are other altcoins following its lead right now? That does not seem to be the case at the moment. While some altcoins are rising, some others are falling, but the second generation altcoin hasn’t moved much. And this lack of movement is now beginning to affect more than just the spot market.

How so?

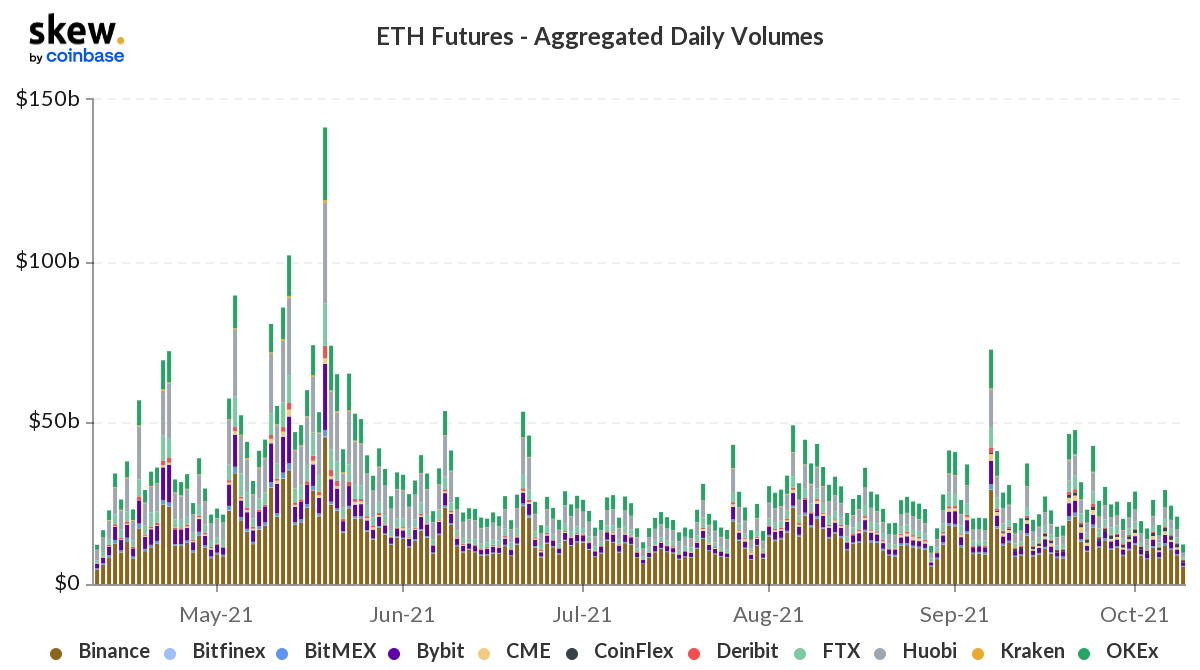

An interesting observation came in the form of Ethereum investors slowing down from investing in futures contracts. Volumes of the derivatives market today reached a 6-month low.

Ethereum futures volume at a 6 month low | Source: Skew – AMBCrypto

A big reason behind this anomaly could be the fact that Ethereum’s price movement has been flat. ETH has not moved much in the last 4 days and has changed by only 1.05%. After a good beginning this month this consolidation may not be the worst thing, but it isn’t the best either.

In any case, this has led to a slowdown in spot volumes as well as they fell to a 7-month low.

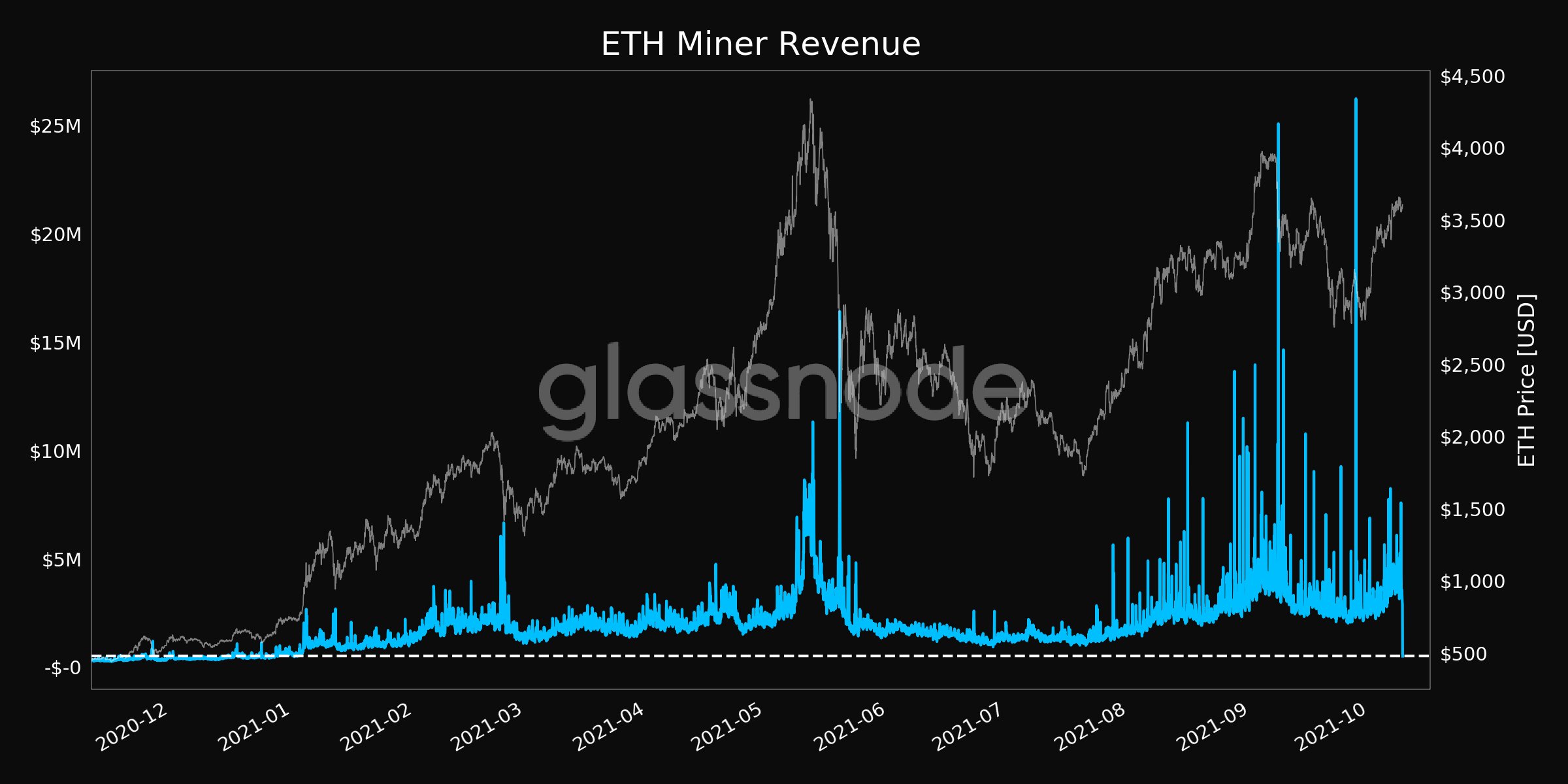

The effects of the same could be seen on validators over the week. Since transactions have come down, validators’ revenue came down as well. At the moment validators’ revenues are at a 9-month low of just $510k.

Ethereum miners’ (validators) revenue | Source: Glassnode

As a side effect of the lack of transaction activity on-chain, the gas fees usage fell to the lowest in over 45 days as well. If transaction counts fall, fewer fees will be charged.

So can Ethereum fix this?

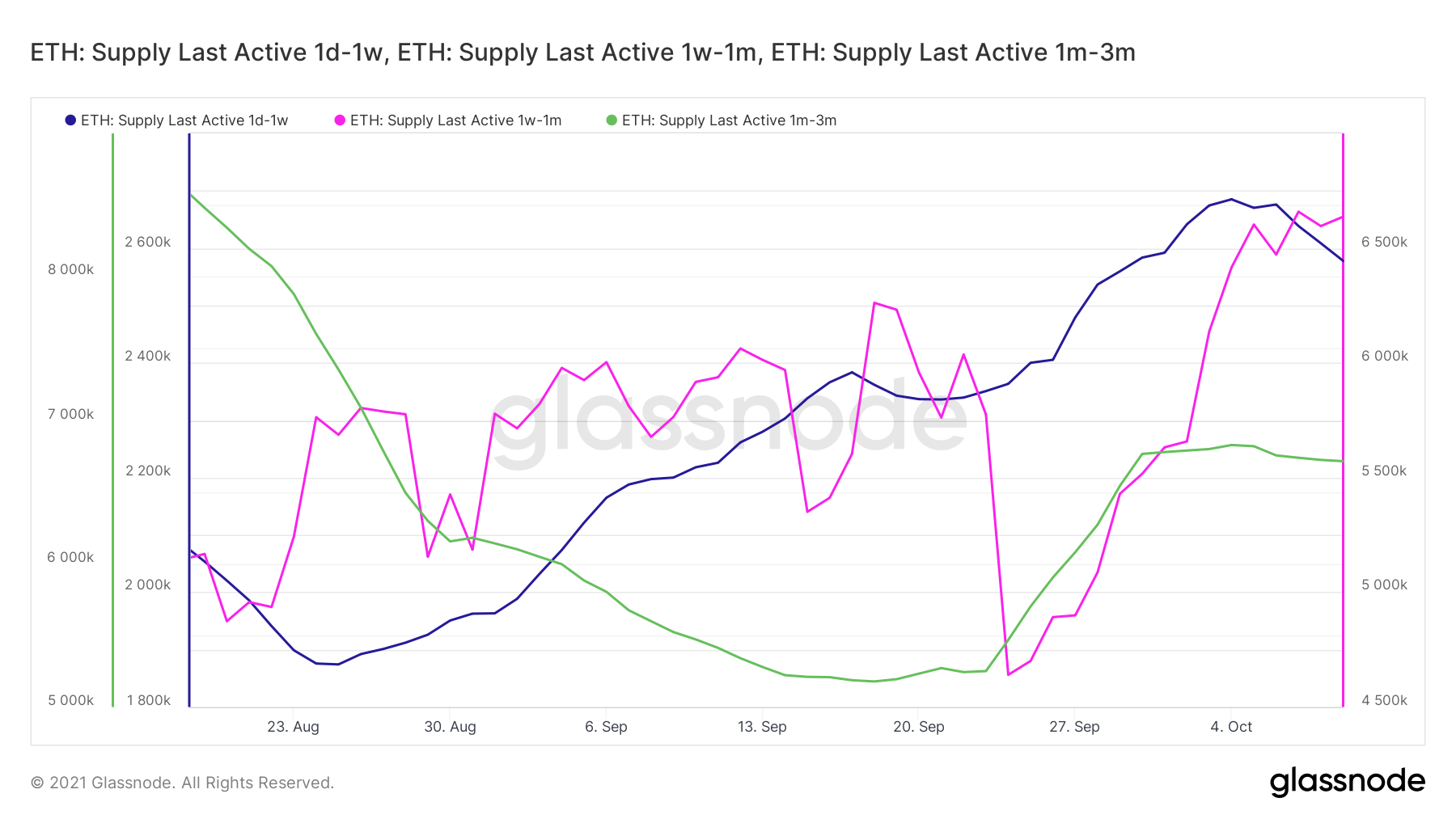

Well, Ethereum can’t but investors can, and at the moment Short-term holders (1 day – 3 months) are at their peak after months. Their increased contribution can probably help in kick-starting the price movement again.

Ethereum 1 day to 3 months Holders | Source: Glassnode – AMBCrypto

Plus some more bullishness could be induced into these investors since more than 96.83% of addresses are in profit. These figures are the highest that Ethereum investors have ever seen.

Ethereum profitable addresses | Source: Intotheblock – AMBCrypto

Thus, If STH and MTH continue to HODL and not sell, Ethereum could potentially move back up again. And as a result, the present scenario would turn into a break instead of a halt.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)