Assessing the odds of CAKE breaking above its near-term resistance

Good news recently came in for PancakeSwap investors as CAKE was able to make it to several lists that had the potential to change CAKE’s fate in the short term.

For instance, CAKE was among the top-voted BNB chain projects on CoinGecko, a crypto data aggregator. Apart from CAKE, Baby Doge Coin, SafeMoon, and RichQuake were also included in the list.

Here’s AMBCrypto’s Price Prediction for PancakeSwap (CAKE) for 2023-24

? Most Voted @BNBCHAIN Projects on @coingecko ?$SFM @safemoon

$BABYDOGE @BabyDogeCoin$QUACK @RichQuack$CAKE @PancakeSwap? #CGC – the largest independent crypto data aggregator with over 13,000+ different cryptoassets tracked across more than 500+ exchanges worldwide? pic.twitter.com/ER3LtcHjnf

— BSCDaily (@bsc_daily) October 12, 2022

Not only this, but CAKE was also on the list of top DeFi projects in terms of social activity on 13 October. This was a positive development as it indicated the increased popularity of the token in the crypto community.

⚡️TOP #DeFi Projects by Social Activity

13 October 2022$UNI $SPKY $TTC $CAKE $QUACK $SOL $ADA $FLOKI $XTZ #XTZ $HBAR pic.twitter.com/oPseSp1lv1— ?? CryptoDep #StandWithUkraine ?? (@Crypto_Dep) October 13, 2022

However, the popularity of CAKE did not reflect on its chart as it was mostly red. According to CoinMarketCap, CAKE’s value decreased nearly 10% over the last week, and at the time of writing, CAKE was trading at $4.23.

Interestingly, a look at CAKE’s on-chain metrics revealed a different story altogether, as several of them indicated a trend reversal in the coming days.

Investors will be happy

CryptoQuant’s data revealed a major bullish signal for CAKE, which made investors happy as it gave hope for better days ahead.

However, not everything was looking good for CAKE as Santiment’s data revealed a few metrics that did not support a price surge.

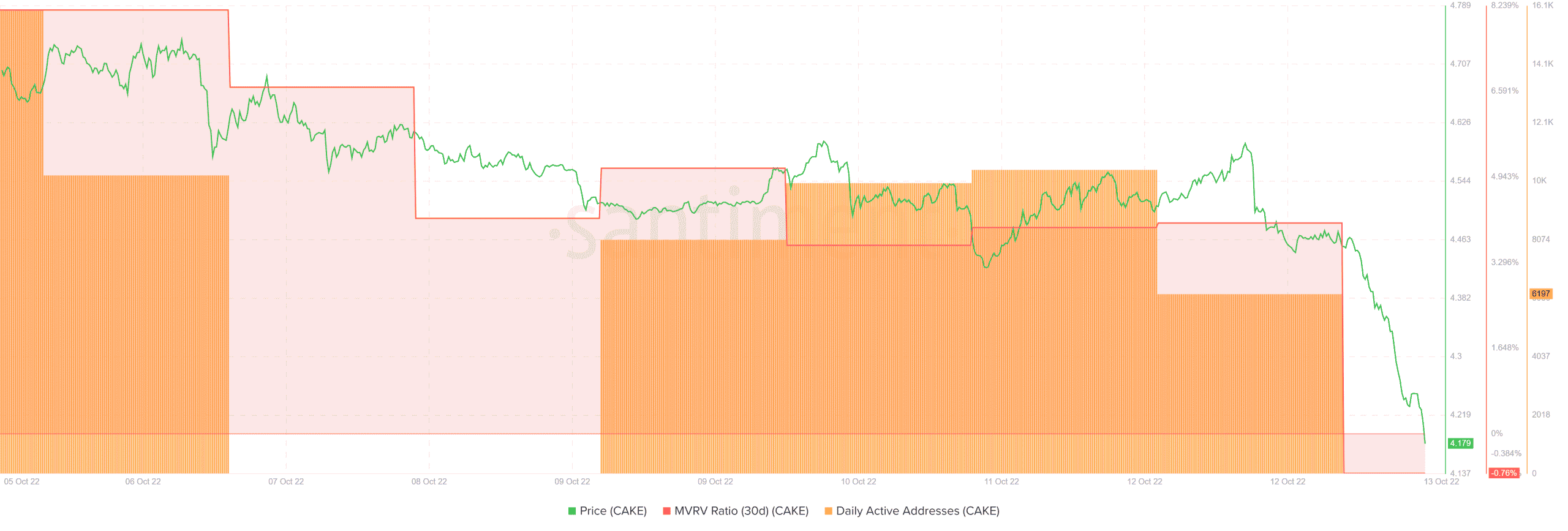

For instance, CAKE’s MVRV Ratio went down, which is, by and large, a negative signal. Moreover, CAKE’s daily active addresses also registered a decline, indicating a lower number of users on the network.

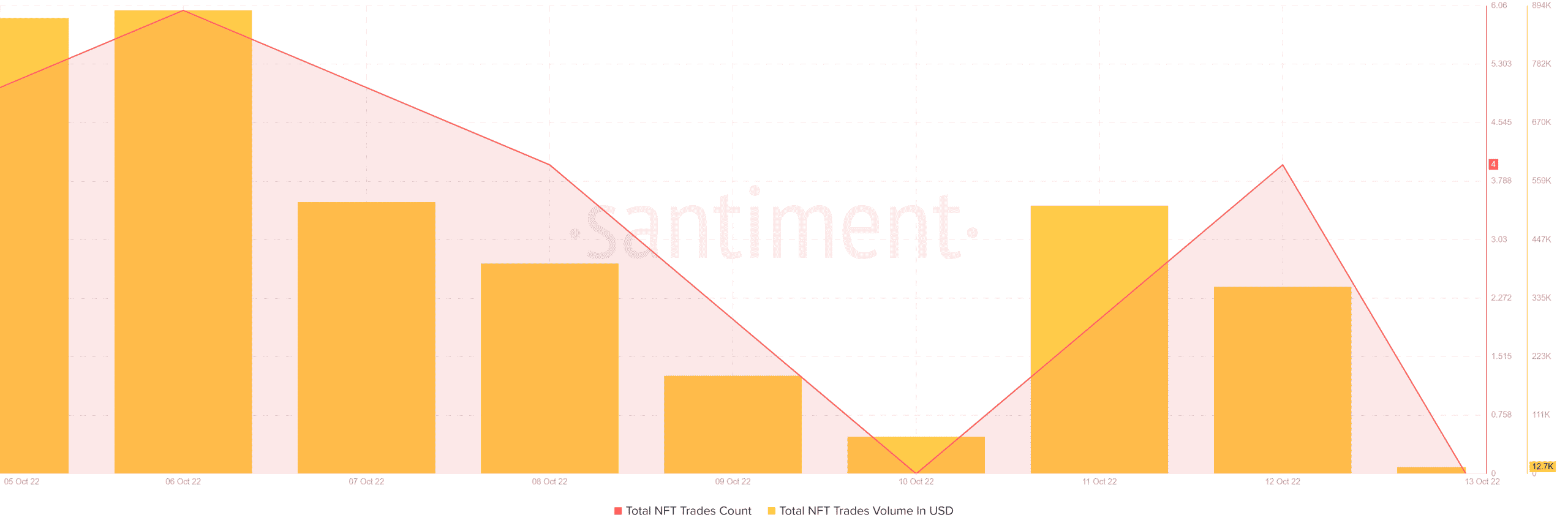

CAKE’s NFT space too witnessed a decline over the last week as the total number of NFT trade counts and trade volume in USD went down.

What to expect?

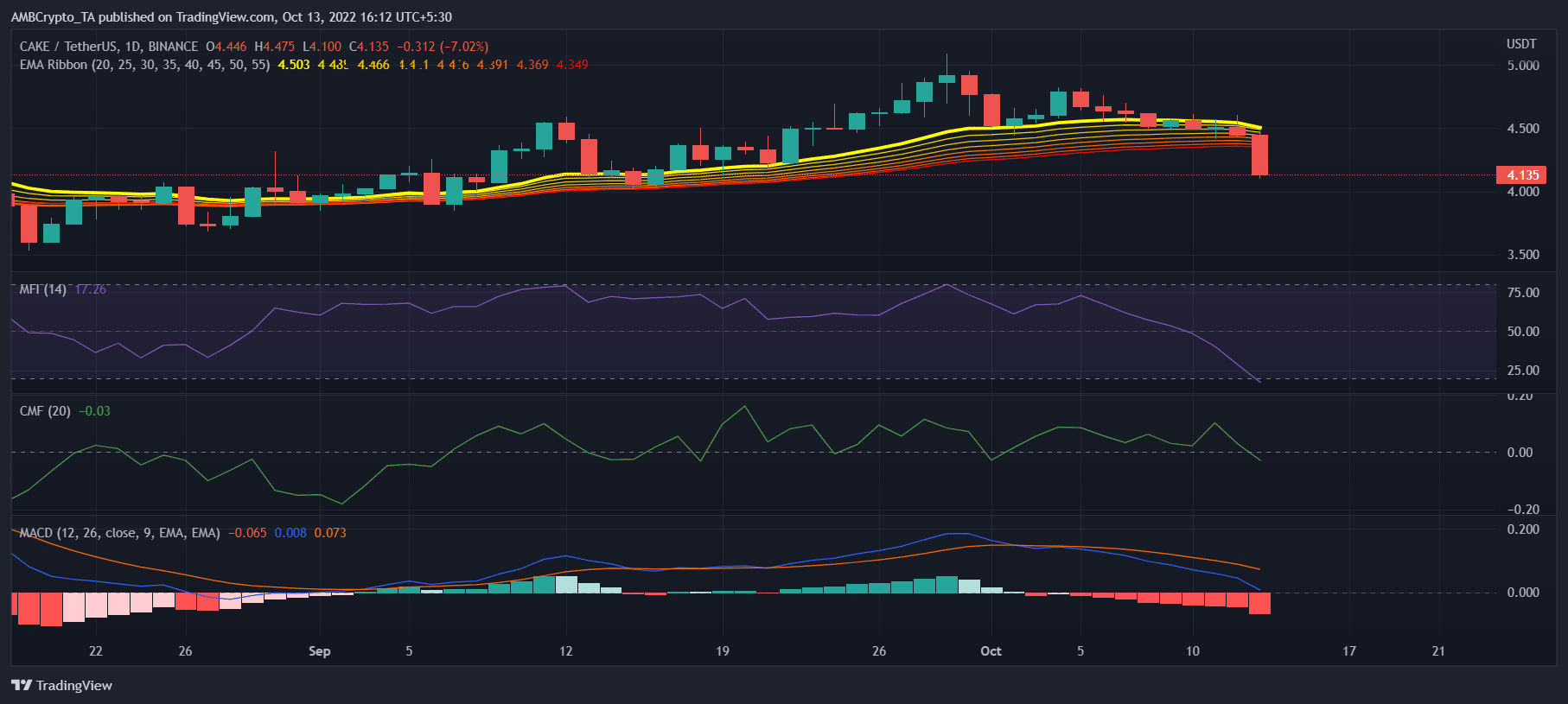

PancakeSwap’s daily chart told an ambiguous story, as a few market indicators were in favor of a price hike, while the others hinted at a potential decline.

For example, the Exponential Moving Average (EMA) Ribbon indicated that the buyers had an advantage in the market. Furthermore, CAKE’s Money Flow Index (MFI) was in an oversold position, further increasing the chances of a price surge in the coming days.

However, the Chaikin Money Flow (CMF) registered a downtick and was resting in a neutral position.

The MACD’s reading also displayed a bearish crossover, which might restrict CAKE’s price from going up in the short term.