Assessing whether UNI’s rally has reached the end of the road

Over the last couple of weeks, Uniswap [UNI] has emerged as a top cryptocurrency. However, it can only sustain the same when it gains more support from investors and the market alike.

The probability of that happening is falling by the day, especially since last month’s rally has finally arrived at its last stop.

Uniswap to swap places…

… from the cryptocurrencies to close in green to the cryptocurrencies that just failed to make the cut. This is one of the evident signs of the same as just last week, after concluding a bullish week, UNI saw consolidation on the charts. This gave the market’s bears enough time to catch up to them.

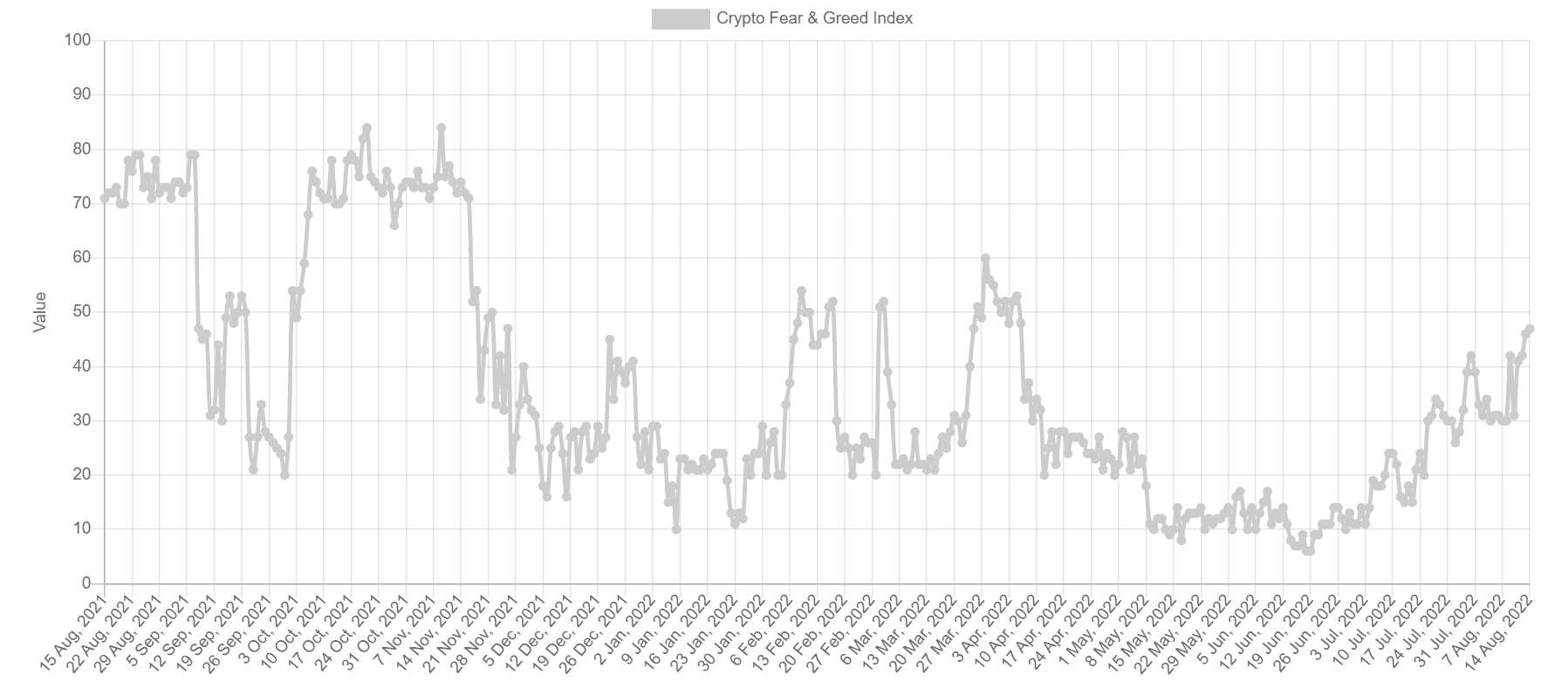

Consequently, the MACD switched from a bullish crossover to a bearish crossover as the Signal Line (red) moved over the indicator (blue) line.

Uniswap price action | Source: TradingView – AMBCrypto

At the time of writing, UNI was just 3% away from completing a 150% rally after rising from its lows in June. However, according to the Squeeze Momentum Indicator, rapidly decreasing bearishness will be a hurdle in UNI’s growth.

As a result, investors that were gradually returning to their highs in the market took a u-turn and decided not to stay active in the market anymore.

The same is evidenced by the velocity of the asset. The rate at which UNI changes hands suddenly dropped to its 6-month low recently, with the same dropping at press time too.

Uniswap velocity | Source: TradingView – AMBCrypto

These factors can trigger either a correction or a crash in the market, which is not ideal for the asset and investors right now. Just this week, UNI holders’ collective average balance came up to $29k – A 126.9% hike in the span of a month from its lows in June.

Uniswap average balance | Source: Intotheblock – AMBCrypto

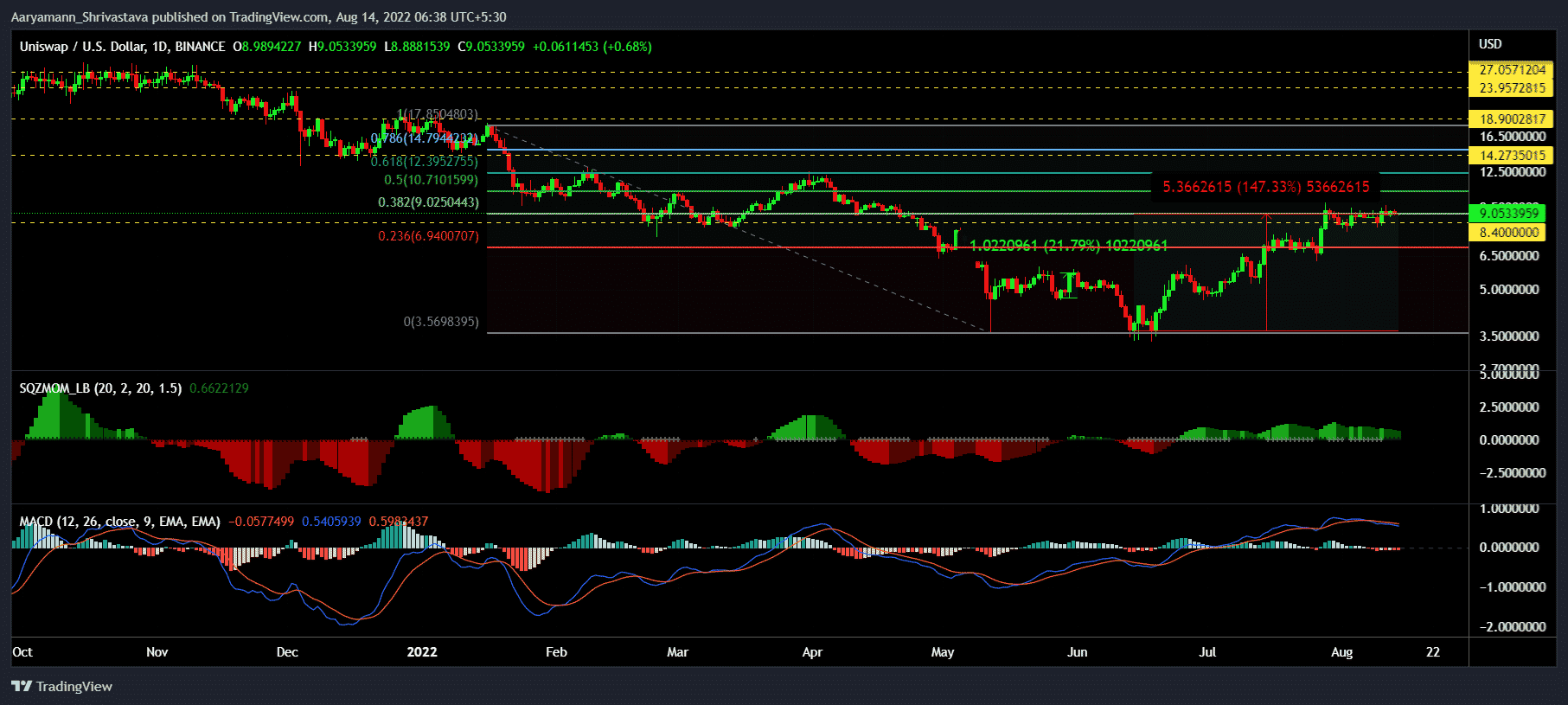

However, the fact that fear in the market is finally beginning to subside means new investors may begin joining networks.

For instance, the Crypto Fear and Greed Index is currently around its four-month high, holding the status of “neutral.”

Uniswap also has the advantage of it being the biggest Decentralized Exchange (DEX) in the world. So, if it decides to counter the arriving bearishness, these factors would come in handy for UNI.