ATOM shed 11.7% in four days — Here’s why the prognosis isn’t good for buyers

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ATOM flipped its market structure bearishly after the drop below $7.17

- The retest of $7 as resistance painted a gloomy short-term picture for the bulls

Cosmos [ATOM] announced that IBC was coming to the Binance Smart Chain. This expansion is expected to offer more opportunities for ATOM to be staked in smart contracts. While this announcement was followed by an 8% move higher, these gains have been wiped out since.

Read Cosmos’ [ATOM] Price Prediction 2023-24

A previous ATOM analysis from AMBCrypto highlighted that the $7 level was an important support level. The past week saw this level yield a >10% rally, but the bears have succeeded in breaching it. What can traders plan for ATOM for the next week?

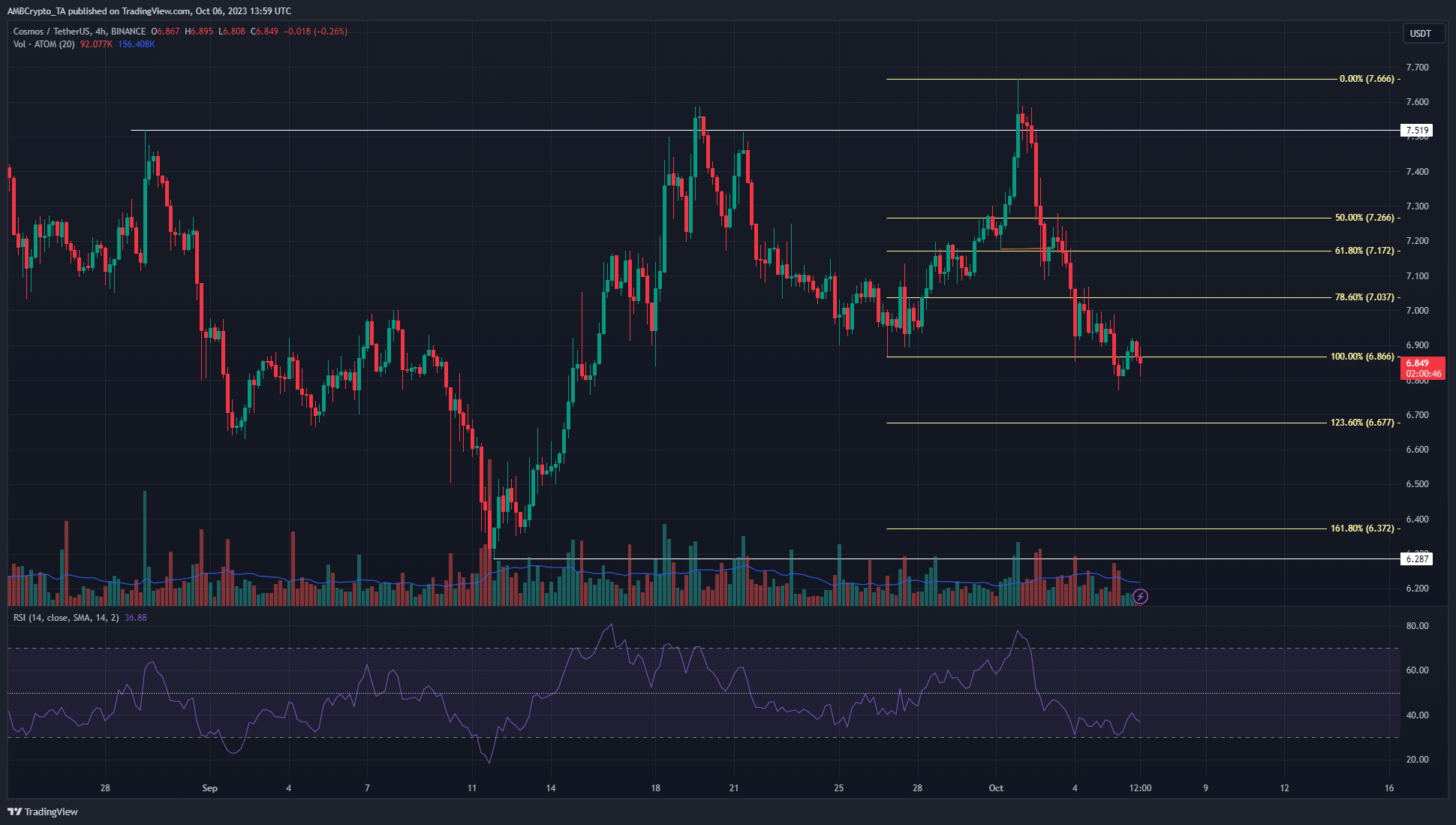

The strong bearish intent meant a move toward September lows was possible

ATOM wiped out all its past week’s gains and then some. The Fibonacci levels (pale yellow) showed that a four-hour trading session closed below $6.866, which was 26 September’s low. The drop below 78.6% retracement meant ATOM was likely headed further south.

The 23.6% and 61.8% extension levels at $6.67 and $6.37 could be places where bulls try to put up a fight. The Relative Strength Index’s (RSI) reading of 36 meant momentum was firmly bearish. So was the market structure.

The low at $6.28 represented the September month’s low and was in proximity to the $6.37 extension level. Hence, a drop below $6.67 would be likely to fall to the $6.28-$6.37 region before the bulls can come to the rescue.

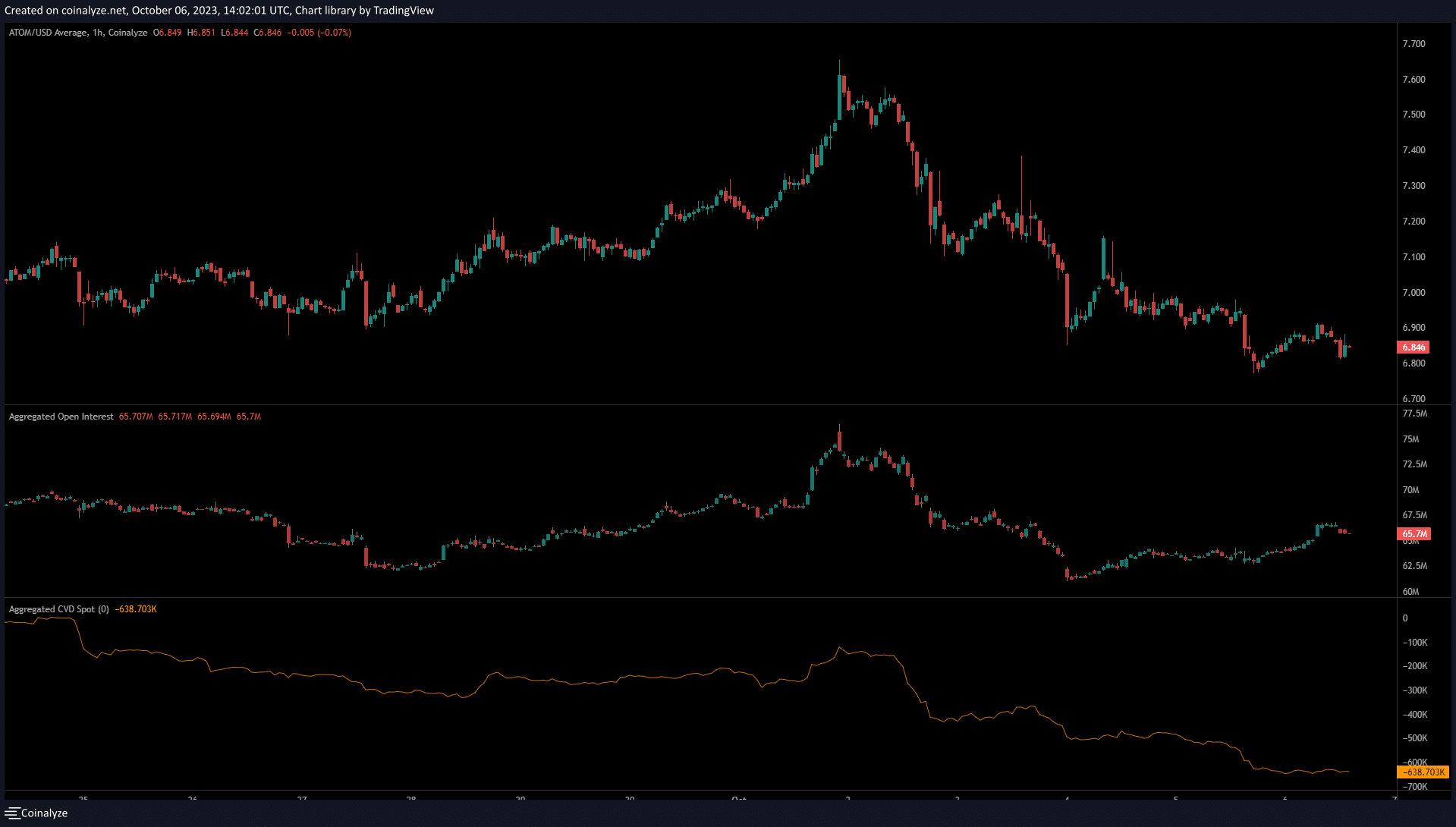

The market sentiment reflected intense bearishness in recent days

Source: Coinalyze

On 4 October, the Open Interest (OI) rose slightly as ATOM prices fell from $7 to $6.93. This highlighted short sellers were in the majority and were willing to short the token’s breakdown below the $7 level.

How much are 1, 10, or 100 ATOM worth today?

The sentiment hasn’t shifted bullish yet. Further, the spot Cumulative Volume Delta (CVD) highlighted trouble was brewing for bulls. The lack of an uptick in the CVD meant the battle was one-sided. Buyers lacked any say in the market, highlighting the strong possibility of continued losses for ATOM.