Avalanche likely to post gains following a breakout past $18.3, here’s why

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

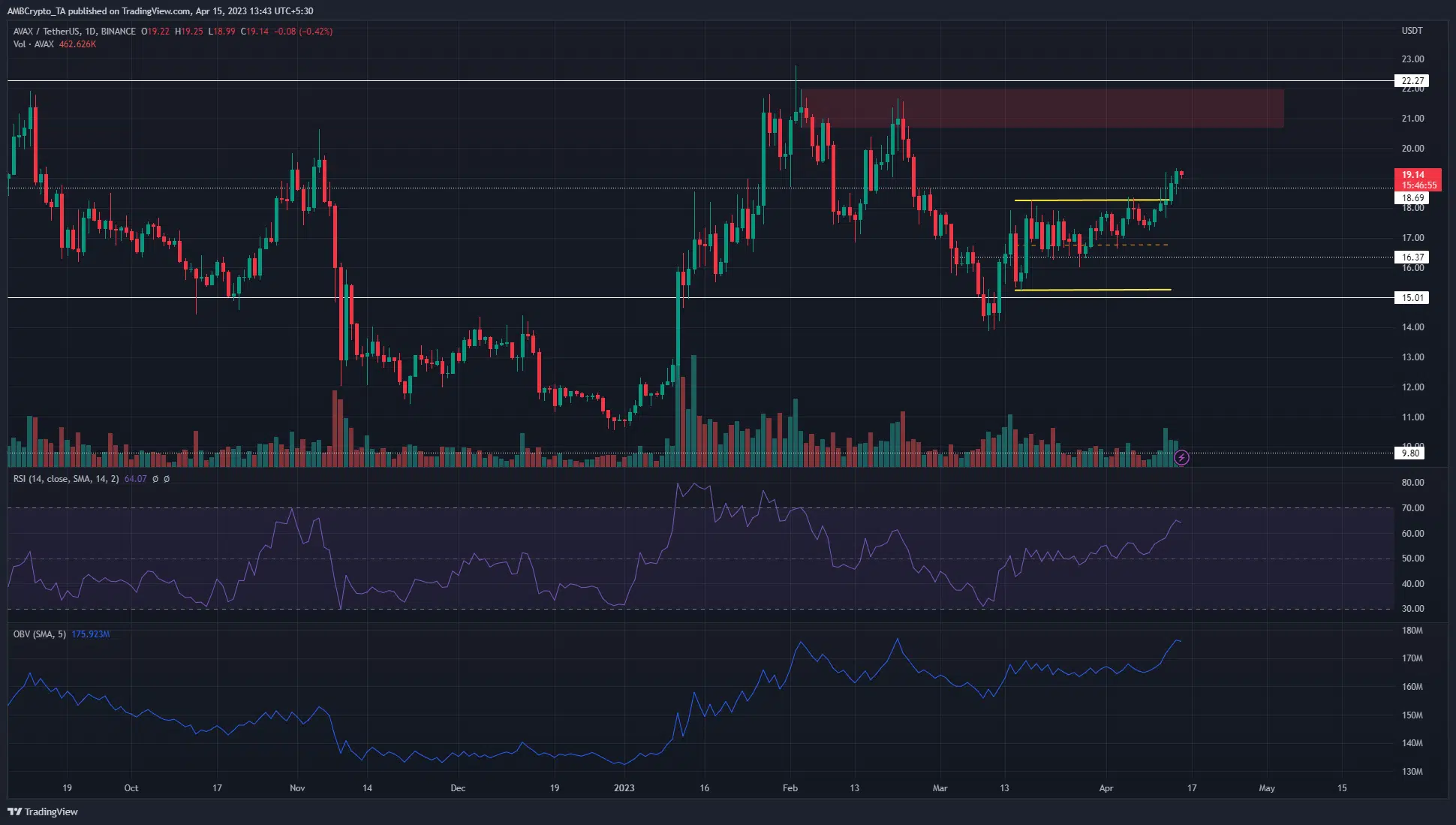

-The higher timeframe AVAX structure was flipped to bullish.

-The daily bearish order block near the $21 region was the next target for bulls.

Bitcoin climbed as high as $31k but at the time of writing it was trading in the $30.4k area. Its price action inspired bullish confidence across the crypto market, and Avalanche succeeded in defeating a month-old zone of resistance.

Read Avalanche’s [AVAX] Price Prediction 2023-24

Avalanche recovered well from the losses it saw during the sell-off in mid-March when the price dipped below $14. The move above the $18.7 resistance flipped the daily market structure to bullish.

A revisit of the range highs, if it occurred, would present a buying opportunity, as it would be a retest of a demand zone.

The breakout past the range highs meant AVAX was headed toward this bearish order block

From 18 March to 11 April, Avalanche traded within a range (yellow) that extended from $15.25 to $18.3. In the past few days, AVAX has broken out above this range and done so on the back of strong demand as well.

The RSI showed hefty bullish momentum and the OBV spiked upward to underline the large buying pressure behind the token. If this continued, it was likely that Avalanche would reach the next region of resistance at $21 soon.

Realistic or not, here’s AVAX’s market cap in BTC terms

The $21 area was important because of the presence of a daily bearish order block formed on 21 February. Highlighted in red, it could pose a substantial obstacle to AVAX bulls. Therefore, buyers from lower levels can look to take profit and re-enter if another breakout materialized.

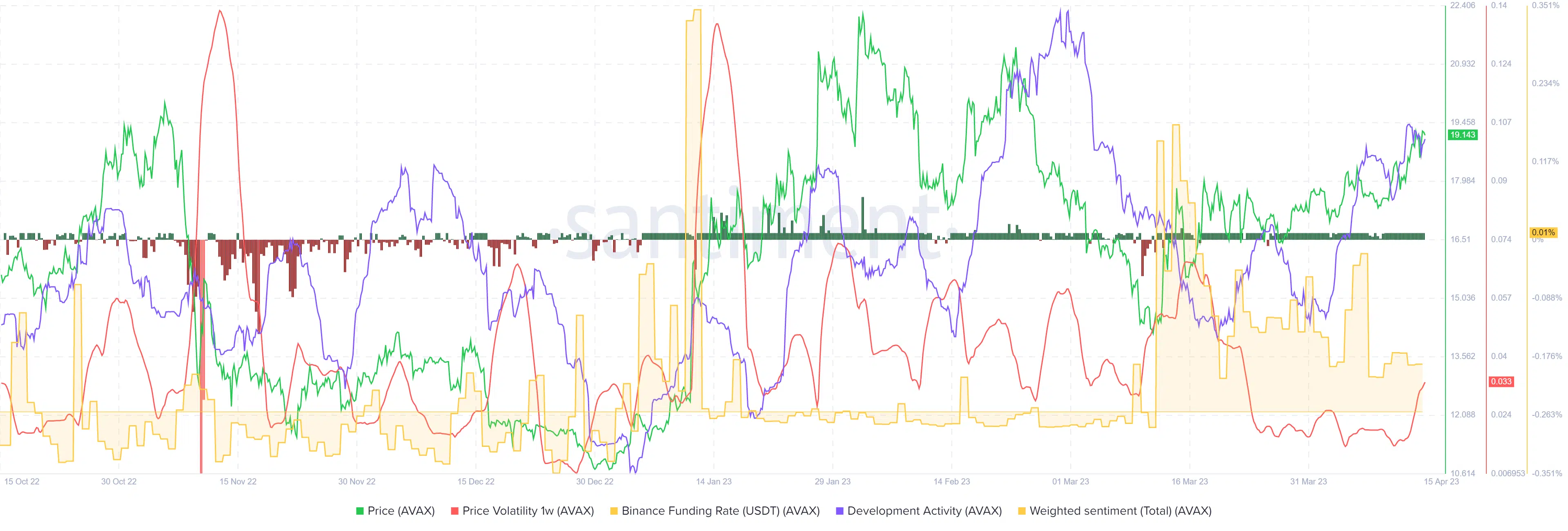

The rise in volatility and the bullish structure could be indicative of further gains

Source: Santiment

The bullish structure and the breakout saw the 1-week volatility rise. This metric had been in decline over a good part of the past month, and its rise in recent days followed the AVAX breakout. The contraction and expansion since mid-March indicated the possibility of a strong rally.

The development activity has been on the rise over the past three weeks, and longer-term investors can gain confidence from this fact. Moreover, the funding rate remained positive, as did the social sentiment.