Uniswap community gives go-ahead for Polygon zkEVM-V3 integration

- The Uniswap community agreed to Polygon’s proposal for its zkEVM launch.

- No DEX has been able to capture Uniswap’s dominance in trading volume.

The Uniswap [UNI] governance proposal to have the Polygon [MATIC] zkEVM integrated into the project’s V3 has been deemed successful.

According to the voting results which ended on 14 April, every member of the Uniswap community agreed to the proposal, with a resounding 42,44 million in support.

How much are 1,10,100 UNIs worth today?

The suggestion, which was brought forward by Jack Melnik of Polygon Labs, centered the launch around the zkEVM’s validation and off-chain transaction computation.

Early on the trend despite a mild threat

It further noted that the Ethereum [ETH] L2 possession of tools capable of creating transparent smart contracts deployment could favor the Uniswap ecosystem. Defending its position as to why this is the right time for such a partnership, the proposal read:

“There’s significant value in Uniswap being available on an EVM-compatible ZK rollup. Deploying early on zkEVM helps solidify Uniswap’s place as the number one DEX and a thought leader”

A few weeks back, Polygon announced the success of its zkEVM Beta. And at that time, the web3 project had announced that over 50 projects were in line to partner with it. Thus, the Uniswap addition means that it was likely that Polygon was experiencing growth in this area.

Meanwhile, the proposal did not fail to highlight some of the risks associated with the integration. Although it noted that there was an ongoing process to evaluate vulnerabilities, the few risks mentioned include unforeseen vectors.

The DEX crown remains a herculean task to take off

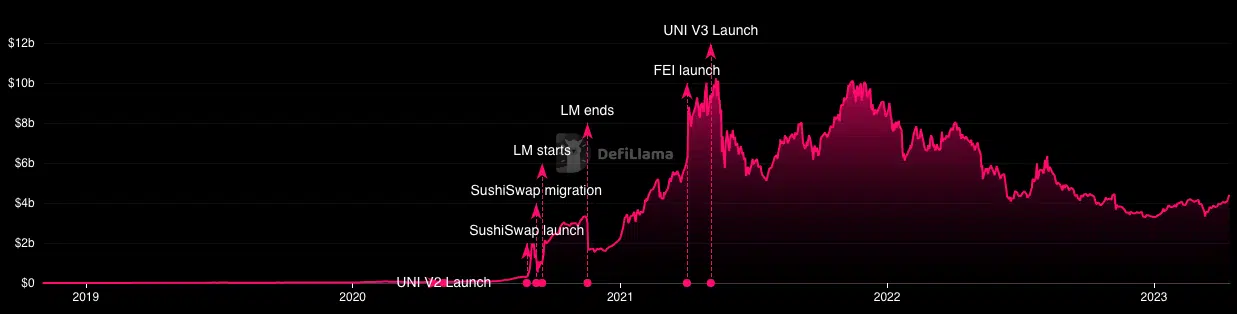

But Polygon pointed out that its gradual liquidity deployment would address the risk. And added that it would be solved before Mainnet. However, the decentralized trading protocol, like most in the DeFi sector, has experienced an increase in Total Value Locked (TVL).

The TVL measures the number of assets locked in a smart contract protocol. According to the DeFi Llama, the Uniswap TVL was $4.39 billion, gaining 8.33% in the last seven days. This affirmed that users have deposited more funds into the several chains under Uniswap.

Realistic or not, here’s UNI’s market cap in ETH’s terms

In terms of the price, UNI has not necessarily improved in the last 24 hours. But in the last seven days, the token value has increased by 4.74%. In addition, the UNI trading volume decreased significantly within the same period.

This implies that fewer tokens have been involved in transactions when compared to the previous. Regardless, the Automated Market Maker (AMM) remained dominant over other DEXes per trading volume. According to Token Terminal, the Uniswap market share was $2.42 billion as of 14 April.