Avalanche’s network activity dips; here’s what the market thinks of AVAX

- Avalanche’s cumulative weekly transactions fell 16.88%.

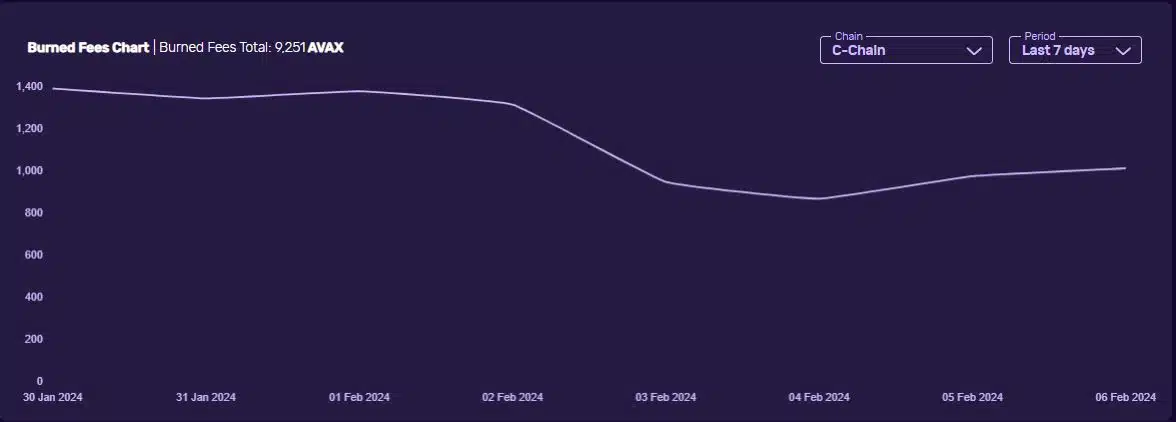

- The fall in transactions impacted the burning rate of AVAX.

Proof-of-Stake (PoS) blockchain Avalanche [AVAX] registered a sharp decline in network usage over the last week, according to a recent post on social platform X (formerly Twitter).

Transactions continued to drop lower

The Contract Chain (C-chain), which is designed for running smart contracts, processed a cumulative total of 7.66 million transactions in the last week — 16.88% lower than the tally recorded a week before.

Consequently, the gas usage in the last week dropped by 2.74%. Note that smart contract interactions require a higher amount of gas as they are more complex.

Hence, the drop indicated less action on the Avalanche-based decentralized applications (dApps).

In fact, daily transactions on the C-chain have plummeted sharply since the Inscriptions frenzy in December.

As evident below, Avalanche clocked more than 5 million transactions between the 15th and the 25th of December.

However, the trajectory couldn’t be sustained in 2024 as daily transactions have fallen as low as 200,000 on the 6th of February.

How much was AVAX impacted?

As per the existing framework, Avalanche burns all the revenue it generates from transaction fees. This meant that the higher the fees, the higher will be the deflationary pressure on AVAX.

However, as transactions decreased over the last week, so did the number of AVAX effectively departing circulation, as per Avascan.

The fall in deflationary pressure could potentially be responsible for the 1.1% weekly fall in the crypto’s price.

Derivatives traders bearish on AVAX

As the spot price dropped, the money locked into AVAX’s speculative market also dipped, AMBCrypto noticed using Coinglass data.

How much are 1,10,100 AVAXs worth today?

As of this writing, the Open Interest (OI) in AVAX Futures contracts was $193 million, a fall of nearly 5% from the previous week. A fall in OI coming alongside a fall in price was reflective of a bearish sentiment.

Additionally, the number of short positions taken for the coin continued to increase vis-à-vis the longs, adding strength to the bearish narrative.