After the mayhem of CryptoKitties last year, the Ethereum network is clogged again with average Gas Price to send a transaction ranging between 50 Gwei to 100 Gwei. After doing some digging, the reason that was causing this congestion seems to be coming from a promotional tactic from a Chinese exchange.

This exchange that initially got publicity due to their “trade to mine” trading event; where users receive 100% of the trading fees from the platform through the equivalent of its exchange tokens. Because of this, many users begin to utilize many types of “wash trading” tactics to boost exchange trading volume and trading fees, to thereby gain more tokens. This allowed the exchange to gain a huge amount of publicity and trading volume in a very short amount of time in the Chinese crypto circle.

Shortly after, it created a new listing strategy under a subcategory of their exchange; where they rank projects with the most number of deposits (per account) of tokens, the top 5 gets listed every other day. Many projects then choose to airdrop their tokens to the most amount of registered user to gain a listing; this then causes a massive backlog in the Ethereum network.

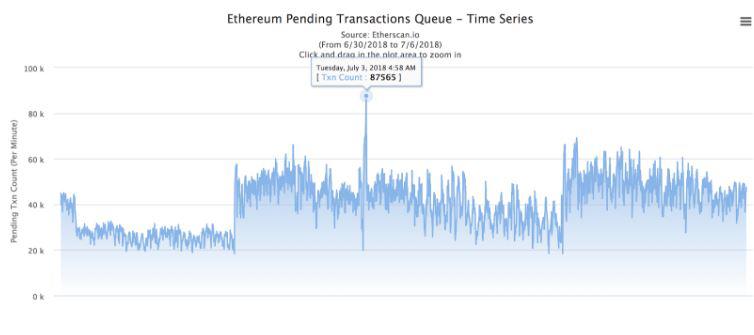

At the moment, data on Etherscan shows there are currently 50,000 transactions waiting to be processed, the peak of it was 87,565. Due to this “strategy”, many DApps that run on the Ethereum network, including Decentralized Exchange (DEX) are suffering to pay high transaction costs, because of the high Gas Fee. Causing many DApps to be put on pause because of the high fees associated with it.

After the quick background story, this article will be mostly talking about trading efficiency and trading cost between decentralized exchanges. The comparisons of DEX will be between IDEX, DEx.top, 0x Protocol, Fork Delta, and Kyber.

For all e.gs used in this article, Gas Price will be set at 50, to demonstrate congestion in the Ethereum network.

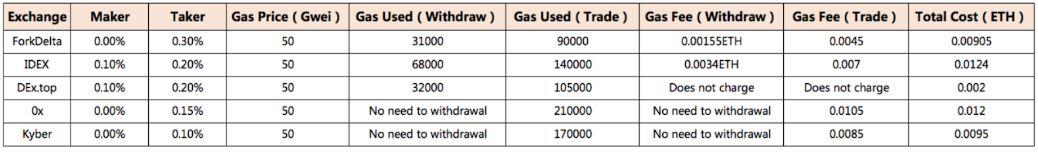

For trading efficiency both IDEX and DEx.top utilizes offline ledgers that match trades before sending transactions to the public blockchain. However, DEx.top batches its transactions, unlike IDEX, therefore increasing trade efficiency. The Gas Fee to trade at IDEX is around average compared to other DEX, but it charges a very steep withdrawal fee to users, which amounts to 0.0034 ETH.

For DEX that utilizes 0x protocol, they have a small advantage on not needing to withdrawal tokens back to their address, therefore saving a small amount on Gas Fee. But the gas used to trade are higher, it is around 0.0079 ETH, which ranks 2nd to last out of the other DEX at our list.

Kyber functions more like a decentralized Shapeshift. Where users pick a currency to trade/convert it for another immediately, with a given rate by Kyber through its reserve pool. The advantage of Kyber is its user-friendly application for beginners. However, this comes at a price, as it costs the most gas to trade, 0.0085 ETH, highest out of all DEX at our list.

For the trading cost, we will focus on the trading fee and the withdrawal fee from the exchanges.

For withdrawal, all DEX require their users to pay for the gas cost, except at DEx.top where the project covers the withdrawal gas cost. Allowing users to save a lot more Gas compared to the other three DEXs.

Below is an e.g of a trader trading at the 5 DEX. For e.g:

A Maker who uses 1 ETH to buy 5000 X Token, the Taker Order matches this whole transaction, and the Taker covers the trading cost. When the Ethereum network is congested, moments like now, and we set Gas Price at 50 Gwei (0.00000005ETH), we can calculate gas used for each other exchange. Each cost would be something like below:

- DEx.top = 1 * 0.2% = 0.002 ETH

- 0x = 1 * 0.1% + 0.00000005 * 158000 = 0.0089 ETH

- ForkDelta = 1 * 0.3% + 0.00000005 * 31000 + 0.00000005 * 90000 = 0.00905 ETH

- Kyber = 1 * 0.1% + 0.00000005 * 170000 = 0.0095 ETH

- IDEX = 1 * 0.2% + 0.00000005 * 68000 + 0.00000005 * 140000 = 0.0124 ETH

DEx.top is 4 times cheaper than the second place DEX that utilizes 0x protocol. Therefore, if users want to trade at DEX, it only makes sense to trade at the exchange with the lowest fee and highest efficiency.

For gas cost, the ranking will be: DEx.top < ForkDelta < Kyber < 0x < IDEX

Out of these five exchanges, DExtop is the only DEX that covers users trading and withdrawal Gas Fee, therefore even in times of congestion, users will not be asked to pay high trading fees. This is especially important to normal retail traders who trade small amounts of crypto as fees add up very quickly.

Because of the creation of the new subcategory of the Chinese exchange, it is expected that the Ethereum network to be heavily congested in the near future, as there are many projects that wish to get listed. As a result, for users who wish to trade at DEX with low fees, picking the one with the lowest fees makes all the sense.

In the end, we hope this “promotion strategy” and the Ethereum network congestion to end quickly because the longer it last, the longer it hurts the average Ethereum users and developers.

To know more, click here.