What traders can expect after BCH’s 10% rally

- Bitcoin Cash bulls terrorize the crypto streets but is there any end in sight?

- BCH oversold but the whales are still actively buying.

What happens when the native cryptocurrency of a forked network outperforms that of the original network? That is Bitcoin Cash’s [BCH] current reality judging by its weekly performance.

Is your portfolio green? Check out the Bitcoin Cash Profit Calculator

Bitcoin Cash holders have been over the moon about its performance since mid-June. For perspective, BCH traded at $234, which represented a 115% upside in the last seven days.

BCH managed to outperform its more popular counterpart, Bitcoin. Its press time price also represented a 156% premium from BCH’s lowest price in the last four weeks. The cryptocurrency, at the time of writing, was trading at its 2022 mid-May levels.

BCH’s parabolic move has already pushed it into overbought territory according to the Relative Strength Index (RSI). But does this mean that it is slated for a sizable cool down?

A major selloff might be on the cards for Bitcoin Cash especially after the robust rally achieved in the last two weeks. However, understanding the reasons behind the current rally might offer insights into what to expect.

No official announcement has been made so far that is enough to trigger a major rally. Nevertheless, every once in a while we see a surge in an unexpected cryptocurrency. That is because whales rally behind a cryptocurrency that they can push up and that tends to attract the retail segment.

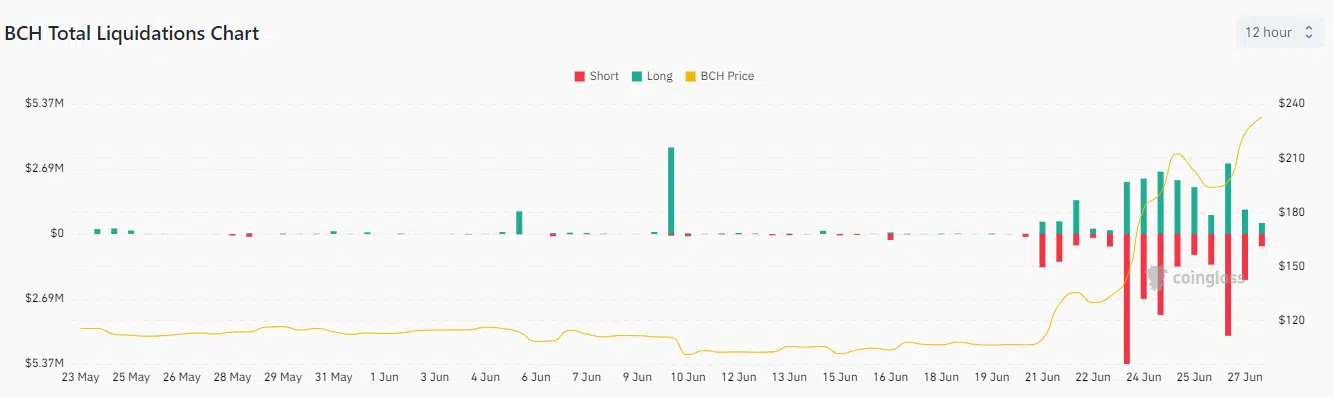

BCH attracts more long and short positions

Short liquidations may also be pushing prices higher. A look at BCH’s short vs. long liquidations revealed that short liquidations have been more dominant in the last few days. Long liquidations have also increased during the same period, indicating that there was also some heavy bullish optimism.

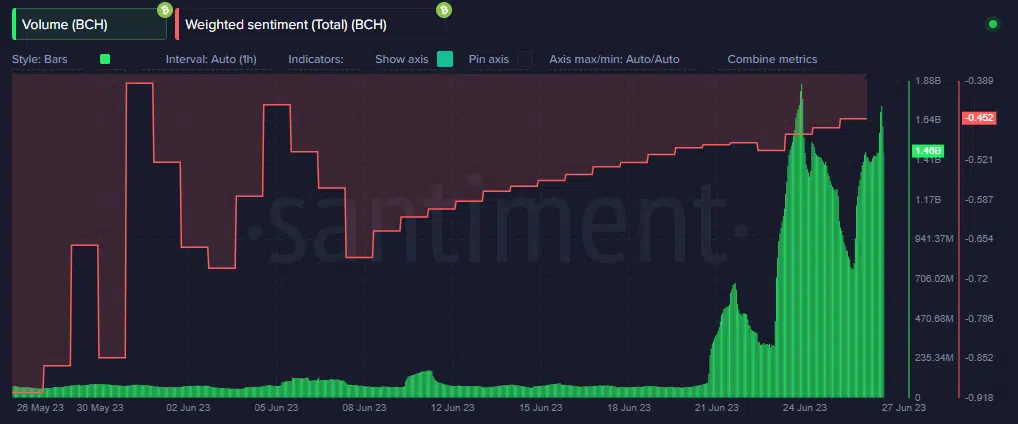

More on-chain data revealed that the Bitcoin Cash investor sentiment has been gradually surging in the last four weeks. Volume remained low for most of the month, up until 21 June when it registered a large spike.

To put things into perspective, volume ranged between $60 million and $70 million before 21 June. After the surge, the volume peaked at $1.86 billion on 24 June and peaked at $1.73 billion in the last 24 hours.

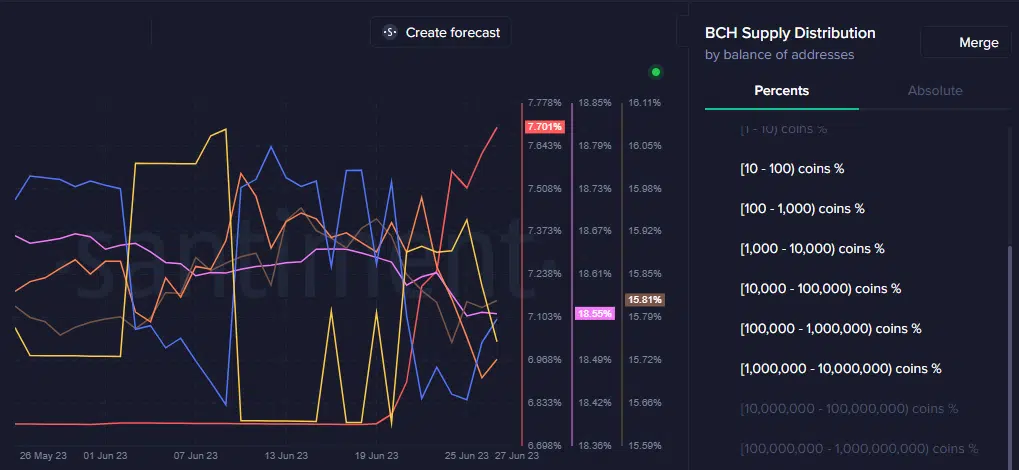

Since Bitcoin Cash was maintaining robust volume despite being oversold, perhaps we can look into the possibilities of a selloff. Its supply distribution metric reveals a mixed bag of reactions among the whales.

For example, the largest whale category (holding over 1 million BCH) have been buying for the last two weeks. This has encouraged many top whale categories to do the same in the last three days.

How many are 1,10,100 BCHs worth today

The supply distribution metric confirmed that whales have been actively involved in the Bitcoin Cash rally. Traders should also note that there has been significant profit-taking along the way. Some whales especially in the 100,000 to 1 million range previously accumulated but have been selling in the last few days.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)