Ethereum

Bearish Ethereum drops to $1800 support, will bulls defend it

ETH continues to face selling pressure in May, but it is not as intense as it was in April.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Sellers were temporarily stalled at $1800 support at press time.

- Negative sentiment persists despite the accumulation seen in the past few weeks.

The U.S. stock and crypto market posted mixed results on 10 May after inflation fell slightly below 5%. In particular, Ethereum [ETH] increased to $1887.5 before sliding below $1800 on the daily session.

Similarly,

Bitcoin [BTC] reclaimed $28k before nosediving back to $27k. At press time, ETH traded at $1833 and flashed red – an overall bearish outlook partly accelerated by the recent Ethereum Foundation move.Is your portfolio green? Check ETH Profit Calculator

Bears shell the $1800 support – Can bulls rebuff them?

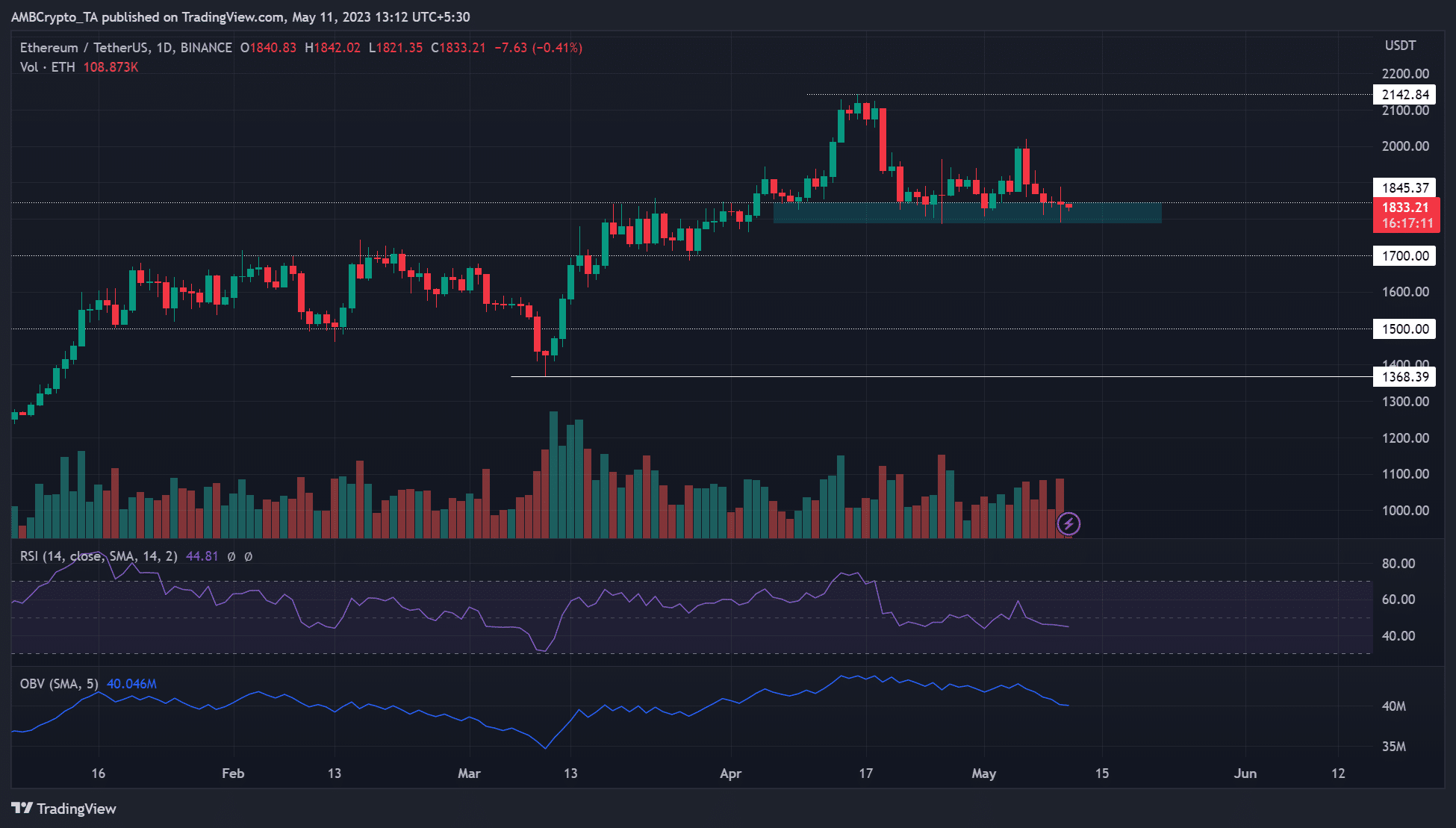

In mid-April, ETH made a new high and climbed above $2100. After that, it retraced, but the $1800 support (cyan) checked the drop. So far, the support has remained steady in the past two weeks and could continue if BTC doesn’t drop below $27k.

A BTC drop to $26k could set ETH to crack $1800 support and expose ETH to more sell-offs. Such a move could decelerate ETH to lower support levels at $1700 or $1500.

Conversely, the $1800 support could come to the bulls’ rescue again if ETH sees aggressive demand at its current levels. Such a move could keep the local top intact. Upper resistance levels to consider lay at $2000 and $2100.

How much are 1,10,100 ETHs worth today?

In the meantime, RSI slid below the 50-mark, confirming elevated selling pressure. Similarly, OBV has also dipped since mid-April.

Sell pressure eased in May compared to April

ETH saw massive accumulation from mid-April, as shown by the rising supply outside of exchanges (yellow). Interestingly, short-term selling pressure increased during the same period, as shown by spikes in supply on exchanges (red).

However, the supply on exchanges dropped significantly in May, while supply outside of exchanges edged higher – suggesting accumulation outpaced selling pressure since the beginning of May.

Nevertheless, weighted sentiment remained eerily negative since the end of February. It only changed on 14 April after ETH crossed $2100 but slid back to negative.