Binance Australia CEO expects ‘lot more interest, demand, volatility’ in 2022

It truly is the season of joy as Bitcoiners awoke to a ‘Santa Claus’ rally that saw the cryptocurrency finally going north of $50,000, after facing resistance for around two weeks. As the bullish year nears its end on a presumably happy note for BTC investors, many industry proponents appear positive on their outlook for the next year.

In an interview with Bloomberg today, Binance Australia CEO Leigh Travers also appeared to be jolly about how 2021 played out for the industry. Further fueling his belief in an even more positive 2022.

However, the exec did admit that volatility would continue to be a part of the industry going forward, noting,

“I’m not going to predict less volatility because certainly, 2021 has been volatile. Whether that’s macro concerns, some individual aspects happening within the crypto market… I continue to expect there is going to be a lot more interest, demand, and volatility.”

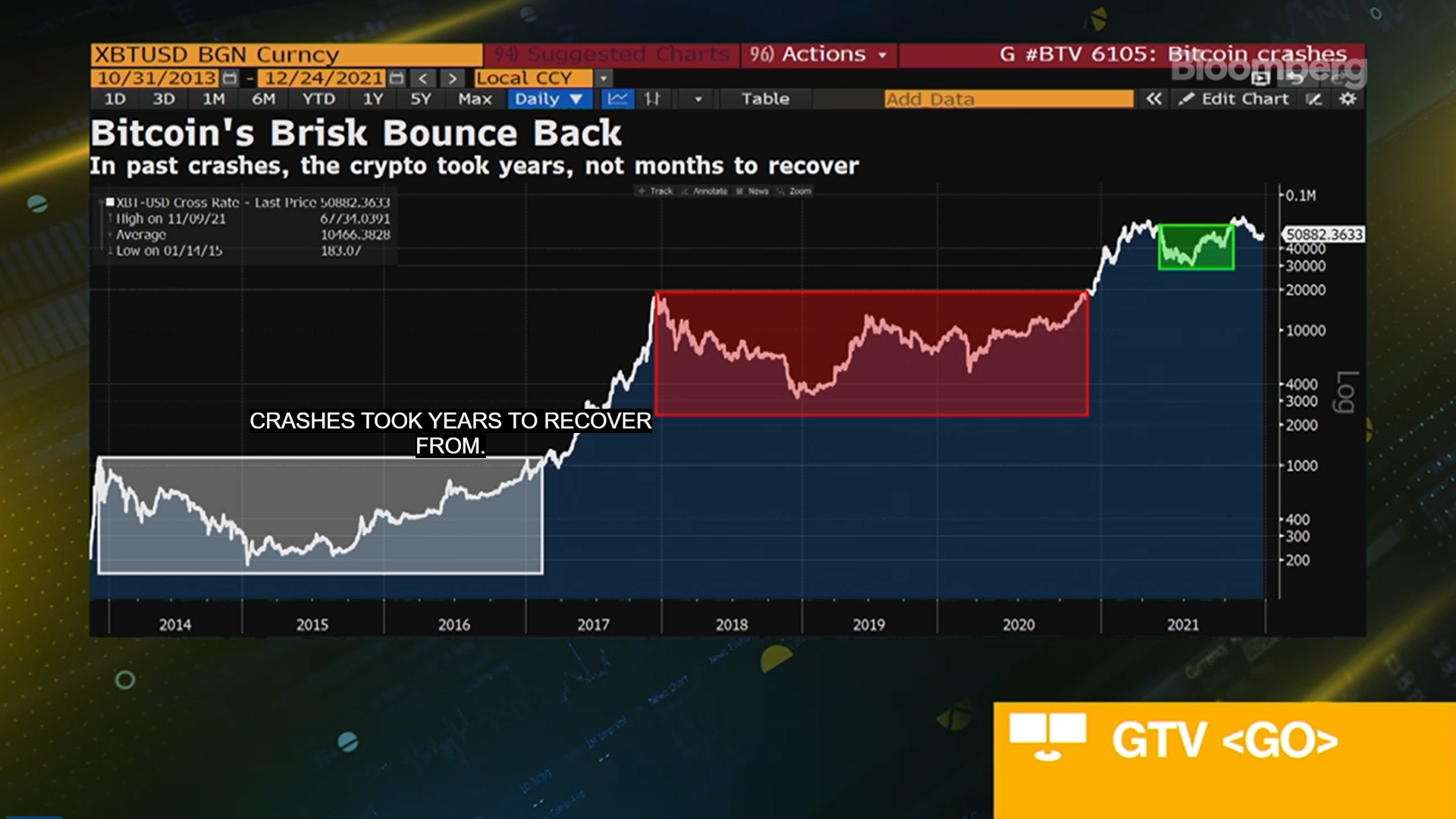

Travers highlighted that another sign of market maturity was the shortening of price recovery periods, which would previously take years to surface. He said,

“It is certainly not just the domain of early adopters anymore. It is getting mainstream. Genuine buyers out there. We certainly saw that this year with a flood of capital coming to join the buy side. We didn’t necessarily see that in previous cycles. This one has been met with a lot of buying capital.”

This could be seen in marketplaces like Australia, according to the CEO, which he expects to double its growth over the next year. He added,

“Globally, we are probably going to move from 5%, maybe even 10% or 15%. There is going to be a huge influx of new participants to this marketplace and that is going to mean dips are going to get bought up.”

Travers further argued that the crypto-acceptance shown by various countries, including Australia, will continue to be a contributor to the growth of the industry moving forward.

“One thing we have seen coming through is really positive countries towards regulating crypto and allowing their consumers to be able to access the innovations that blockchain and cryptocurrencies can bring. We are fortunate to have a positive environment.”

The Australian government recently gave its nod to numerous forward-looking regulatory crypto proposals as part of its new “payments and crypto reform plan.” These include the introduction of a licensing regime for crypto exchanges, a governance framework for decentralized autonomous organizations along with a common access regime for new payments platforms.