Binance Coin and what investors can do to not burn their fingers

Binance coin, the industry’s fourth-largest cryptocurrency by market cap, recently saw a breakout above its down channel. Understandably, a lot of investors and traders were left with their fingers itching to buy in.

But, is that a wise idea? Here’s a full look at the coin’s price action so far.

Technically speaking, BNB has pictured a positive breakout over the down channel and this bodes well for the short term of the coin. However, it must also be noted that it is still trading below its 50 and 200 DMA and well below its immediate resistance level.

Along with that, the RSI indicator isn’t showing any sign of recovery whatsoever. So, BNB has a long way to go before it can stir up any positive momentum.

However, the current price level presents a unique opportunity to buy into a well-established and popular coin with a lot of things going for it, metric-wise.

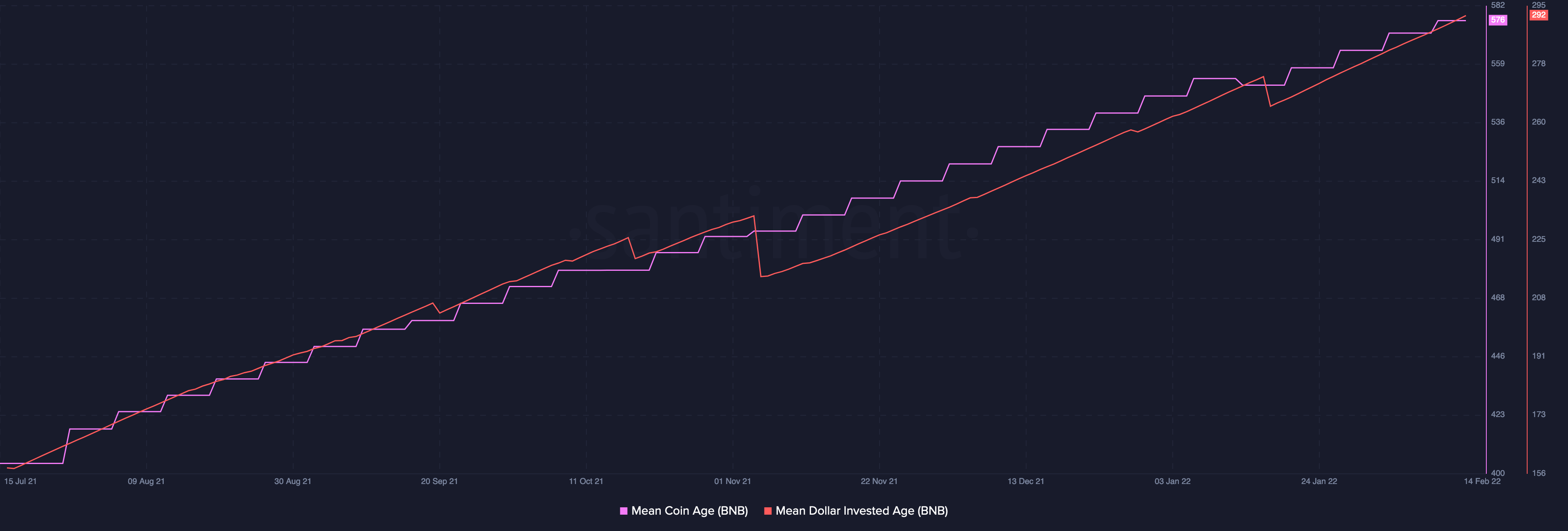

The mean coin age for BNB, for instance, has been on a steady uptrend. This indicates HODLer optimism, despite the recent corrections and market wide bearish sentiment.

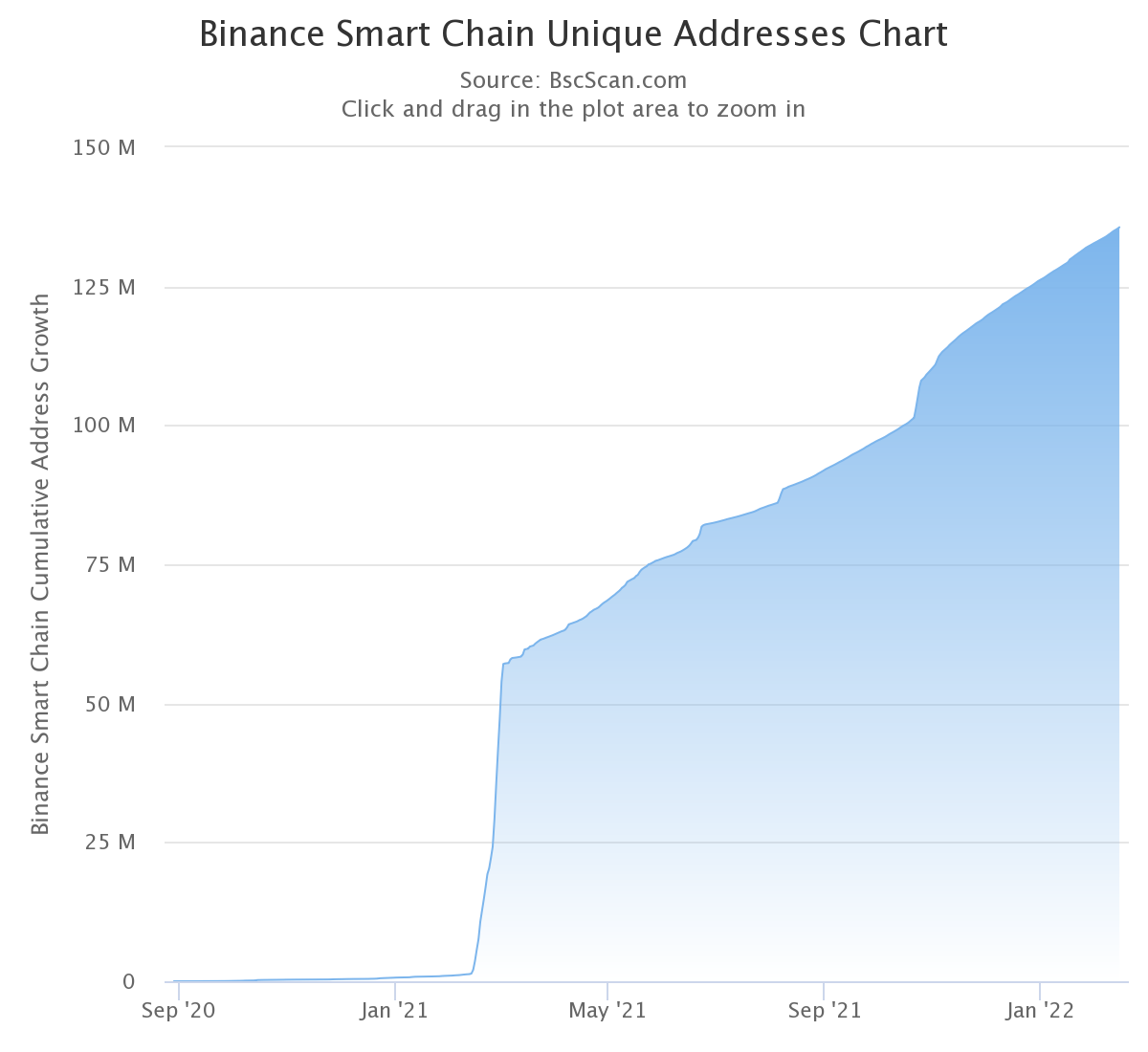

Furthermore, data pulled from bscscan.com clearly underlined a steady uptrend on the Binance Smart Chain Unique Addresses Chart. In fact, as of 14 February, the current number of unique addresses was well over 135.6 million.

Binance Smart Chain Unique Addresses | Source: bscscan.com

This can be coupled with the fact that social dominance has been seeing spikes over the last couple of days too, according to Santiment. All of these factors point to a revival in community interest, something that is generally followed by a period of recovery.

In the short-term, BNB’s press time rally of 5% had resulted in over $728k worth of short positions being liquidated across exchanges. From a scalper’s point of view, this can be a good opportunity to buy into the coin as the short-term rally can continue as more short positions are liquidated and losses are booked.

Total liquidations | Source: Coinglass.com

In conclusion, on-chain metrics do seem positive across the board, but they need some major price validation from the charts. This hasn’t happened yet.

A major positive validation could come in the form of a breakout over the 200 DMA, providing some much needed downside support to the coin.

However, considering the coin’s innate use cases and optimism, a piecemeal approach to buying can help in locking in a favorable price. At the same time, one will not risk too much money and save fingers from getting burnt!