Binance Coin [BNB] offers an attractive buying opportunity here

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Binance Coin saw a sharp rejection at $300 earlier in October

- The price has since seen some bullish reaction at the $260 area

Binance Coin approached an important support zone on the price charts. The $260 mark has been significant in the past two months and saw the price bounce the previous week as well. Can traders expect a repeat of the same, especially as Bitcoin hovered above the $19k support?

Here’s AMBCrypto’s Price Prediction for Binance Coin [BNB] in 2022

Binance Coin indicators showed rising buying volume, and the range lows can be an area BNB bulls can watch out for. A good risk-to-reward buying opportunity could materialize. Bitcoin itself was not yet bullish, hence caution could be important for BNB traders in the next few days.

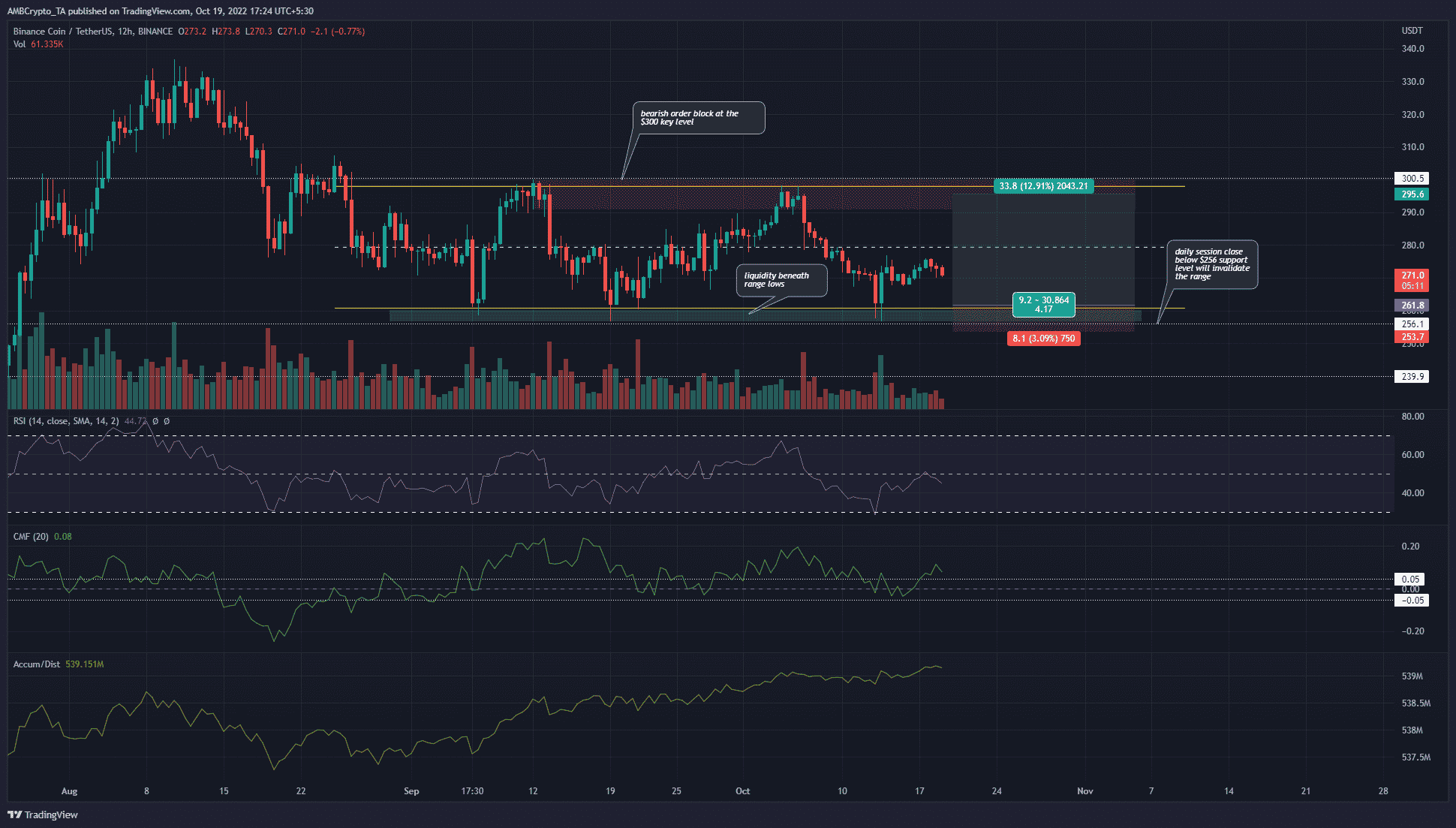

The liquidity pocket beneath the range lows can see a bullish reaction

The 12-hour chart showed a range (yellow) established for Binance Coin. This range extended from $260 to $300. The mid-point of this range lay at $280 and has been a significant level of support and resistance in recent weeks.

Just beneath the range lows lay a pocket of liquidity (cyan) where BNB has been eagerly bought up. Therefore, it offers traders an area to place their bids, and also offers a clear invalidation.

It was possible that BNB could deviate to $250 before surging higher, to fake out the bulls and early short-sellers. Barring such mishaps, the invalidation was clear.

The RSI was below neutral 50 and showed bearish momentum for BNB at press time. On the other hand, the CMF was above +0.05 to show significant capital flow into the market. The A/D indicator was also in an uptrend. This pointed toward an accumulation phase and supported the idea of buying BNB on a dip toward the $260 mark.

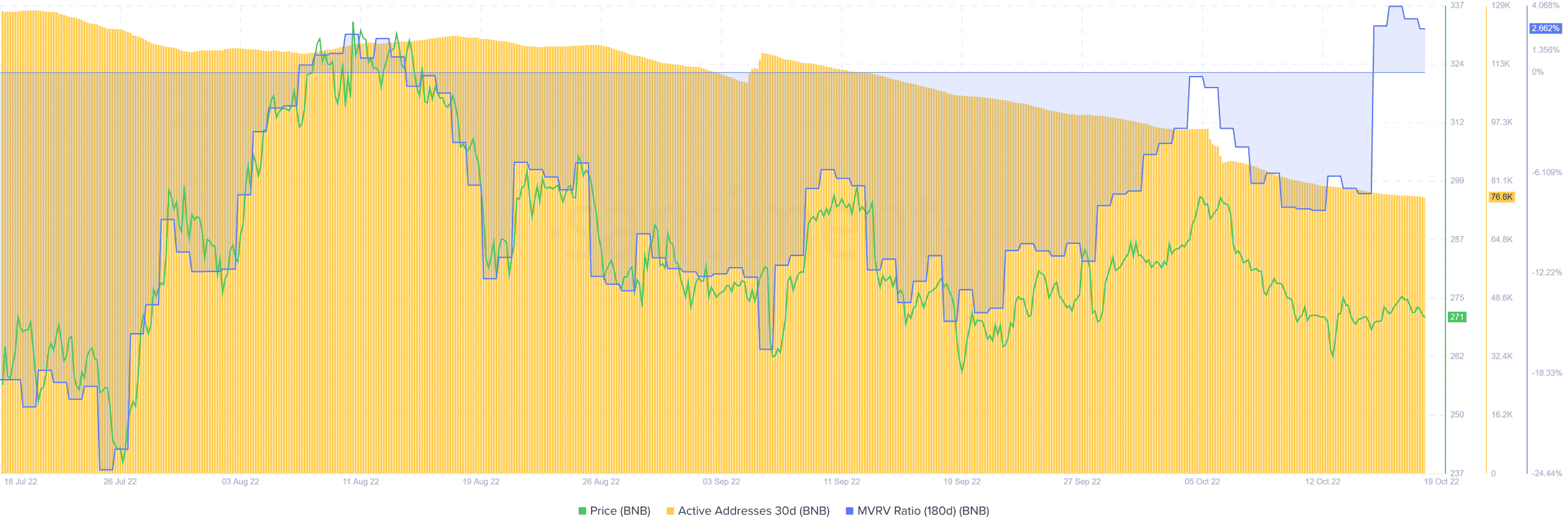

Active addresses are on a downtrend as usual but MVRV perks up

Source: Santiment

The active address count has been on a downtrend since May 2021. Early August saw the numbers find some stability, but they began to dwindle yet again. Hence, the metric was not really a surprise.

The MVRV ratio, on the other hand, did show a pleasant surprise for the bulls. It climbed back above 0% to show 180-day holders of the coin to be in profit, if only slightly.

More cautionary bulls would point to the MVRV’s surge in early August before a sharp decline in the prices. Perhaps this time was similar, and a downturn in the prices can appear.

Yet, based on technical analysis, there was a good chance that BNB’s descent to the $260 liquidity pocket would see a bounce. This bounce can reach as high as $280 and $300, where bulls can look to book a profit.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)