Binance Coin: How buyers can leverage BNB’s volatility to remain profitable

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

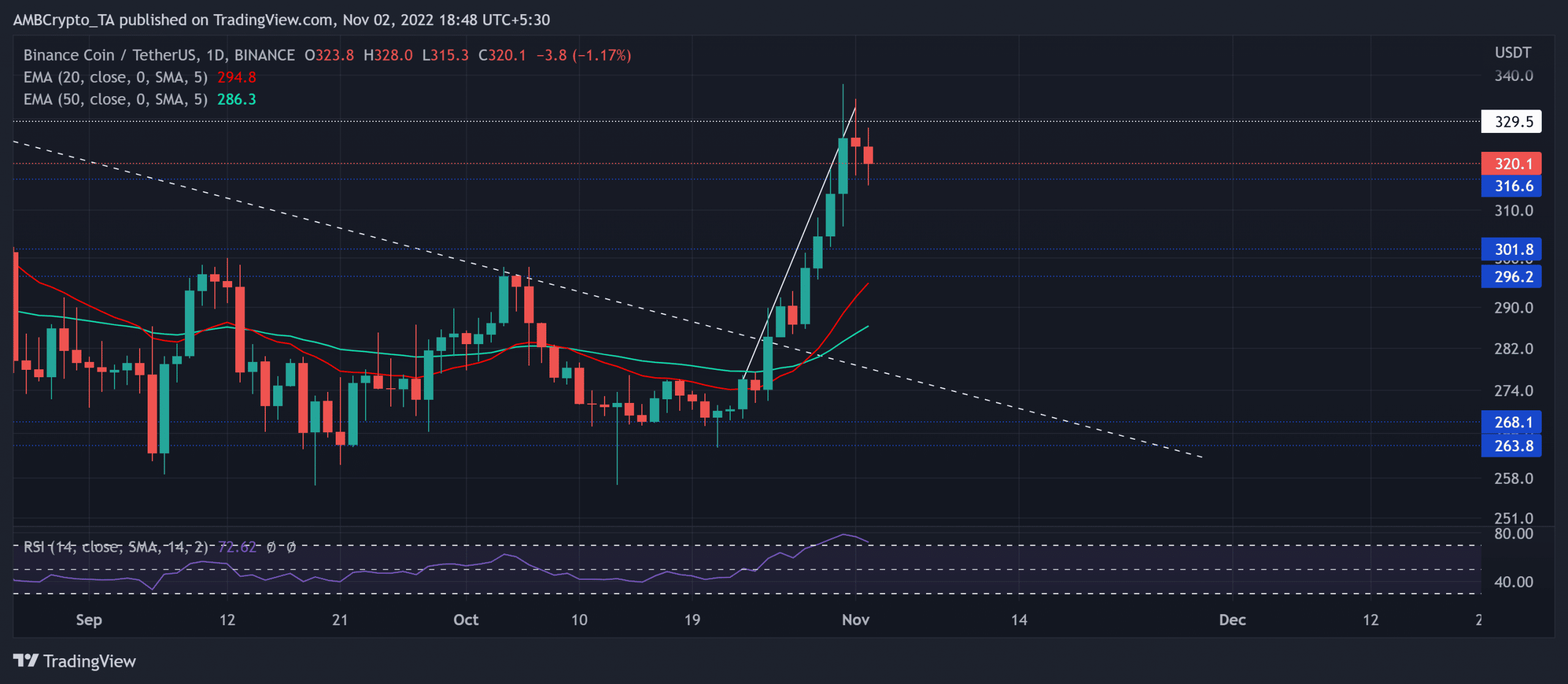

- BNB witnessed a bullish volatile break on its daily chart.

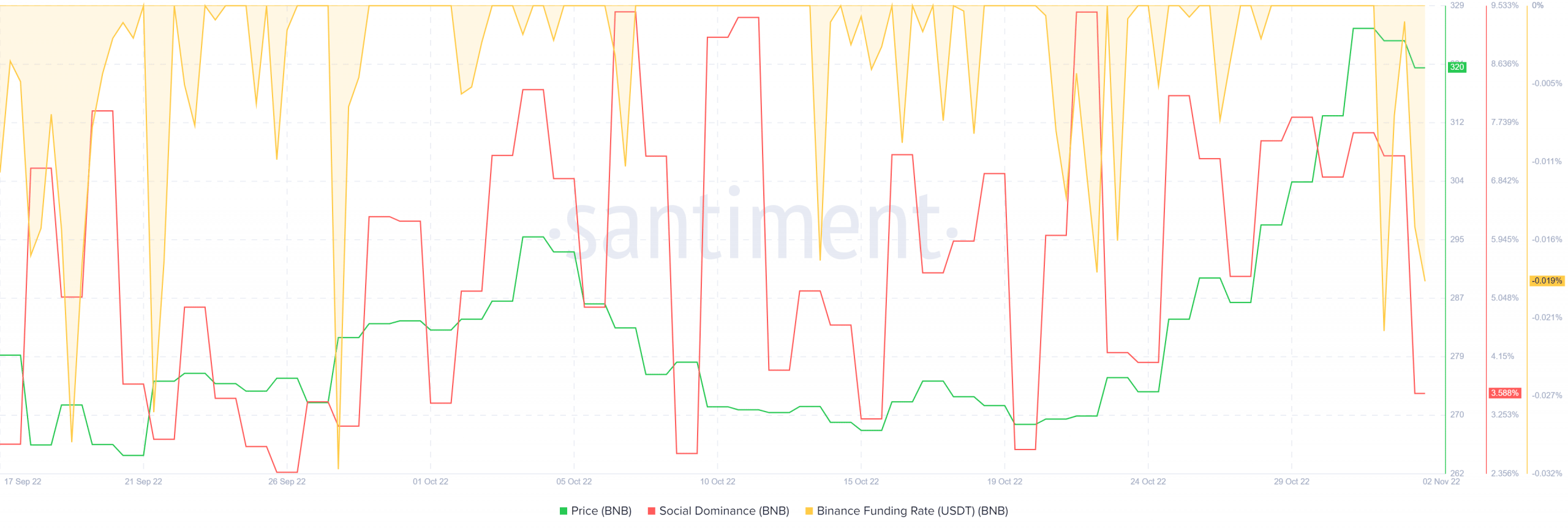

- On the other hand, the crypto’s social dominance and funding rates marked a decline.

Since dropping towards its multi-yearly lows in mid-June, Binance coin [BNB] regained bullish momentum to test its 11-month trendline support (previous resistance) (white, dashed).

Here’s AMBCrypto’s price prediction for Binance Coin [BNB] for 2023-24

Following the footsteps of the king coin and most altcoins, BNB struggled to break into a high volatility phase until recently. With the buyers inducing a steep uptrend over the last two days above the 20/50/200 EMA, bulls would strive to maintain their edge in the coming sessions. At press time, BNB was trading at $320.1.

BNB witnessed a bullish volatile move

While the alt undertook a sideways track for nearly two months, the buyers finally found a reliable break above the $296 zone. The bull run before this break stemmed from a bullish hammer at the $268 baseline in late October.

The resulting reversal led to an over 20% growth until the buyers faced barriers in the $329 zone.

Moreover, during the recent gains, the 20 EMA (red) jumped above the 50 EMA (cyan) to reveal an increased bullish vigor. Should the immediate ceiling propel a firm reversal and the current candlestick close as red, BNB could witness an evening star pattern on its daily chart.

The resulting outcome would expose the alt to a potential test of the $316 mark. A close below this mark can induce further losses.

Alternatively, a likely bounce-back from this support can set the stage for a reversal rally. Any potential rebound above the $329 ceiling could see its first major testing level at the $355 region.

To enter a long position, the buyers must wait for a convincing rebound from its current decline. The Relative Strength Index (RSI) entered the overbought region and hinted at a possibility of a reversal in the coming sessions.

Decreased Social Dominance & Funding rates

Over the past two days, BNB’s social dominance marked a sharp plunge. Empirically, the price action has been quite sensitive to this metric. Should the price follow, BNB could see a pullback in the coming sessions.

To top it up, an analysis of the BNB Funding rates marked a robust plunge over the last two days. This reading suggested a slight bearish inclination in the futures market.

Finally, investors/traders must keep a close eye on Bitcoin’s movement as BNB shares a relatively high correlation with the king coin.