Binance Coin, SUSHI, Enjin Coin Price Analysis: 25 March

The crypto-market has seen increased bearishness over the past few days. As expected, this was on the back of BTC retracing towards the $53k-price range. Altcoins such as Binance Coin, SUSHI, and Enjin Coin registered a bearish breakout from periods of consolidation on the price charts.

Binance Coin [BNB]

Source: BNB/USD, TradingView

Binance Coin, at press time, was trading at $246.2 with a market cap of over $38 billion. The coin, however, endured a 10 percent drop over the week and at the time of writing, was starting to gather enough momentum to initiate a recovery run. If the uptrend restarts soon, BNB will have to go past the strong resistance level at $254, while there is also another resistance around the $274-mark.

The coin also has strong supports at $235 and $213. In the last 12 hours, the former did its job fairly well and helped the price moved north.

The MACD indicator underwent a bearish crossover and there seemed to be no signs of a reversal. The RSI indicator pictured a bit of divergence as it was heading away from the oversold zone and inching closer to the neutral zone.

SushiSwap [SUSHI]

Source: SUSHI/USD, TradingView

SUSHI’s price fell substantially over the past 24 hours, with the alt making its way towards its immediate resistance at $16.5. The coin, at press time, had a trading price of over $15 and registered a 24-hour trading volume of around $473 million. The support at $14 fared well in the face of bearish pressure and helped the coin head north again.

The Bollinger Bands for SUSHI were expanding and signaled heightened levels of volatility in the market. The MACD indicator underwent a bearish crossover with its Signal line going above the MACD line. There weren’t any signs of a trend reversal either.

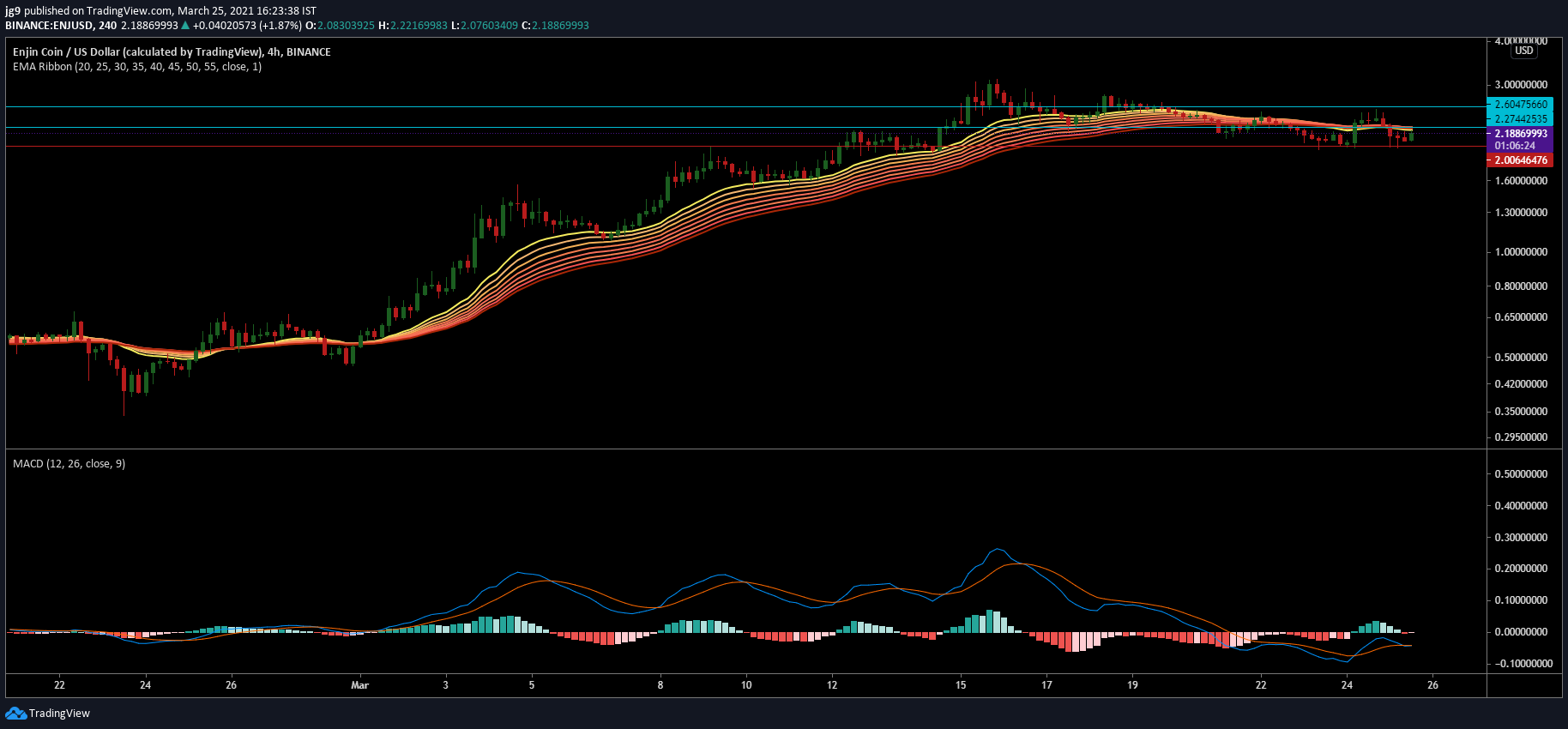

Enjin Coin [ENJ]

Source: ENJ/USD, TradingView

ENJ has been extremely rangebound over the past few days and despite the heightened bearish momentum, the coin continued to trade mostly sideways. ENJ, at the time of writing, was valued at around $2.20 after its price fell by a whopping 17 percent in a week. However, in the last few hours, the crypto was moving from its immediate support and heading towards its resistance at $2.27.

This was also a price point at which the EMA ribbons settled, with the same likely to offer added resistance against ENJ’s upward movement. The MACD indicator registered a few trend reversals and at the time of writing, the indicator had just witnessed yet another bearish crossover.

If a reversal fails to happen, ENJ could see its newfound bullish momentum arrested, forcing the coin to trade sideways.