America’s pain is Asia’s gain in the crypto-space

- U.S. entities now hold 11% less Bitcoin than they did in mid-2022.

- China’s comeback could alter the dynamics in the digital assets market considerably.

The lawsuit against crypto behemoth Binance was the latest attack launched by regulators on crypto participants in the U.S., casting serious concerns about the future of digital assets in the world’s largest financial market.

How much are 1,10,100 BTCs worth today?

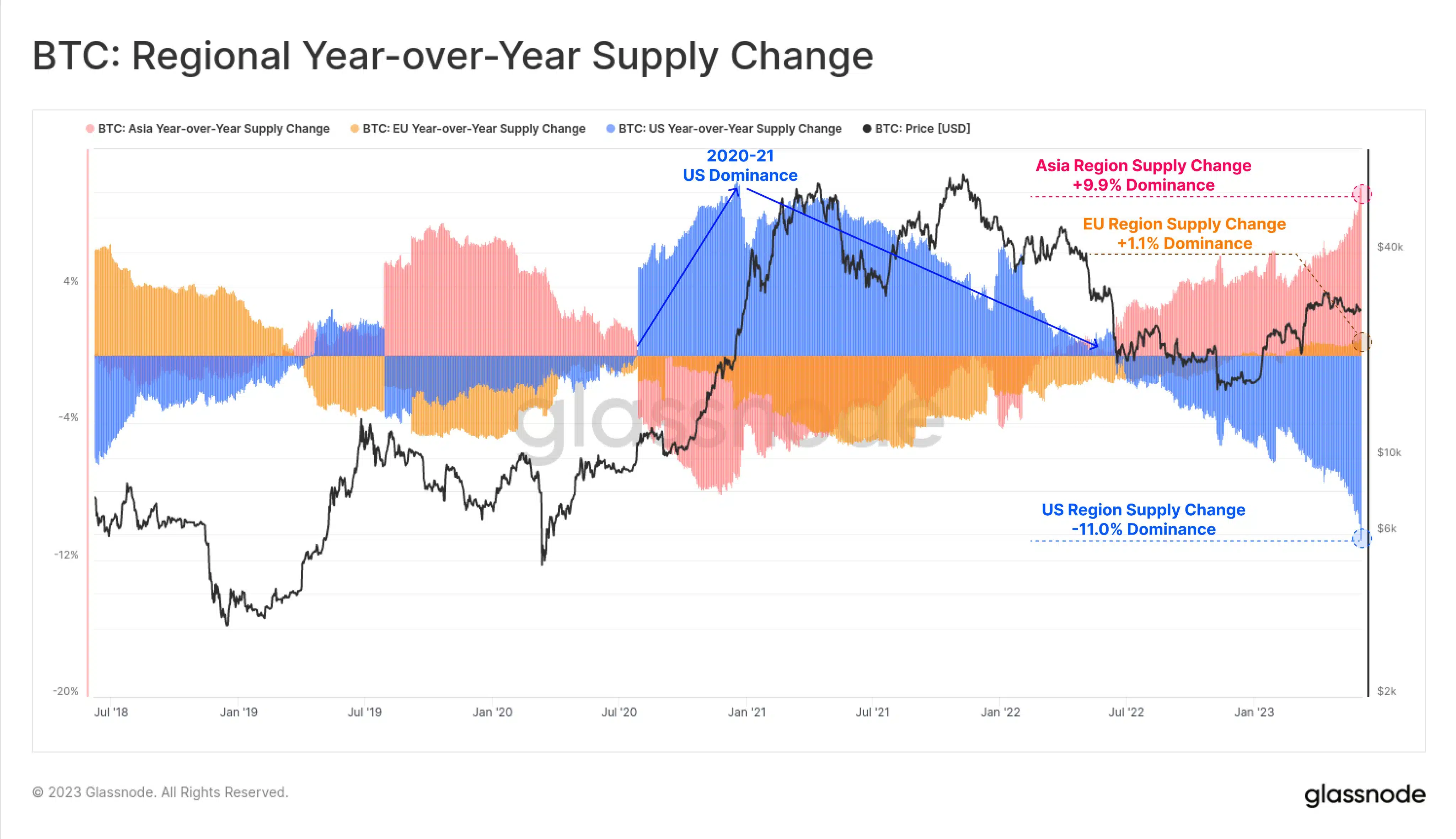

The hardline approach of the agencies has reflected on the overall sentiment. According to on-chain analytics firm Glassnode, capital in the crypto market has migrated out of the United States and into rising Asian markets.

U.S. losing sheen?

The analysis highlighted that the extreme dominance of U.S.-based entities, prevalent during the golden period of crypto market in 2020-21, has fallen significantly at the time of publication. These entities now hold 11% less Bitcoin [BTC] than they did in mid-2022.

On the other hand, a significant increase in supply dominance, nearly 10%, was visible across Asian trading hours. European markets have stayed largely neutral over the last year.

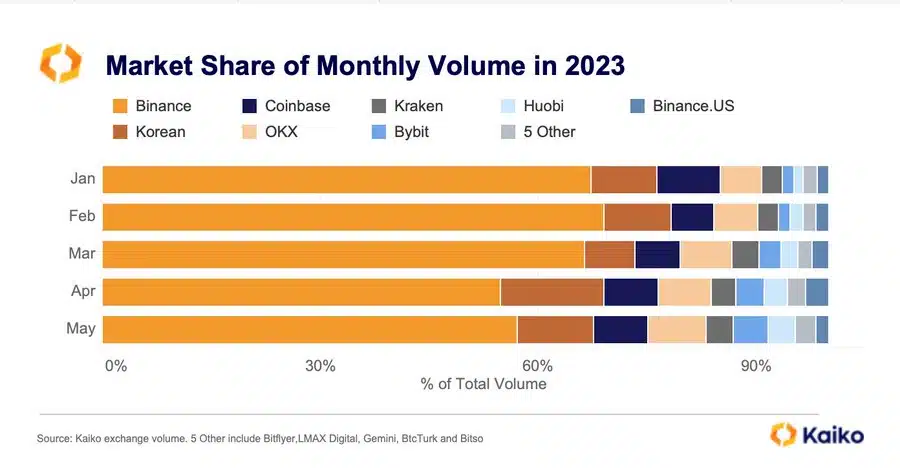

Notably, the divergence in BTC supply change based on geography has widened since the beginning of 2023, with Korean exchanges, in particular, arriving prominently on the scene.

As per digital assets data provider Kaiko, Korean exchanges have acquired a significant chunk of monthly trade volume from U.S. based exchanges like Coinbase since the start of 2o23.

Is the crypto dragon back?

While the regulatory landscape in the U.S. has become tougher for crypto entities, a new ray of hope was coming from China. The Chinese government recently published a white paper outlining its aspirations to establish capital Beijing as a worldwide innovation hub for the digital economy.

Is your portfolio green? Check out the Bitcoin Profit Calculator

China, the Asian economic powerhouse, was one of the first countries to embrace crypto assets. At one time, China was the BTC trading and mining capital of the world. However, after the blanket ban in 2021, it ceded its position to the U.S.

Brian Armstrong, CEO of crypto exchange Coinbase, which has been at the receiving end of U.S. regulators crackdown, recently said restrictive crypto policies in the U.S. will end up benefiting an ambitious adversary like China and they can end up challenging the global dominance of the U.S. Dollar.