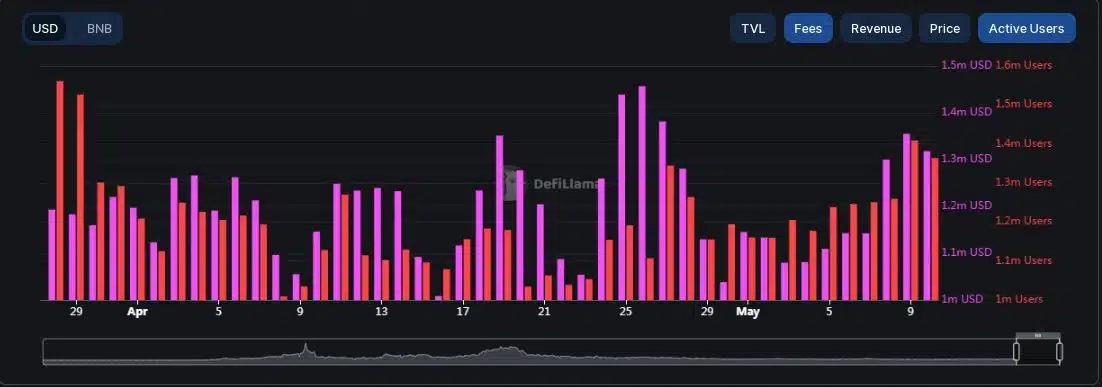

- Daily active users shot up to 1.41 million on 9 May.

- TVL on the chain witnessed its steepest monthly drop.

Since the beginning of 2023, Binance’s blockchain ecosystem dealt with a variety of issues, including regulatory crackdowns and increase in the number of hacks on its BNB Chain. However, amidst the uncertainty, there was a silver lining for the crypto juggernaut.

Is your portfolio green? Check the BNB Profit Calculator

After sustained periods of decline, network activity on the chain has started to rebound. The daily active users shot up to 1.41 million on 9 May, the biggest surge seen in more than a month.

Moreover, the jump in the number of users boosted the overall trading activity as the transaction fees collected on the platform also hit a 2-week high.

Not everything was hunky-dory

While the growing network traffic could have cheered the BNB fanbase, the liquidity on the chain continued to deplete.

The total value locked (TVL) on the BNB Chain was in a steady downtrend, falling more than 15% over the last month to $5.37 billion at the time of writing. This was the steepest monthly drop among major blockchains.

The dwindling liquidity coincided with BNB’s price trajectory over the last month. The exchange token shed 4.7% of its value in the last month, data from CoinMarketCap revealed.

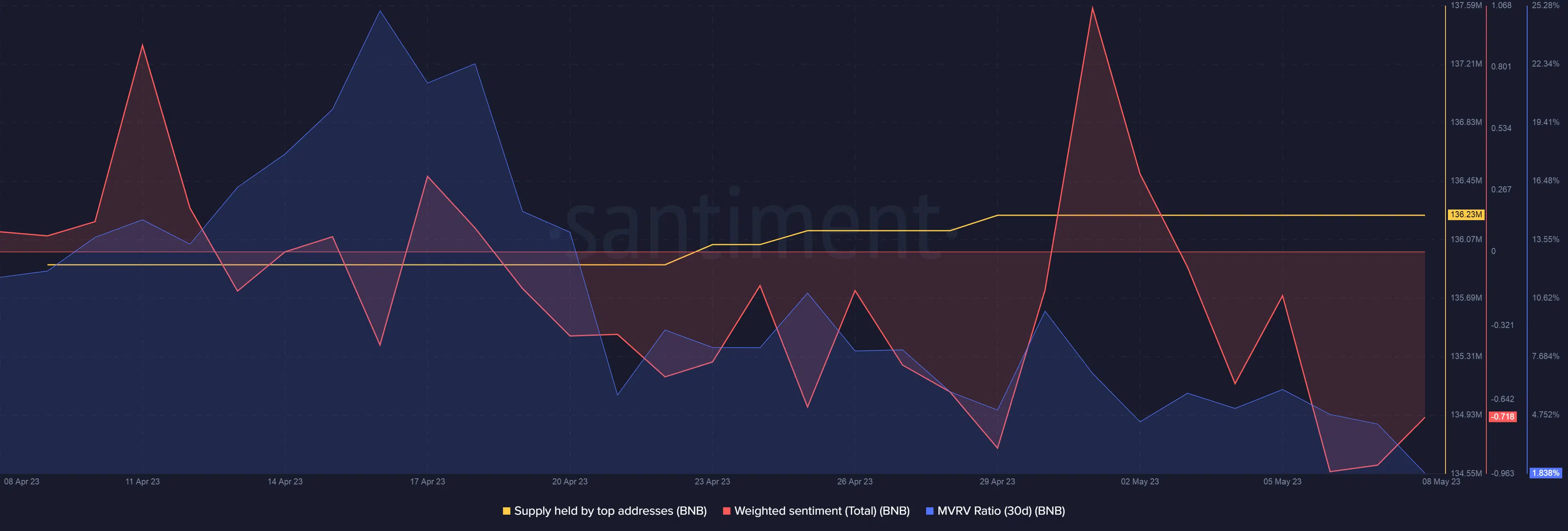

Due to the continuing downturn, investors’ sentiment plunged back into negative territory. The MVRV Ratio also declined sharply, indicating that most holders of BNB would incur losses if they were to sell their tokens.

The uncertainty led large addresses to adopt the wait-and-watch approach as supply held by them plateaued in May after steadily rising during the last week of April.

Volume on Binance plunges

According to data analytics firm CCData, spot trading volume on the world’s largest cryptocurrency exchange fell by 48.1% to $287bn in April. This marked its second-lowest monthly trading volume since 2021.

Moreover, its market share declined, dropping to 46.3% for the second consecutive month, the lowest level since October 2022.

However, it was not only Binance which felt the pinch. The financial contagion induced by the collapse of big banking entities in the U.S. engulfed other centralized crypto exchanges (CEXs) as well.

Our Latest Exchange Review is now live!?

April highlights:

✔ @binance's spot trading vol. fell 48.1% to $287bn

✔ $BTC – $TUSD vol. soared 851% to $34bn

✔ @upbitglobal's market share hit an all-time high of 4.77%Discover more in our Exchange Review? https://t.co/KrvA9MVrEX

— CCData (@CCData_io) May 10, 2023

How much are 1,10,100 BNBs worth today?

Spot trading volume across all CEXs fell by 40% in April, the lowest since December.

According to a report by Financial Times, one of the top officials from Binance lashed out at the current regulatory environment for crypto trading in the U.S. and would do “everything it possibly can” to be regulated in the UK.