If you’re a USDT or DOT investor, Binance’s latest update will mean…

- Binance now supports deposits and withdrawals of USDT on Polkadot.

- DOT’s funding rate was high, and market indicators were bullish.

Binance announced on 25 May that it has extended support for Tether [USDT] on Polkadot [DOT]. Binance customers can now easily bring their USDT to Polkadot, making transactions with the stablecoin more user-friendly.

1/ ? Another big landmark for the Polkadot ecosystem! @Binance, a leading centralized exchange, now supports deposits and withdrawals for @Tether_to (USDT), the top stablecoin by market cap, on Polkadot. pic.twitter.com/WCaUTlFckO

— Polkadot (@Polkadot) May 25, 2023

Read Polkadot’s [DOT] Price Prediction 2023-24

As per Polkadot’s tweet, this development will encourage even wider adoption of USDT and enhance its usability within the ecosystem. This will not only benefit USDT but also allow Polkadot users, the parachains, and their dapps, to easily access the stablecoin.

Tether’s supply on exchanges slumps

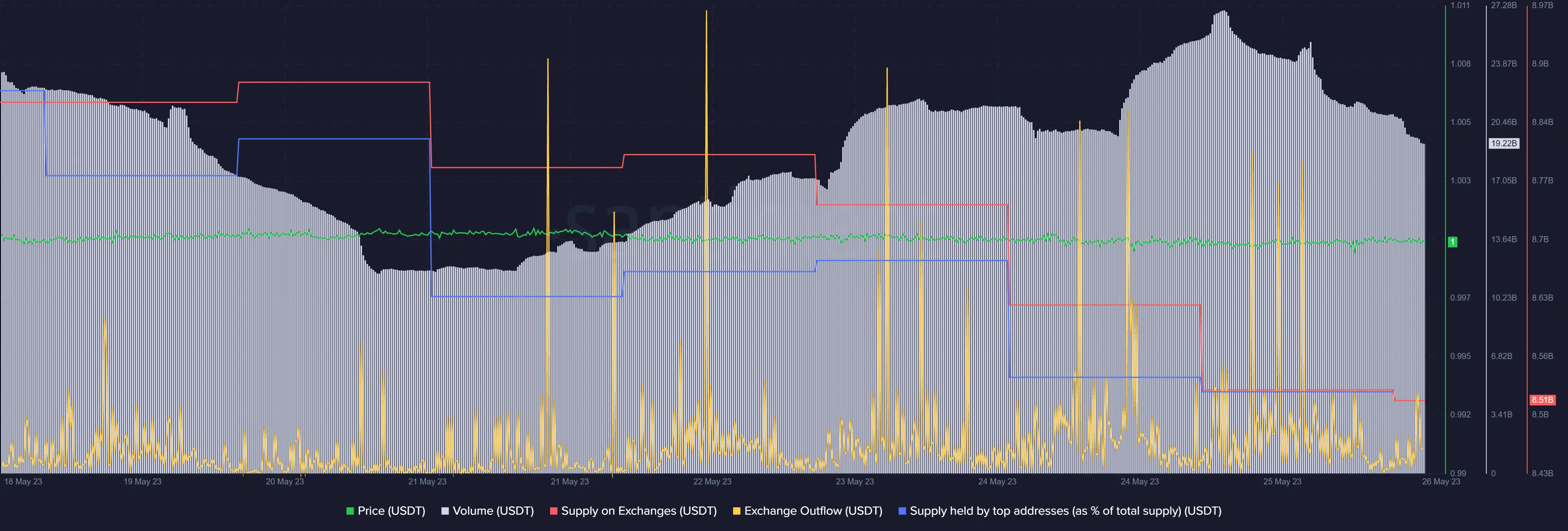

While this episode took place, USDT’s supply distribution registered some interesting activity. USDT’s volume increased, which implied that investors were trading the stablecoin.

The popular stablecoin’s exchange inflow also spiked, accompanied by a decline in supply on exchanges, suggesting that in the current slow-moving market, investors are buying more USDT.

Interestingly, the whales chose to follow a different route. As per Santiment, USDT’s supply held by top addresses declined.

This typically means that the whales were selling USDT to accumulate other assets as the market remained low.

Here’s how Polkadot reacted

Binance’s announcement did not have much effect on Polkadot in terms of price action.

As per CoinMarketCap, DOT’s price declined by more than 2% in the last seven days. At press time, it was trading at $5.22 with a market capitalization of over $6 billion.

Nonetheless, a look at DOT’s on-chain metrics gave hope for a price uptick in the coming days.

These suggest a price hike

For instance, DOT’s demand in the futures market increased, as evident from its green Binance funding rate. Its weighted sentiment, after a dip, also recovered, suggesting that investors were confident in the token.

DOT’s development activity was also high, which can further improve market sentiment. Combining these with DOT’s increased 1-week price volatility, a possible price uptick seemed likely.

Is your portfolio green? Check the Polkadot Profit Calculator

Are the bulls gathering speed?

A few of the market indicators complemented the on-chain metrics, as they too suggested a price hike. Polkadot’s Chaikin Money Flow (CMF) registered an uptick.

The Money Flow Index (MFI) also followed a similar path and headed upwards, which increased the chances of a northbound price movement. Nonetheless, DOT’s Exponential Moving Average (EMA) Ribbon remained bearish as the 20-day EMA was below the 55-day EMA.