Binance’s Q1 numbers reveal this about the future of the exchange. Assessing…

- Binance lost 16% share of its global trading volume in Q1 2023

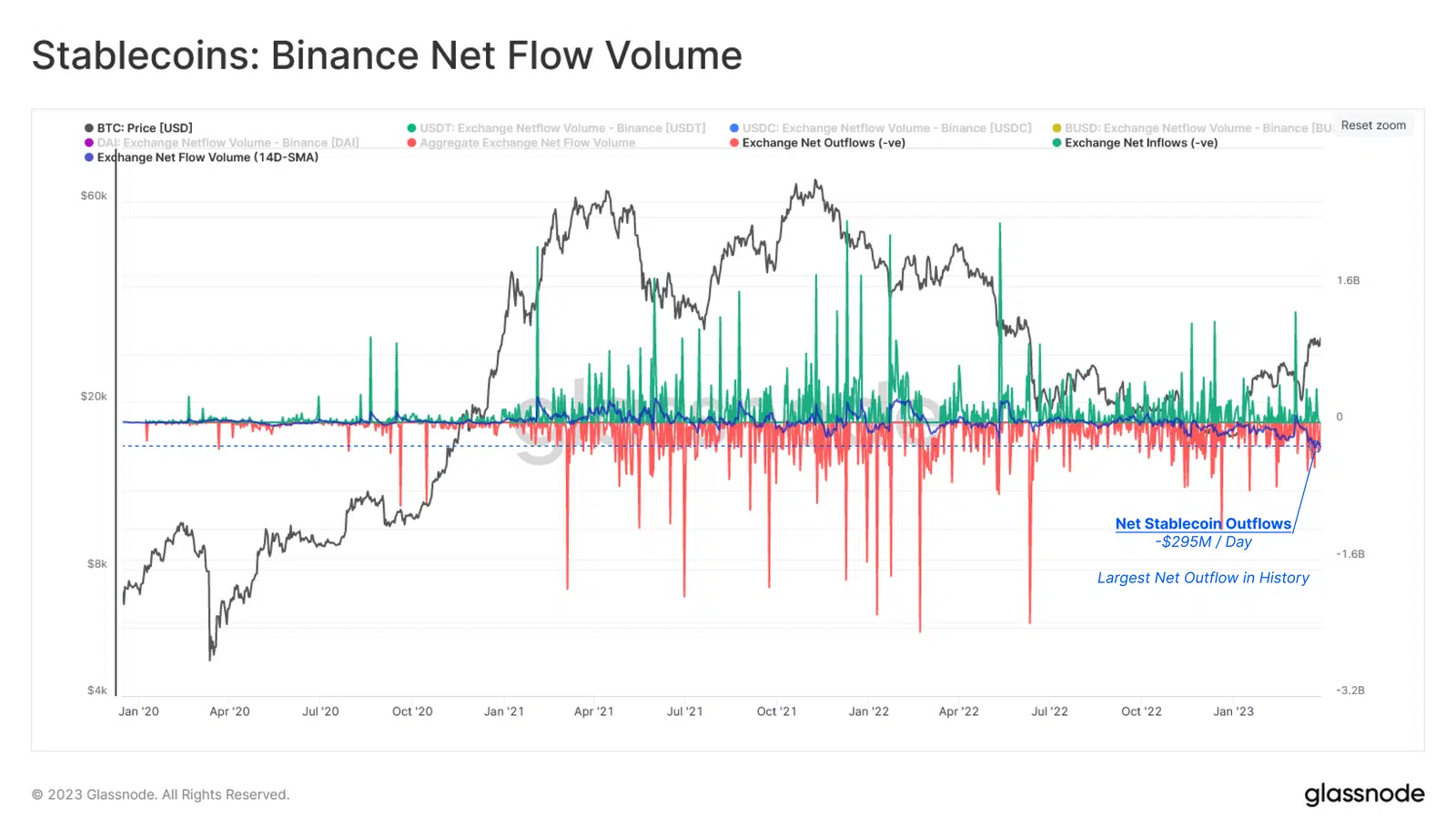

- The net stablecoin outflow reached -$295 million/day, which was the largest ever outflow witnessed by the exchange

Binance lost a sizable chunk of the global market share in the first quarter of 2023, as regulatory bodies tightened their chokehold around the world’s largest cryptocurrency exchange.

As per a report by crypto market data provider Kaiko, the crypto behemoth lost 16% share of global trading volume after the U.S. Commodity Futures Trading Commission (CFTC) accused the organization of violating certain compliance rules to expand its operations.

The lawsuit-induced FUD thus, resulted in a radical shake-up of its exchange reserves with users withdrawing funds for self-custody.

Is your portfolio green? Check the Binance Coin [BNB] Profit Calculator

Record stablecoin outflows

As per a report by on-chain analytics firm Glassnode, recent stablecoin outflows outpaced inflows. This indicated that a larger number of stablecoins were withdrawn from the trading platform as compared to the overall deposits.

With Binance firmly in the cross-hairs of US regulators, we investigate how the market has responded by assessing the netflow of coins through exchanges.

We also evaluate the supply dynamics of Bitcoin, to gauge the current state of holder confidence.https://t.co/JgxyrXIvYN

— glassnode (@glassnode) April 3, 2023

The daily net flow of stablecoins flowing through Binance was plotted on a chart as shown below. Furthermore, a 14-day EMA was also used to offset the impact of daily flows.

Recently, the net outflow reached -$295 million/day, which was the largest net outflow in the history of the cryptocurrency exchange. According to the graph, the indicator was already on witnessing a downtrend and in a negative area over the past few weeks.

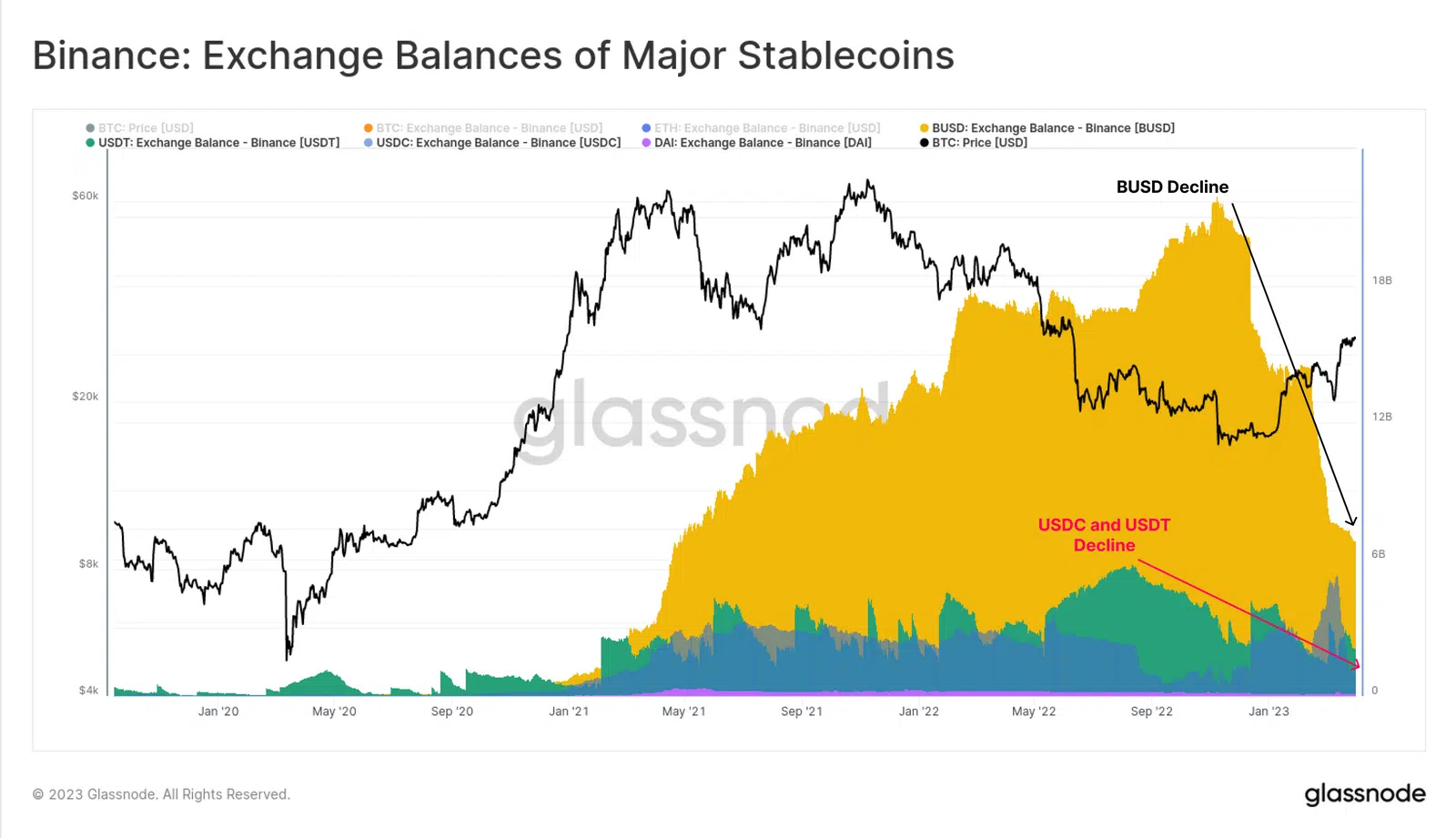

As per Glassnode, the primary reason behind the record outflows was the drastic increase in redemptions of Binance USD [BUSD], following the news of Paxos halting the issuance of the stablecoin in February.

Additionally, the graph below captured the notable decline in the balance of the third-largest stablecoin on Binance exchange. This was once the most-preferred stablecoins on the platform. From a peak of almost $21 billion during November 2023, it shrunk to $6 billion at press time.

Status of the BNB Chain

As per data from DeFiLlama, the stablecoin market cap on the BNB Chain [BNB] was $6.42 billion at the time of writing, with a marginal weekly growth of 0.04%.

Tether [USDT] had a market dominance of nearly 50% while BUSD’s market cap shrunk by 20% to stand at $2.21 billion over the last 30 days, capturing 34% of the share.

How much are 1,10,100 BNBs worth today?

The ecosystem’s native token BNB made gains of 6.79% over the last month, per data from CoinMarketCap. However, with regulatory headwinds, the pace of growth subsided with the token growing by just 0.23% on a weekly basis.