Bitcoin: A drop in these holders could mean trouble for BTC because….

- Bitcoin whales drop to a new two-year low

- Bitcoin also showed resistance at the $17,000 level

Bitcoin [BTC] managed to bounce back above the $17,000 price range. While the current expectation was that it might continue to rally, whale activity suggested otherwise. According to a recent Glassnode update, the number of Bitcoin whales have been on the decline.

? #Bitcoin $BTC Number of Whales just reached a 2-year low of 1,665

Previous 2-year low of 1,671 was observed on 22 November 2022

View metric:https://t.co/k1K8OK2tl3 pic.twitter.com/CPJxLaybbH

— glassnode alerts (@glassnodealerts) December 4, 2022

Read Bitcoin’s [BTC] price prediction 2023-2024

The Glassnode update revealed that the number of whales holding BTC dropped to the lowest levels in the last two years. According to the update, the number of whales stood lower than it was on 21 November. Furthermore, the latter happens to be the date when Bitcoin dropped to its current 12-month low.

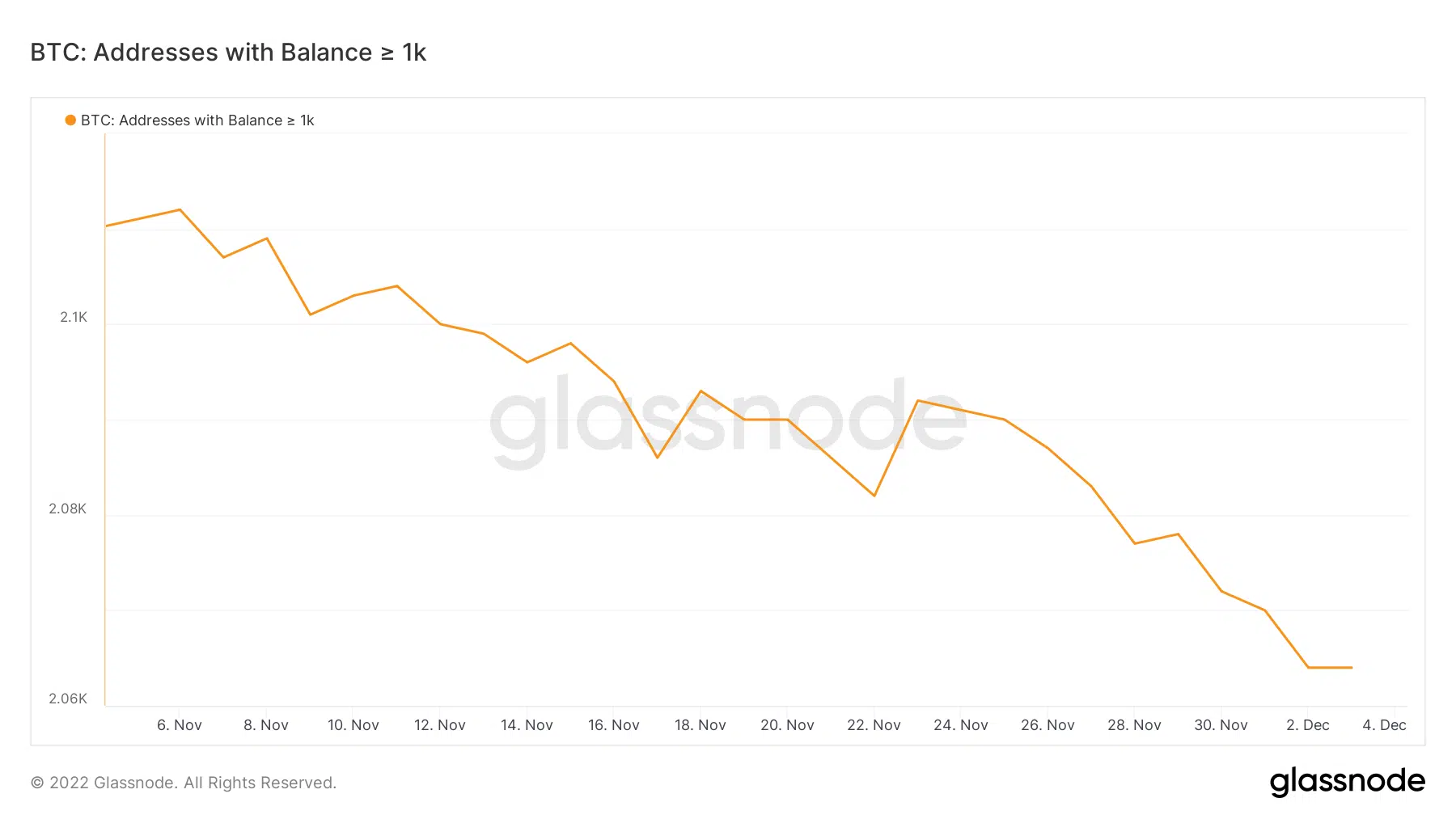

Such a decline often indicated that whales have been selling or the lack of strong demand from whales. The above observation can also stand consistent with the monthly decline in the number of addresses holding more than 1,000 BTC.

Despite the observed lower interest from whales, Bitcoin’s current price level indicated significant accumulation to support the slight upside. This was especially compared to its current monthly low. It particularly demonstrated some resilience above the $17,000 price level.

But why has the price gone up despite lower participation by the whales? A potential explanation could be that retail traders have been aggressively accumulating BTC. This may explain why the Money Flow Indicator (MFI) could have achieved noteworthy upside since the second week of November. It also explained why the upside could be weak or relatively limited.

Assessing the prevailing Bitcoin retail demand

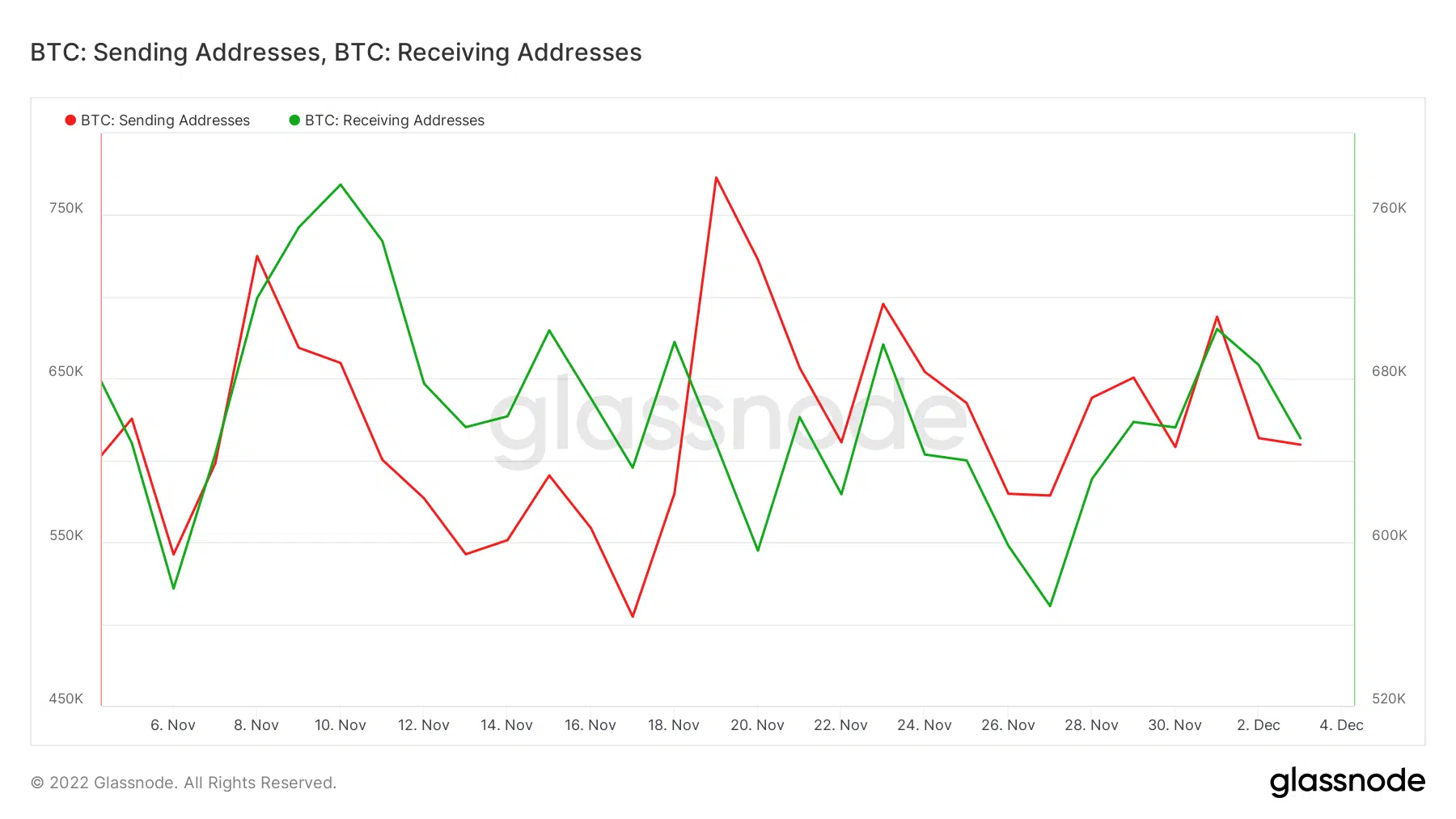

A look at the sending and receiving addresses further supported the above conclusion about the retail segment supporting the upside. According to the latest Glassnode readings, the number of receiving addresses outweighed sending addresses.

In other words, the buy pressure outmatched the prevailing sell pressure. This explained why BTC managed to stay above $17,000 in the last few days.

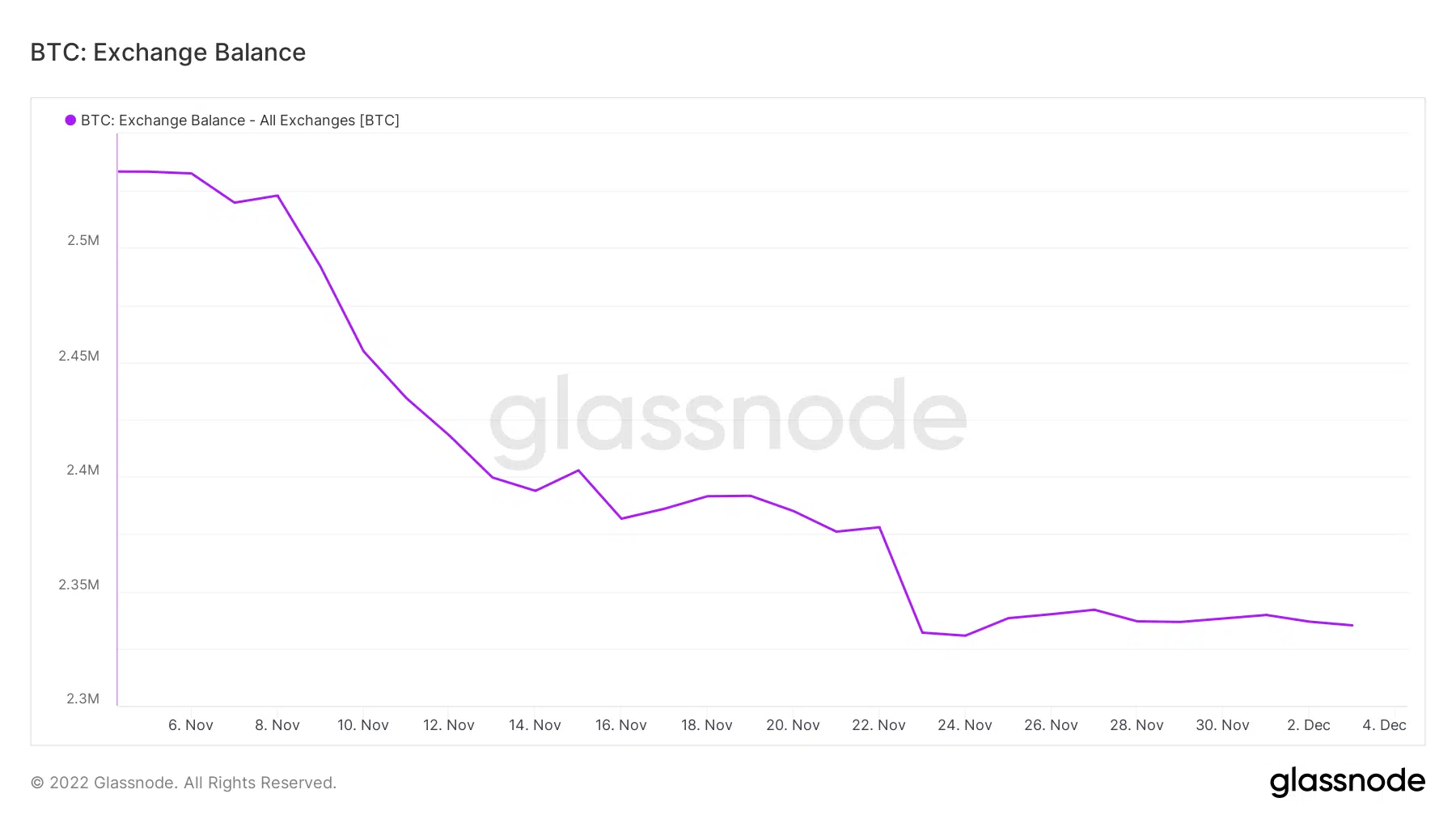

In addition, the lack of more downside may have been backed by the fact that exchange balances haven’t increased. Instead, the balance of Bitcoin on exchanges still stood within its monthly lows. This was confirmation around the absence of significant sell pressure to support more downside thanks to strong retail demand.

Bitcoin will likely continue moving sideways if the current market conditions prevail. A lack of whale participation could also mean that the demand would remain limited. Furthermore, it may not particularly serve more upside in the short-term. Especially if retail accumulation gets exhausted.

The current situation also suggested there was a likelihood that could observe a return of sell pressure. On the other hand, traders may see continued bullish momentum if whales regain interest in BTC.