Bitcoin: A-Z of how the king coin fared following FTX’s proposed acquisition

- Bitcoin’s price fell below the $17,500 mark for the first time in two years

- Short traders who had hoped for a further decline in price got liquidated

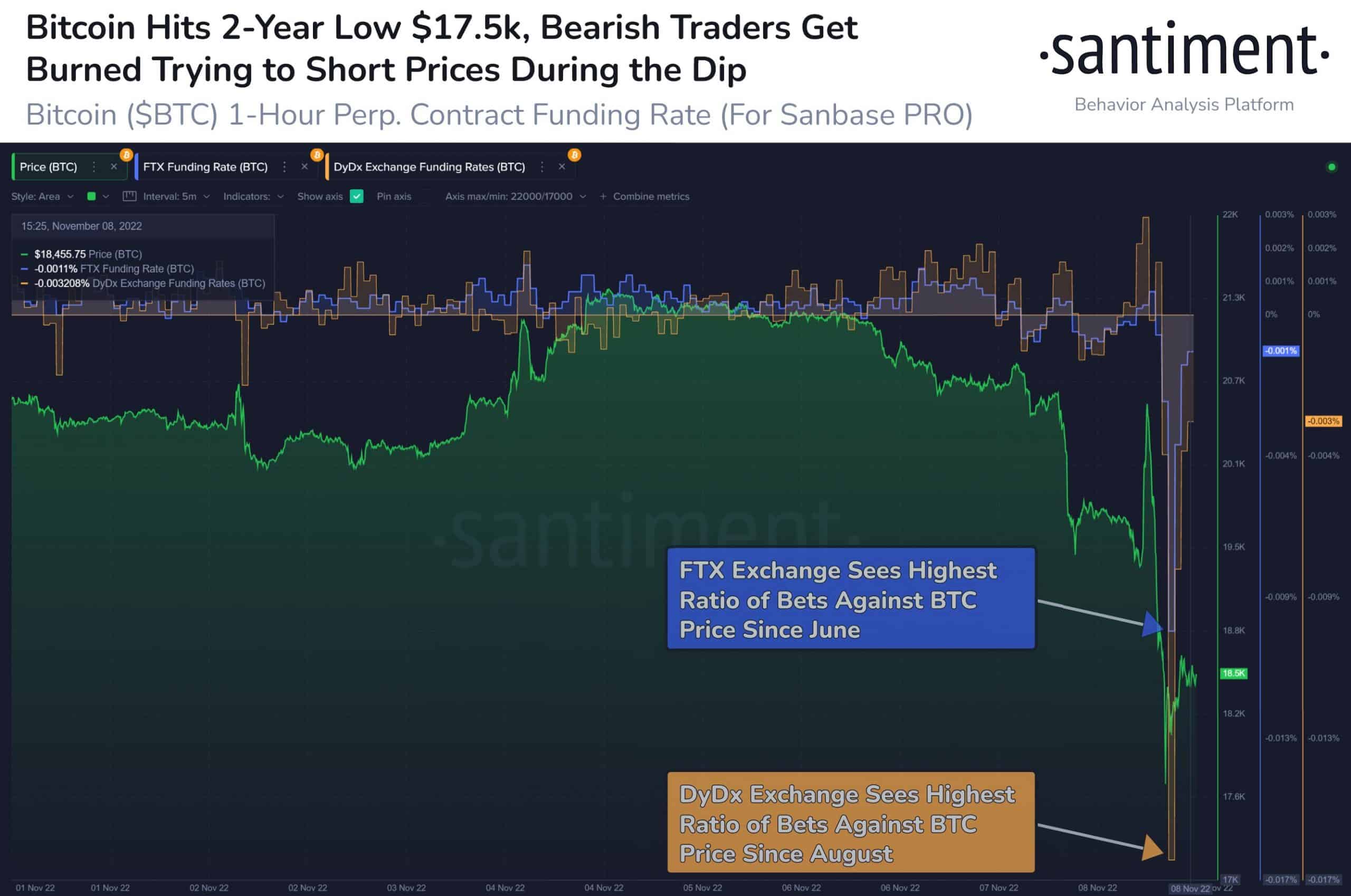

Binance CEO Changpeng Zhao’s confirmation of the intended FTX acquisition sent the market spiraling downwards on 8 November. Bitcoin [BTC], the leading cryptocurrency, wasn’t spared post this market event. BTC traded momentarily below the $17,500 price market, its lowest market price in the last two years.

Read Bitcoin’s [BTC]Price Prediction 2023-2024

According to Santiment, the momentary blow to BTC’s price pushed “overzealous traders on exchanges” to attempt to short the king coin. For example, data from the on-chain analytics platform revealed that leading cryptocurrency exchange DyDx logged its highest ratio of bets against BTC’s price since August. Likewise, troubled FTX saw its highest ratio of bets against the king coin’s price since June.

To the dismay of many short traders, BTC’s price recovered to trade at $18,325.75 at press time. This resulted in liquidations. Per data from Coinglass, of the $713.91 million removed from the cryptocurrency market in the last 24 hours, BTC liquidations stood at $232.38 million. This represented over 30% of BTC removed the cryptocurrency market in the last 24 hours.

Uneasy lies the head

At the time of writing, BTC’s price was down by 7% in the last 24 hours. While its trading volume rallied by 78.93% in the last 24 hours, the price/trading volume disparity hinted at buyers’ inability to support any further price rally in the current market.

As the market wades through the impact of FTX insolvency, CryptoQuant analyst Dan Lim warned that it might be imperative to “keep an eye on the movements of miners, especially their bitcoin holdings, mining, etc.”

According to Lim, miners generally believe in the possibility of a price rise, so they mine a lot. As a result of this, BTC’s hash rate climbed. However, miners started to lose as the king coin’s price traded sideways.

On a daily chart, selling pressure rallied significantly. As a result, BTC was oversold at the time of writing. Its Money Flow Index (MFI) was 21, while its Relative Strength was no better in a downtrend at 34.

In addition, its Chaikin Money Flow (CMF) chased new lows below the central line at -0.03, indicating that sellers had control of the BTC market.

However, CryptoQuant analyst BinhDang assessed BTC’s Spent Output Value Bands metric in three value bands [(10-100), (100-1K), and (1K-10K)] and found that sellers would soon tire out.

According to BinhDang:

“In 3 previous deep declines, based on the volume oscillator and 7DMA, the participation and increasing selling pressure were shown in all three value bands. However, yesterday’s test’s participation declined significantly, even weakly, in the two bands (100-100)(100-1K). Besides, The Estimate leverage Ratio & O.I has also cooled down to the same level as the deep drop in June. This may indicate that the selling power is almost exhausted.”