Bitcoin and altcoins: This portfolio technique could maximize your ROI

Who doesn’t want an ideal portfolio, perfect investments, and a high return on investments? Almost everyone aspires to have a perfect investment portfolio with a balance of risk to ROIs, and a dream to retire by the beach towards the end of their 30s. While the idea is pleasing, what is that one thing that only a few get right in their quest for a perfect portfolio, it’s strategy!

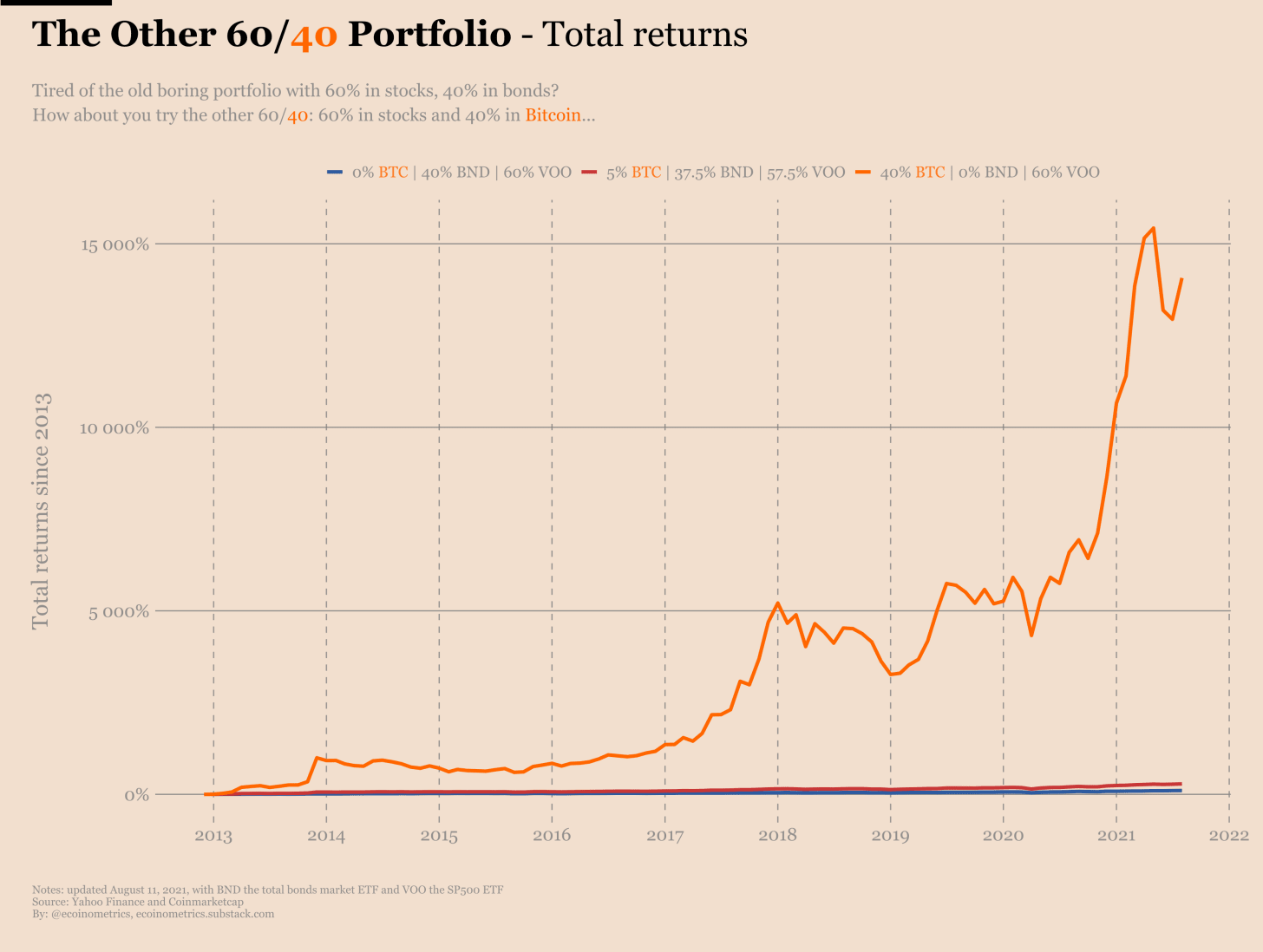

There are tonnes of ways in which one can organize and strategize their investments but there’s one way that’s been around for decades and that is a simple 60/40 portfolio. The idea is to allocate 60% of the portfolio to stocks and the rest 40% to bonds. While stocks are traditionally believed to generate growth, bonds are there to reduce volatility and generate income.

Even though the traditional 60/40 technique is said to give a smooth growth, what happens if say a part of the portfolio is allocated to cryptocurrencies. Will the ROIs increase or will the risk be too much? Let’s find out…

Bitcoin in the portfolio can make this difference

Allocating a part of the portfolio to Bitcoin can give a sizeable boost to the total returns while tipping the risk scales a little up. Recently, an Ecoinometrics update highlighted that allocating 5% of the portfolio to Bitcoin, keeping 37.5% on bonds, 57.5% on stocks could be a good strategy. Even if ROI on Bitcoin is zero that’s anyway 5% of the portfolio.

It further highlighted that for a 5% risk, after two halving cycles the total returns would be 2.5x higher than the traditional 60/40(as seen in the above chart), which is pretty good. But, what happens if the stakes are increased? What if according to the 60/40 strategy one allocated 60% in stocks and 40% in Bitcoin? In that case, returns will be off the charts as seen in the chart below.

That’s not it, looking at the same statistics on a rolling performance basis, taking one-year rolling returns also highlighted a better performance than the traditional method. As seen, it is notable that the 5% allocation to BTC doesn’t dip very often into negative one-year returns territory. 5% allocation setup is almost always outperforming the traditional 60/40.

What about the risk?

The 5% allocation looks like the safest bet when looking at everything combined however a 40% allocation is set to reap higher returns. The issue here is that Bitcoin and almost all cryptocurrencies are subject to higher market risks than a traditional asset. Just recently during the bear market, Bitcoin’s ROI wasn’t high enough. In fact, at the time of writing BTC’s 3 month ROI was -0.69%.

Here what really matters is the risk-adjusted returns on the portfolio and if that is your strategy then being 40% in BTC has been the clear winner over the past 8 years. Ecoinometrics measured risk-adjusted returns using the Sortino ratio and highlighted that adding both 5% and 40% Bitcoin doubled the risk-adjusted returns when compared to the traditional 60/40 portfolio. This further meant that even a small portfolio allocation to Bitcoin could reap high returns.

Adding altcoins could be a game-changer?

Thus, adding Bitcoin to the portfolio is a highly profitable strategy but what if one adds more risk to the game? Even though Bitcoin is the king-coin when it comes to high returns and massive rallies altcoins don’t lag behind either. Notably, rearranging the portfolio to be 60/40 wherein 40% is allocated to cryptocurrencies including altcoins could be another profitable strategy.

At press time, 97% of Ethereum holders were making money, while the same number stood at 96% for ADA. Similarly, Litecoin and Chainlink highlight higher than 60% profitability and made a good allocation to the portfolio, as highlighted in this article.

While the final call towards the kind of portfolio would always be the investors, it’s never too bad to look at all the options. Furthermore, with alts like Ethereum and Cardano doing pretty well on the institutional interest front it won’t be so bad to pump up your portfolio even if it comes with a little more risk.