Bitcoin and Ethereum succumb to TradFi – What now?

- The U.S. debt ceiling decision propelled S&P 500 and gold prices, surpassing Bitcoin and Ethereum.

- Bitcoin and Ethereum were trading at a profit on a daily timeframe at press time.

In a fascinating turn of events, the prices of the S&P 500 and gold have taken a leap, outshining Bitcoin [BTC] and Ethereum [ETH]. This remarkable shift can be attributed to the U.S. Congress’s decision on 1 June, wherein they opted to suspend the country’s debt ceiling.

Bitcoin and Ethereum below traditional stocks

The United States Congress has successfully endorsed an agreement that increases the government’s borrowing limit to avert the potential calamity of defaulting on debt repayments. The Senate passed the deal on 1 June, and the House of Representatives approved it the day before.

Once signed into law by President Joe Biden, this agreement will enable the federal government to borrow funds until after the next presidential election in November 2024.

The trend of cryptos and equities

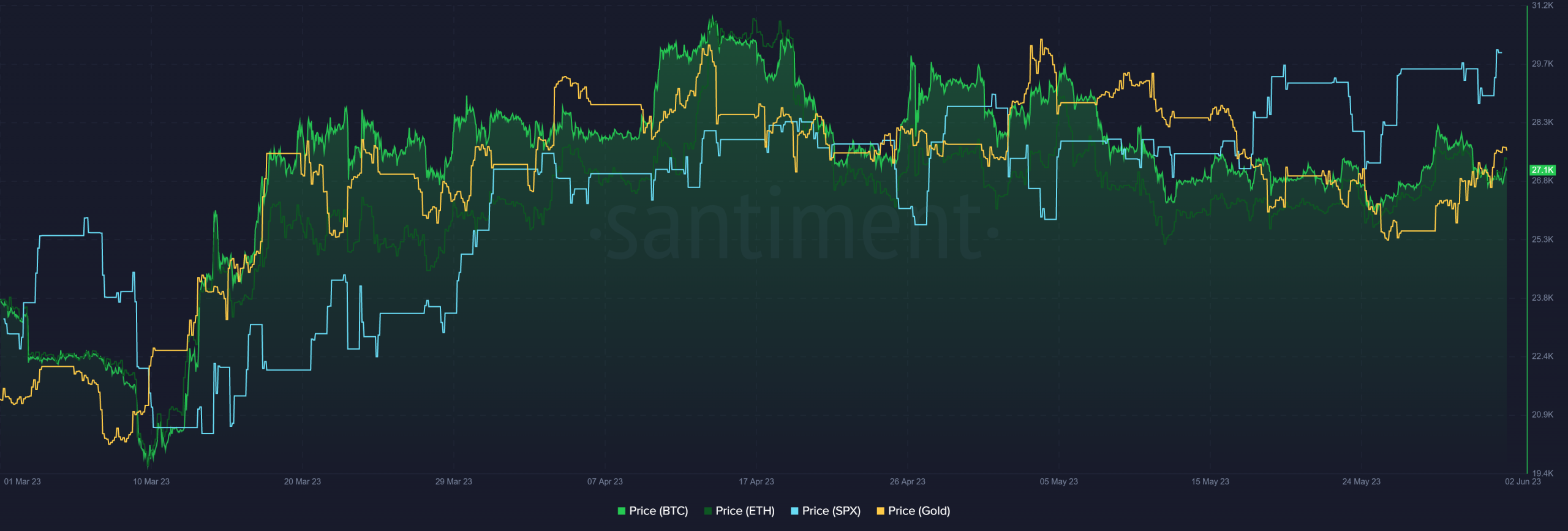

Fascinating insights from Santiment revealed that the decision to raise the debt ceiling profoundly impacted the price movements of various assets.

Traditional stocks, as exemplified by the S&P 500, witnessed a remarkable surge, reaching their highest level since August. Moreover, the price of gold also experienced an upward lift, as indicated by the chart.

As of this writing, the S&P 500 price had surpassed the $4000 mark, while gold exceeded $1,900.

On the other hand, the chart demonstrated that cryptocurrencies, including Bitcoin and Ethereum, were trailing behind equities. They were experiencing a comparatively lower performance than traditional stocks, showing a weak correlation.

Bitcoin and Ethereum price trend

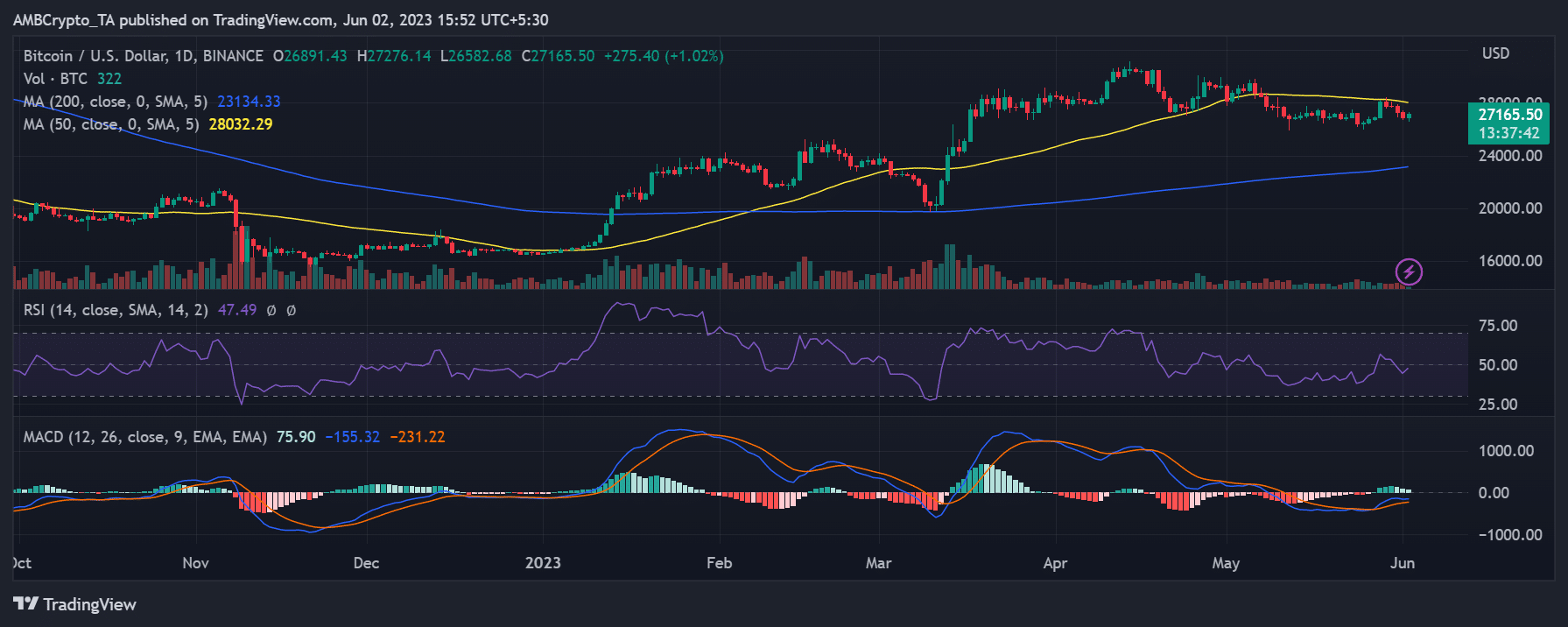

Bitcoin has recently witnessed a series of fluctuations, oscillating between highs and lows but consistently remaining below the $30,000 price threshold. As of this writing, Bitcoin was trading at approximately $27,160, showcasing a modest gain of over 1%.

It was exhibiting a bearish trend at press time, as indicated by its Relative Strength Index (RSI) on a daily timeframe. Nevertheless, there was a noticeable uptrend in its RSI line, thanks to a price increase.

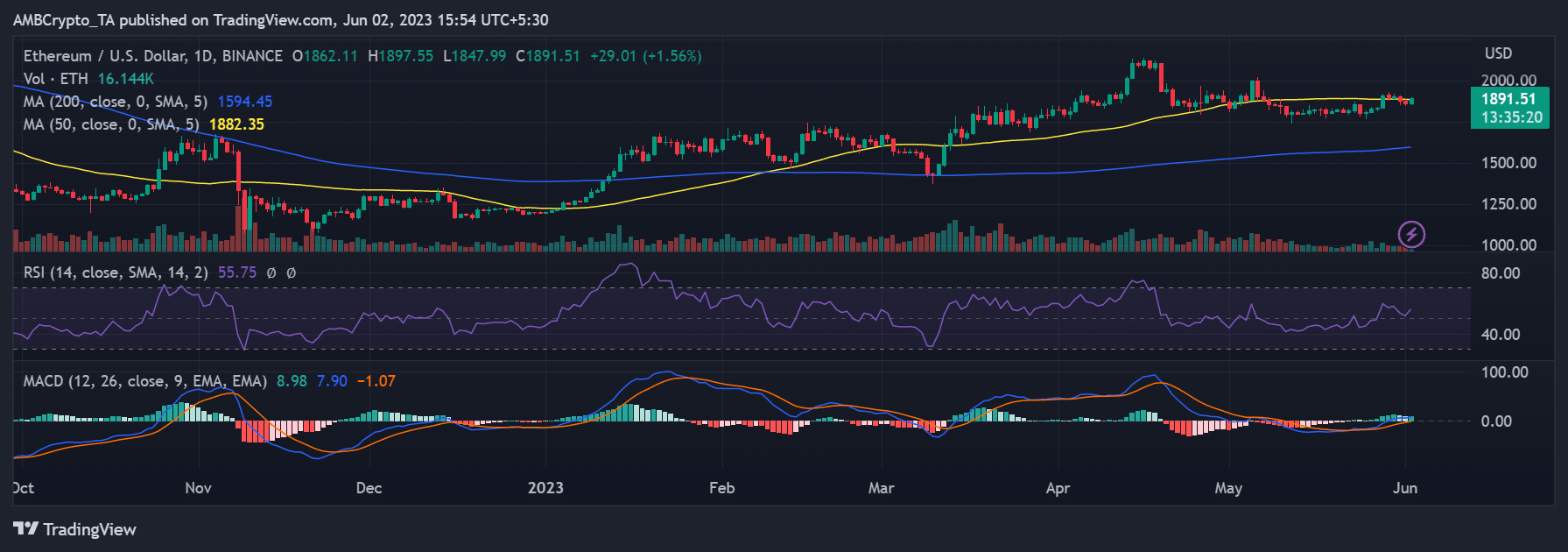

Is your portfolio green? Check out the Ethereum Profit Calculator

In a similar vein, Ethereum has also been trading with a profit. Its value at the time of writing stood around $1,890, reflecting a gain of over 1.5%. Unlike Bitcoin, Ethereum was experiencing a bullish trend, according to its RSI line.

As for the future, it remains uncertain whether there will be a stronger correlation between the price movements of Bitcoin, Ethereum, the S&P 500, and gold in the coming days.