Bitcoin at $80k in April: What are the market expectations?

Over the course of the past week, Bitcoin has registered a slight price slump. Of late, the bulls in the coin’s market have been on the decline and given its $53k valuation at press time, a question on most traders’ minds is whether or not BTC is going to reclaim levels close to $62k in the next few weeks.

While Bitcoin’s credentials as a long-term asset remain unquestioned, what about its short-term performance, and will the market see a further decline in price before a bounceback?

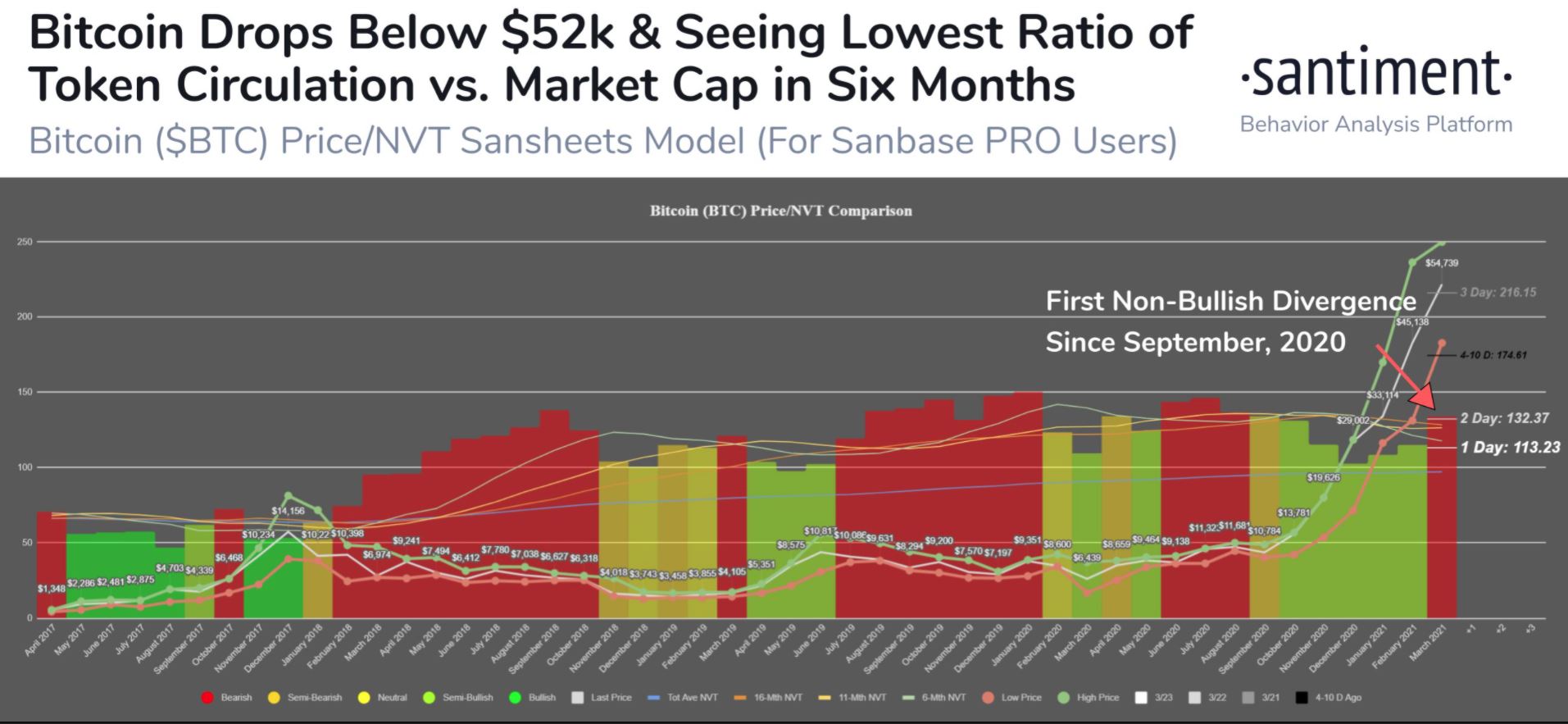

Source: Santiment

Market data provided by Santiment highlighted how the arguments for a bullish divergence are fast disappearing given the press time valuation of the world’s largest cryptocurrency. The low ratio of token circulation that was noted after Bitcoin dropped below $52k painted a bearish outlook for the coin in the near-term.

According to the data provided, this ratio of token circulation was last seen in September 2020, a period during which the cryptocurrency’s price endured a prolonged spell of sideways movement.

Source: Glassnode

While this has been the case, investors seem to be increasingly confident of a near-term bounceback. In fact, data suggested that price expectations for Bitcoin in April are high, with many investors confident that an $80k valuation can be realized by then.

There are a high number of calls expiring on 31 April that deem the price to hit the $80k mark, giving Bitcoin a little over a month’s time not just to bounce back, but also to establish a new ATH by quite the margin.

While one can’t for certain predict how the market will respond in the coming weeks, there are signs that a comeback for BTC cannot be discounted. The address activity for BTC continues to rise on a long-term trajectory, despite the bearishness in the price and the overall uncertainty dictating market sentiment at the moment.

In fact, Santiment highlighted that Bitcoin’s latest 24-hour active address output of 1.24M just matched a one-month high and one can argue that such market fundamentals may lend a hand when it comes to a swift price recovery on the charts.

Taking a look at the coin’s volatility level in the past 6 months also suggested that a good amount of price movement can be expected from Bitcoin. In the coming weeks, a period of sideways movement can seriously arrest the coin’s upward aspirations.

Further, according to data from BitPremier, BTC’s 30-day volatility was around 4 percent, and while that is low in comparison to BTC’s past month volatility, one can argue that there isn’t enough momentum in the market, coupled with volatility, to trigger a trend reversal.

Source: Coinstats