Bitcoin [BTC]: Yes, a mining hashrate all-time high, but at what cost

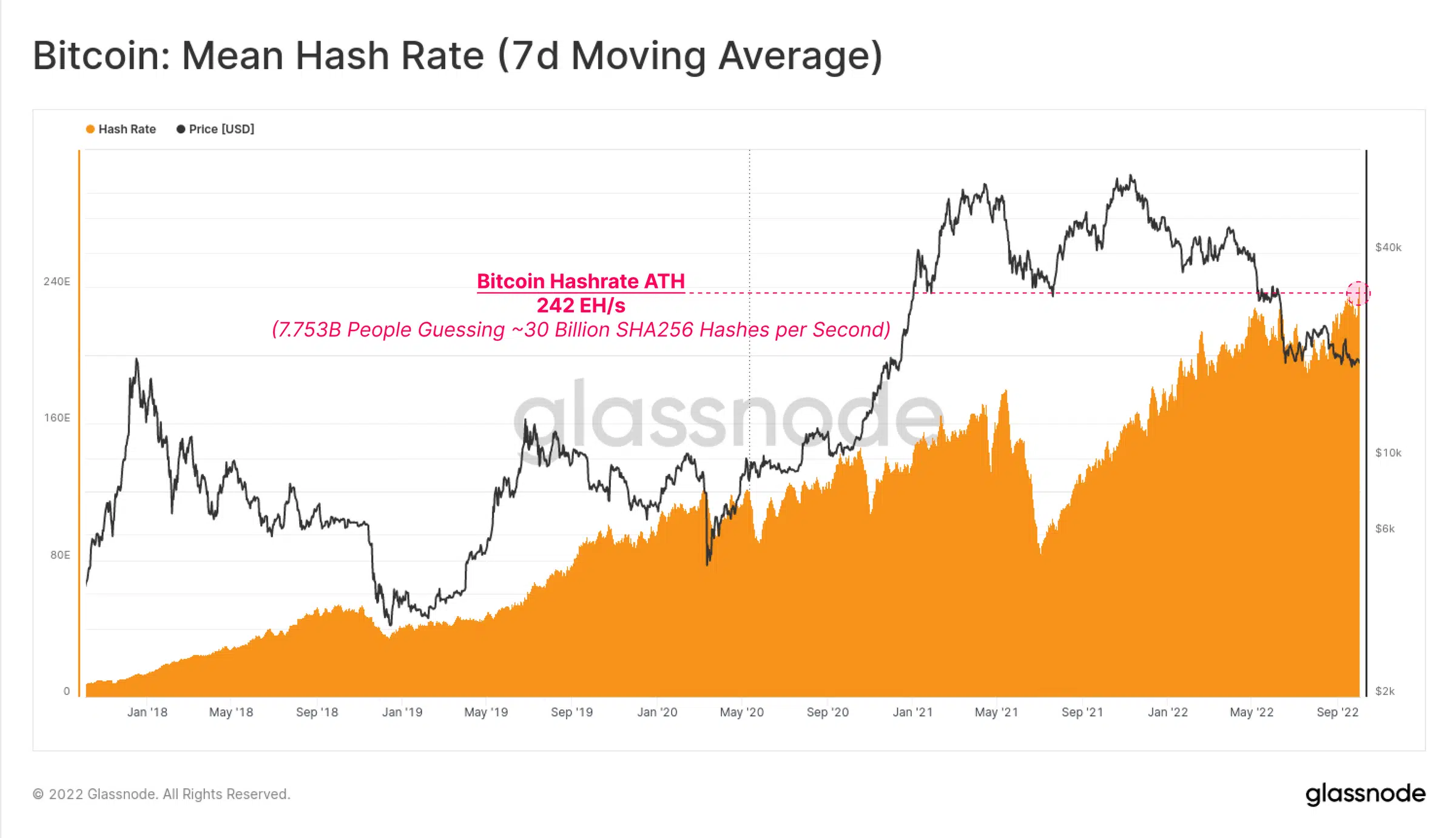

Bitcoin [BTC] investors may finally have something to rejoice about. Amidst the general downturn in the global financial markets and a consequential collapse of the cryptocurrency market, one thing remained consistent. BTC’s hashrate continued to grow despite tough times in the crypto market.

According to data from blockchain analytics platform Messari, Bitcoin’s hashrate, on 1 October, rallied to a high of 282 MH/s. At press time, the mining hashrate on the network stood at 245 MH/s.

Glassnode, in a new report, noted that the new all-time high could be denoted as 242 Exahash per second. For context, “this is equivalent to all 7.753 Billion people on earth, each completing a SHA-256 hash calculation approximately 30 Billion times every second,” the on-chain analytics platform stated.

The journey to the all-time high

In assessing the mining activity on the network, Glassnode, in its report, considered the network’s hash ribbons. It found that Bitcoin’s hash-ribbon started to “unwind” around August-end, which suggested an improvement in mining conditions on the Bitcoin network.

Historically, Glassnode found that this was usually followed by a rally in the price of the leading coin.

However, Glassnode noted that with a continued decline in the price per BTC, the recent rally in hashrate on the network was attributable to “more efficient mining hardware coming online and/or miners with superior balance sheets having a larger share of the hash power network.”

Additionally, Glassnode also assessed the Mining Pulse metric. This metric, according to Glassnode, is used to track miner activity. It measures the average block interval relative to the target of 600-seconds.

A look at Bitcoin’s Mining Pulse revealed that there was a severe decline in mining activity on the network that spanned between the end of May and early August.

In previous bear markets, such movements have been followed by a “severe and rapid decline in hashrate.” Commenting on whether a similar reaction was imminent, Glassnode added that the same “remains to be seen.”

What does the hashrate cost BTC

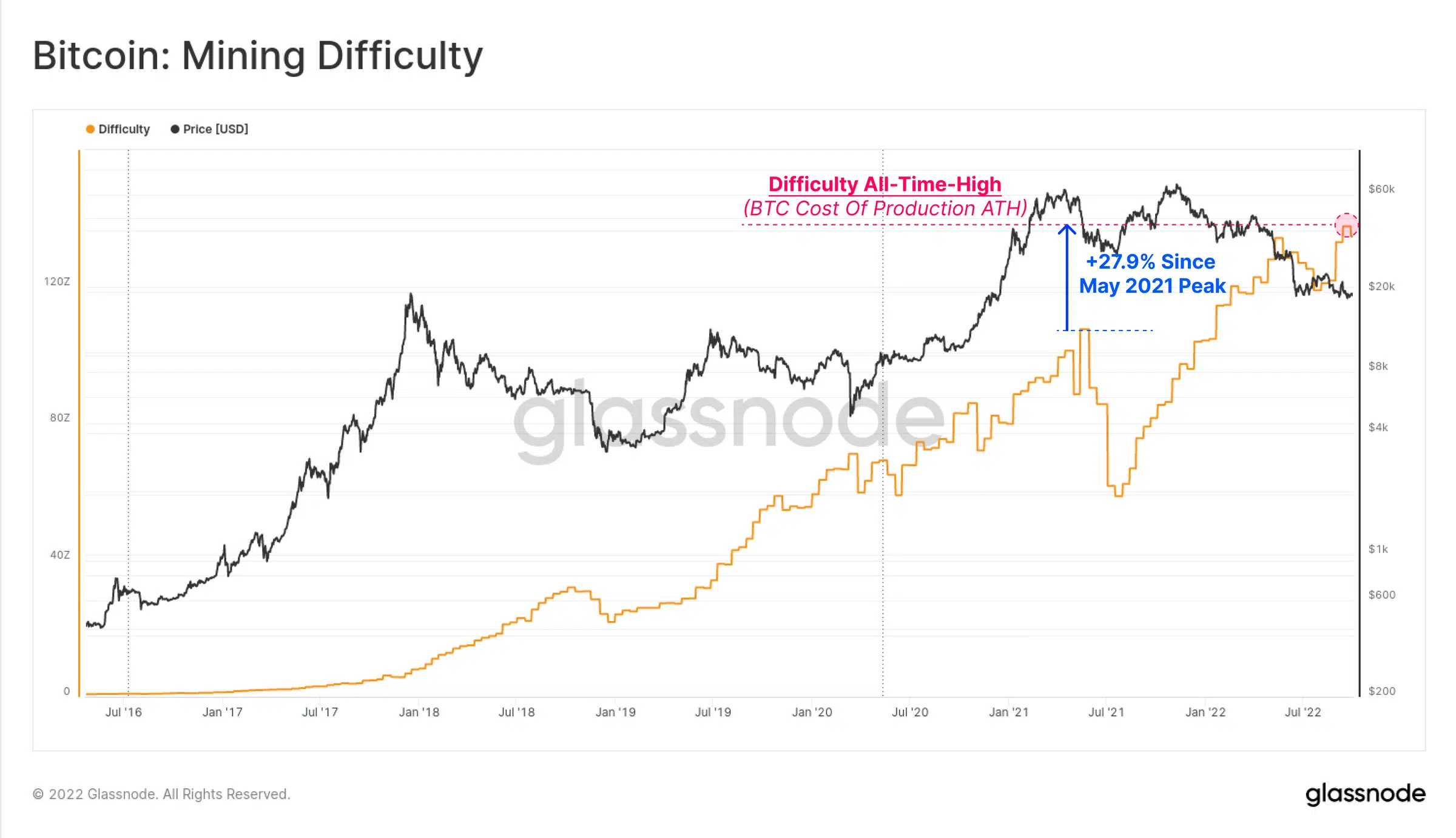

With a growth in the hashrate on the network, mining difficulty also embarked on an uptrend. This meant that the cost of production per unit of BTC witnessed a surge.

With a continued decline in the price per BTC, a spike in production cost laid stress on miners’ income, Glassnode found.

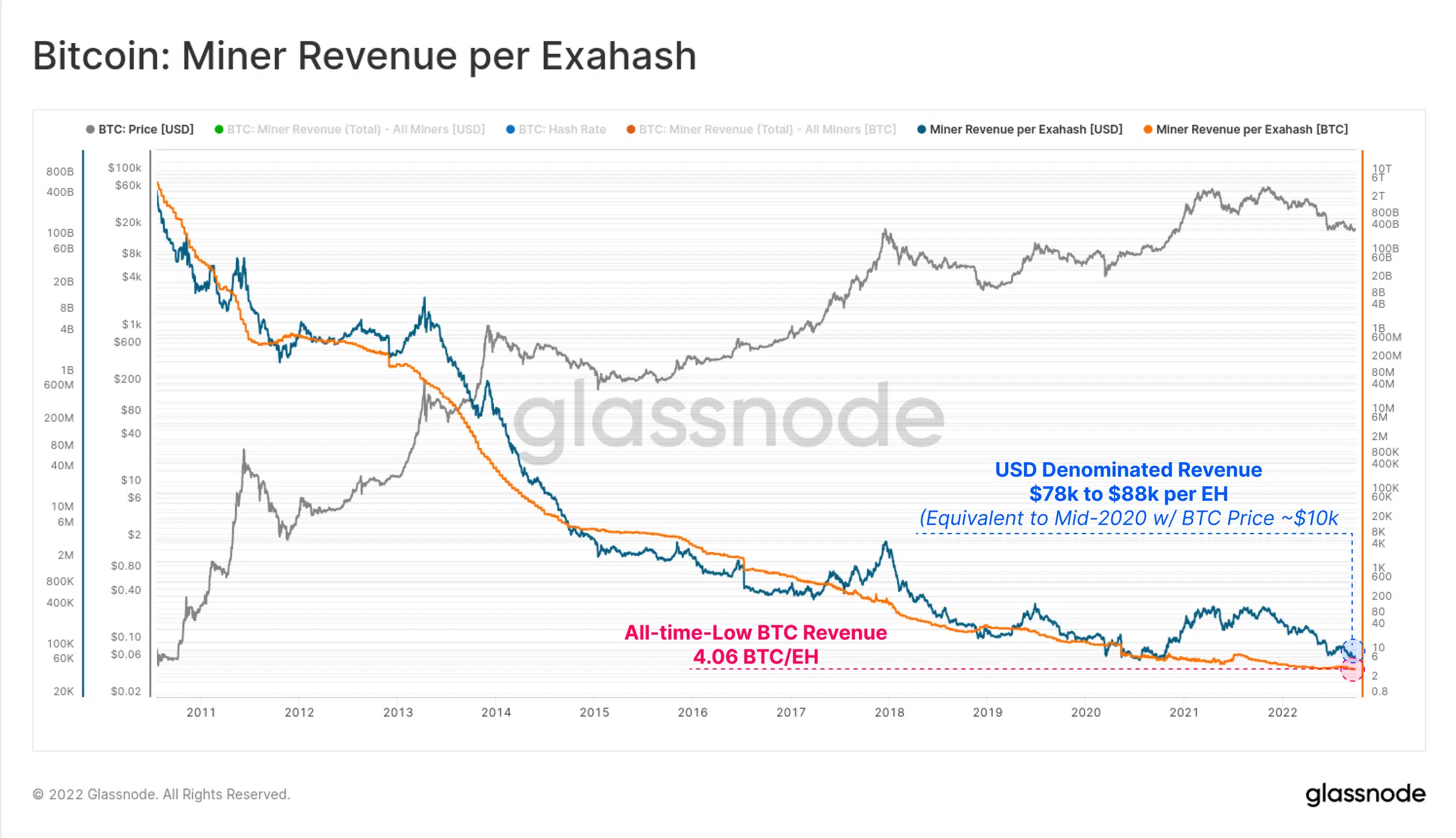

Furthermore, as per Glassnode, the spike in production cost led to a decline in revenue earned per Exahash. This figure stood at an all-time low of 4.06 BTC per EH per day. Glassnode stated that,

“On a USD-denominated basis, this equates to between $78k to $88k in revenue per EH per day. This has returned to Oct-2020 levels, which was after the 2020 halving event, and where BTC prices were around $10k (currently ~$20k). From this, we can see that a 66% increase in Difficulty and Hashrate since Oct-2020 corresponds to an approximate halving in revenue per hash.”

Still trading below the psychological $20,000 region, BTC exchanged hands at $19,644.53 at press time, as per data from CoinMarketcap.