Bitcoin: Can miners survive this double-edged combat?

Bitcoin [BTC] miners have been faced with harsh realities lately. The worst part is that it doesn’t seem to get any easier as these difficulties look too strong to handle.

According to CryptoQuant, BTC miners have faced the hurdle of not selling their holdings for crumbs. However, the dwindling state of the Bitcoin hashprice has left most miners with no option but to succumb to selling pressure.

The hashprice, the market value per hashing capability, is the same one that serves as income for these miners. Unfortunately, CryptoQuant noted that the revenue neared the lowest recorded point.

Oh! Save the kingsmen

Based on the report, over 5,000 BTC moved from mining pools into exchanges this week. This all happened before BTC fell below $19,000. Despite the recovery in trading above $20,000, CryptoQuant pointed out that the selling pressure may skyrocket in the coming days. With this situation, it could be possible that miners could follow a similar action that led to selling most of their rewards in June.

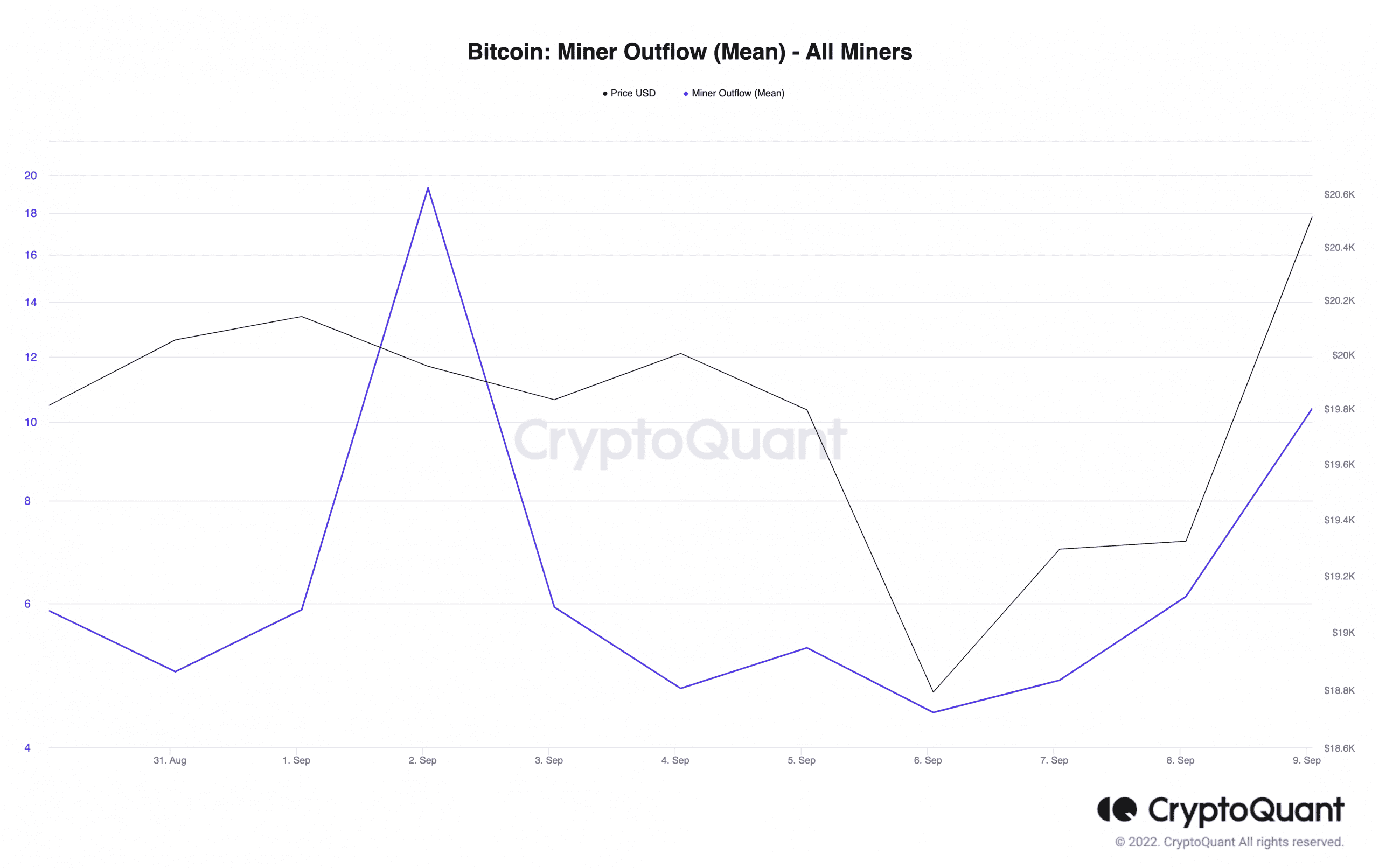

While assessing the analytic platform opinion, miners’ metrics confirmed it to be true. According to data from the same platform, miners’ outflow had taken a 2.22% uptick over the last 24 hours.

However, the exit from the mining pool did not start as of 8 September. According to CryptoQuant, the mean miner outflow started increasing on 6 September.

As of the start date, it was 4.41. At press time, it had increased to 10.37.

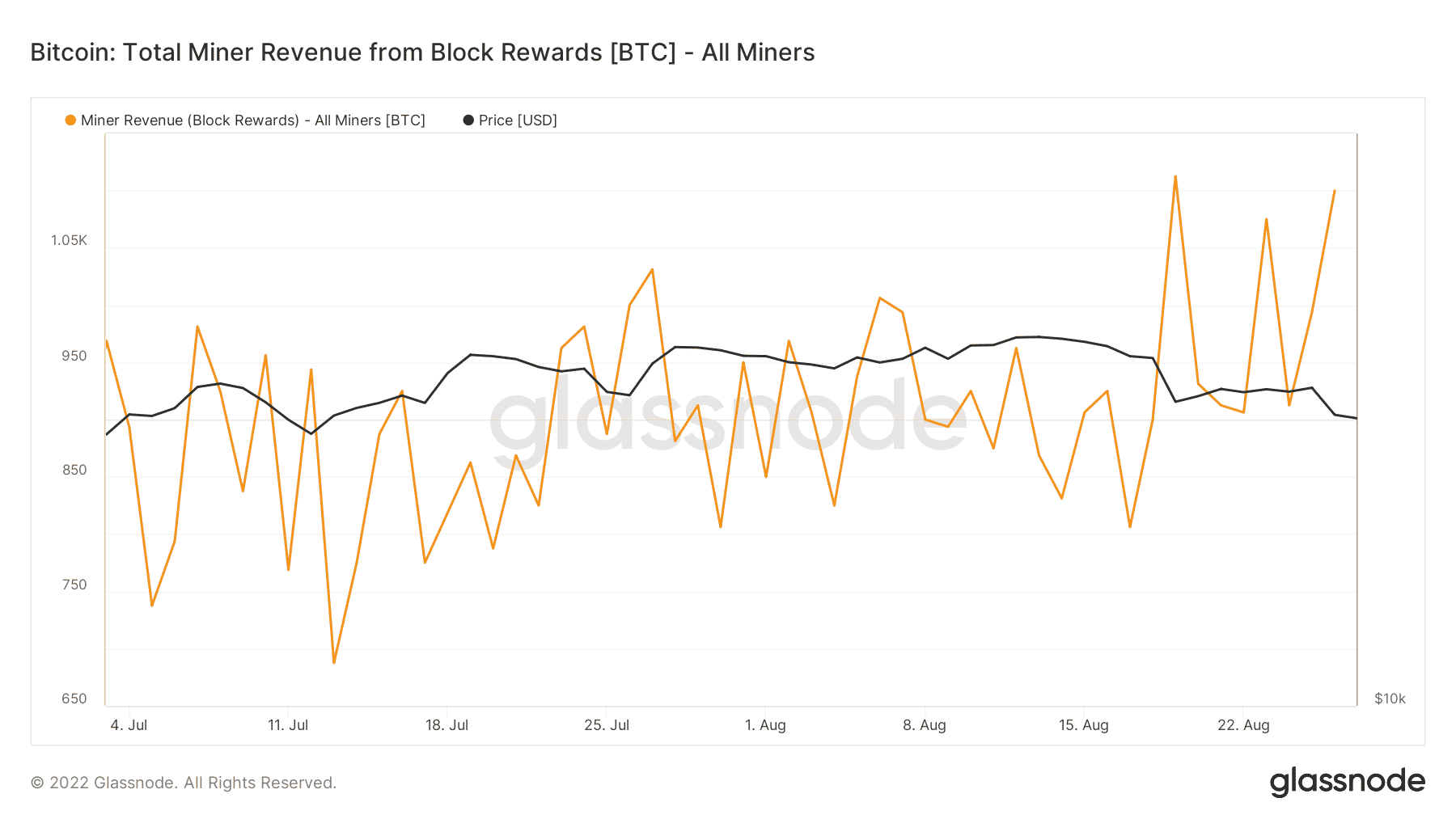

Additionally, a look at Glassnode showed that miners have not been so profitable lately. As such, taking such a decision to keep selling was almost inevitable. Miners’ revenue, which was 1,060 BTC as of 4 September, had fallen to 80.85 at the time of writing.

However, the CryptoQuant report did not point out miners as the only ones guilty of selling. BTC whales have also been pumping their holdings into exchanges in a bid to sell. Just like the miners, there was the possibility of a continued trend.

Be warned

Interestingly, BTC miners do not have only one headache to cure. This is because miners in the United States have been issued a stern warning. According to the report from the White House, miners may need to find a lasting solution to the energy consumption or risk facing a ban.

The decision may have been expected, especially as crypto mining activities had increased in the country. However, finding a means to ensure that the green energy proposed for mining settles the dispute may be the most critical concern for miners.