Bitcoin Cash [BCH] reclaims the $150 price level but…

Bitcoin Cash [BCH] is among the top gainers in the last seven days after going through another strong bullish phase. An interesting outcome considering that it showed signs of a potential bearish retracement after its mid-month rally.

It delivered a substantial pullback on 25 July, setting precedence for a bearish week but it has turned out to be a bear trap.

BCH bulls managed to push above the $150 price during 28 July’s trading session after a previous faux bearish attempt. This is a critical price level because it was the cryptocurrency’s lowest price level in May. BCH has not only managed to reclaim this level but also push past it to its $158 press time price.

Its price chart reveals a breakout from its descending wedge pattern. However, its ability to hold on above the $150 price level might be put to the test especially now that the price is already overbought as indicated by the Relative Strength Index (RSI).

Is there incoming selling pressure?

Bitcoin Cash is up roughly 36% in the last three days and such gains are bound to start attracting some selling pressure. This is because some investors looking for short-term profits may opt to sell considering the uncertainty behind the recession.

BCH’s on-chain metrics may provide some clarity with regards to the potential for more upside or a likely reversal.

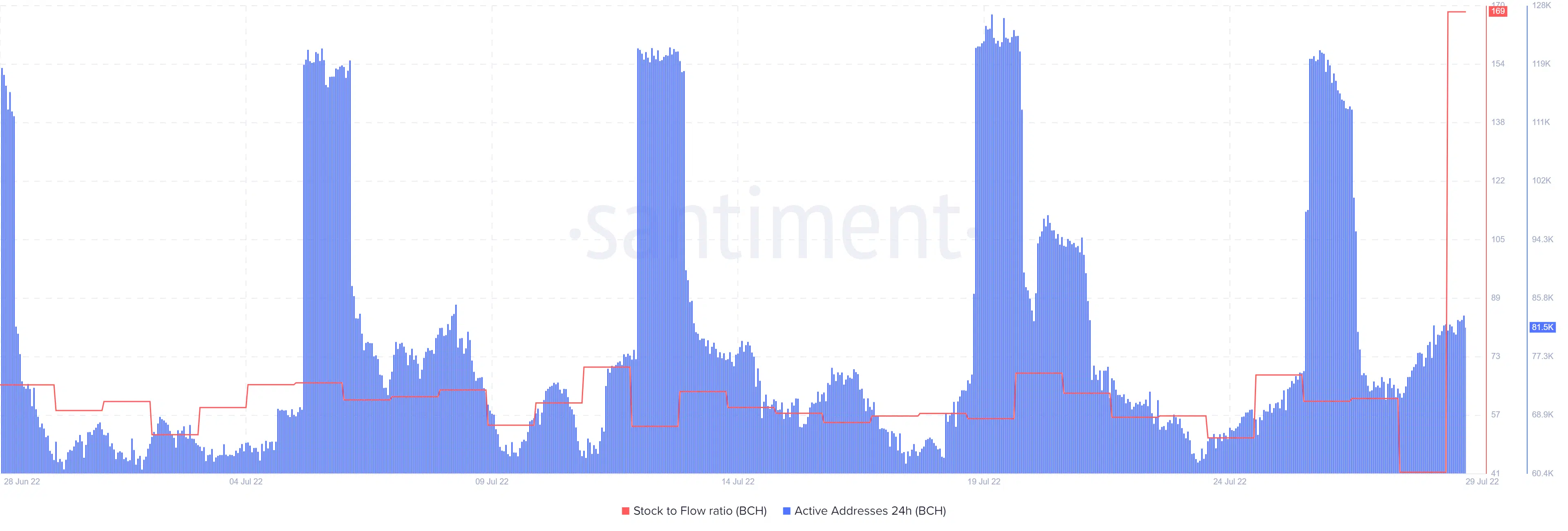

The cryptocurrency’s stock-to-flow ratio is currently at its highest monthly level courtesy of the latest upside. This means BCH is now scarcer on exchanges than it has been in the last four weeks.

Meanwhile, the number of active addresses has increased especially in the last 24 hours.

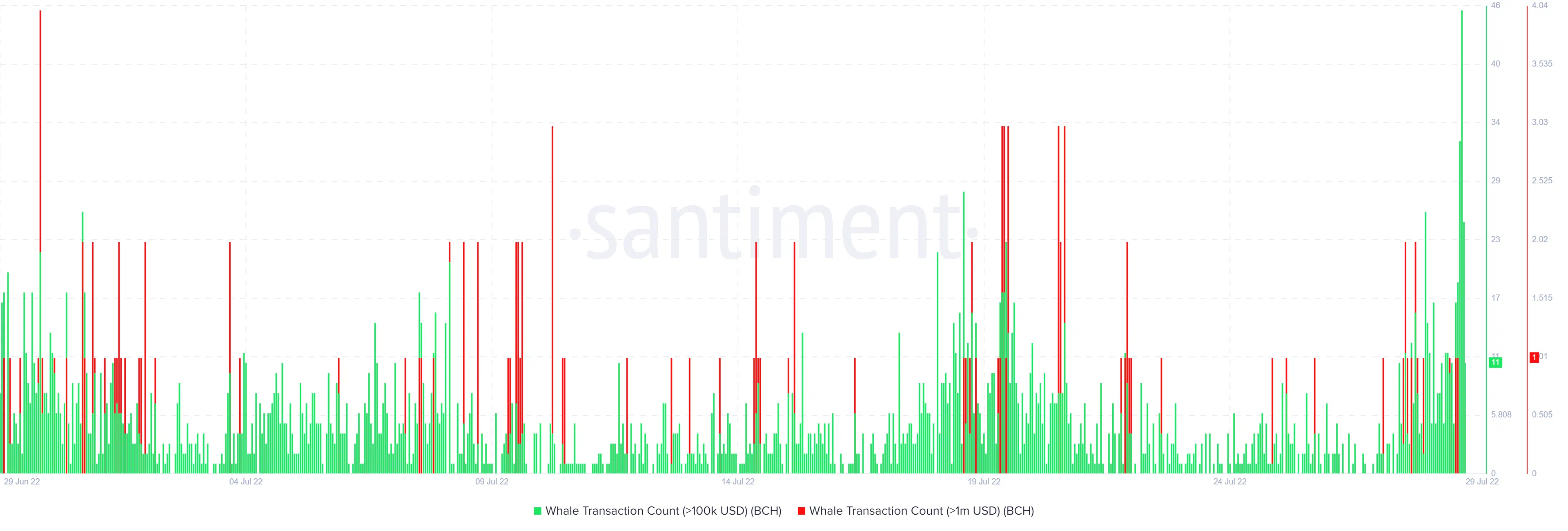

While the above metrics may look like they support more upside, whale transaction counts may provide a different picture. The number of whale transactions peaked at 26 on 28 July, but they established a new high at 33 in the last 24 hours.

However, BCH only managed a slight upside on 29 July compared to the strong rally on 28 July.

This observation suggests that some, if not most of the whale activity in the last 24 hours at press time might have been profit-taking. It would explain why the rally was limited compared to the previous day.

Additionally, BCH is expected to experience significant selling pressure especially now that it is in overbought territory. However, investors should note that the market has been in recovery mode and may continue to rally.

This means that any potential retracement will potentially be limited if the market maintains its currently bullish trajectory.