Bitcoin could rally once more – Watch out for this on USDT’s chart

- The stablecoin supply ratio hinted at a bearish sentiment.

- The Tether Dominance chart could be useful for determining BTC’s local top

Bitcoin [BTC] formed a range after crossing the $50k threshold, which was also a psychological resistance level. The bullish momentum had stalled, although the higher timeframe market structure remained bullish.

Tether [USDT] trading volumes picked up strongly over the past month as altcoin and BTC prices soared higher.

The institutional demand for BTC is likely to grow through 2024. Millions of dollars continued to flow into Bitcoin ETFs.

AMBCrypto’s look at some stablecoin metrics and the USDT Dominance chart proved insightful.

The stablecoin supply ratio trends upward once more

Data from CryptoQuant showed that the Stablecoin Supply Ratio (SSR) saw a sharp drop from the 8th to the 23rd of January. It has since risen higher than the January highs.

The rise of the SSR metric showed that the buying power of the press stablecoin supply was lowered relative to Bitcoin.

Given Bitcoin’s price trajectory in the past month, this was understandable. But the SSR rally also indicates possible bearish sentiment — though we are yet to see strong evidence of that.

The market cap of Bitcoin rose from $755 billion on 23rd January’s lowest point to stand at $1.013 trillion.

Similarly, the market cap of the altcoins, excluding Ethereum [ETH], rose from $439.86 billion to $546.7 billion at press time.

Whether the market would continue to register gains could be better understood by examining stablecoin metrics.

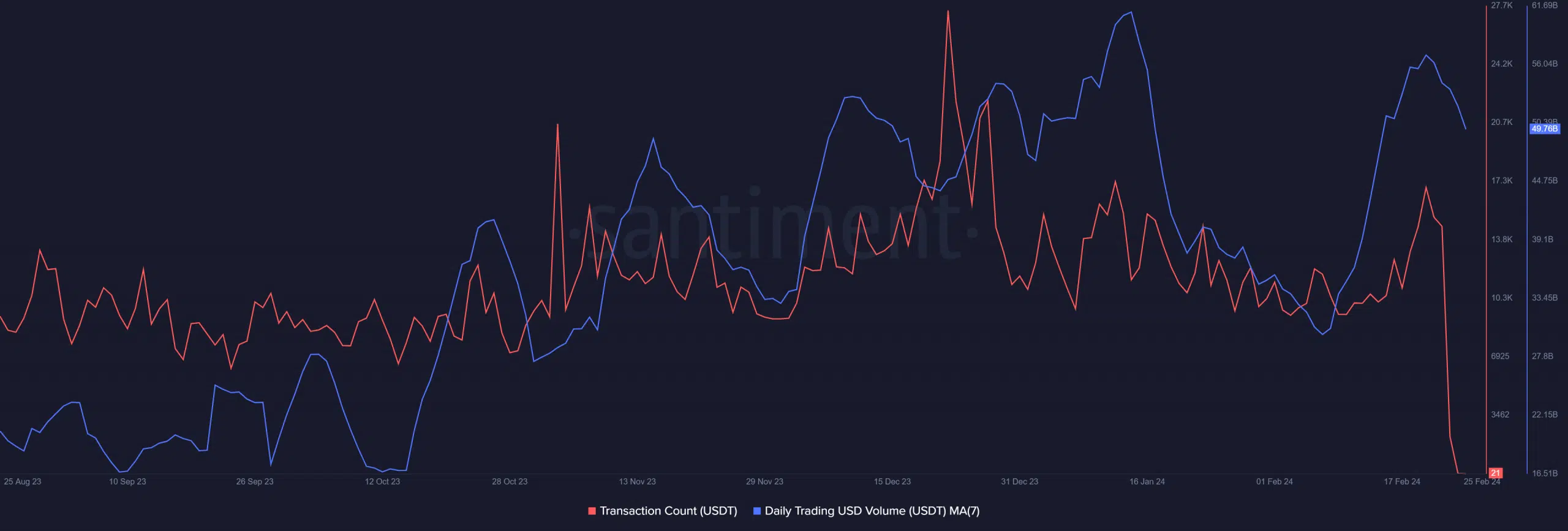

USDT transaction count has trended lower in 2024

Source: Santiment

AMBCrypto looked at Tether metrics on Santiment. The trading volume saw a strong resurgence in February after falling in January.

This was consistent with the rally in prices that we saw since the 23rd of January, which was also accompanied by an increase in trading volumes.

The transaction count has trended down since the latter half of December. It picked up in mid-February but was nowhere near the December highs.

The USDT Dominance chart is a measure of Tether’s market capitalization, as a percentage of the total crypto market cap. The D3 chart from TradingView showed that it has trended downward since early November.

Is your portfolio green? Check out the BTC Profit Calculator

At press time, the dominance was at 5.09%. Technical analysis showed the 4.9% level was a strong support.

If the dominance chart falls lower than 4.9%, it would be a strong indication that Bitcoin is set to rally beyond the $53k resistance to reach $58k. The altcoin markets would also follow the price surge.