Bitcoin, cryptos are ‘Wall Street with new technologies’

Individuals and even institutions have realized the power of cryptocurrencies. Over the years, traditional financial institutions have begun dipping their toes into digital assets while many others choose to stay out of this pool. Any FOMO concerns here?

Well, crypto-tokens have fueled a transformation like nothing seen before – as per this executive of a firm that manages over $2 billion in institutional assets

Eric Peters, Founder, CEO, and CIO of One River Digital Asset Management recently appeared on the Bankless podcast to present his views on the subject.

“I think it is a transformation and definitely is the most interesting macro opportunity and macro investment thesis I’ve seen in my career.”

He called this domain “the Wall Street with new technologies.”

“The connection to legacy financial systems — let’s call it Wall Street with new technologies — is going to first happen in the pools of capital directed by a limited number of people as opposed to some big investment committee.”

Nevertheless, he encouraged everyone at his firm and its clients to think about the resistance crypto is facing as an opportunity. Consider this – The firm entered the crypto-space in November 2020 when it bought over $600 million in Bitcoin and Ethereum. Since November 2020, clients have gained a massive $1.2 billion from that investment.

He also opined,

“The power of these [crypto] technologies hold the potential to lead to dystopia or renaissance. The path toward renaissance is consistent with the development of Bitcoin.”

Having said that, not all firms and their executives adhere to the same school of thought. It’s natural for some institutions to not fully embrace crypto because of regulatory concerns and constraints. However, those who took the leap – reaped the benefits.

He further noted,

“If they could all do it right now, Coinbase wouldn’t exist if legacy financial institutions were able to take the risk that those guys took. Look at the value they created.”

According to Peters, companies getting involved in crypto-infrastructure will lead the way to a more innovative future. Whereas for others, there has been “no lost sleep” over why legacy institutions aren’t getting involved.

“[Maybe] they don’t want to tear down what they built for a new opportunity.”

BUT are they missing out on something?

According to Peters, certainly yes. Digital assets provide younger generations the opportunity to gain control and the power to topple the “quasi-corrupt edifice that was built to not favor the younger generations.” Peters added,

“We have this huge imbalance and all of a sudden this new technology magically appears and could provide the lever to re-balance the system.”

Moreover,

“There’s always a risk that people lose faith in fiat, and that is a risk that has existed throughout the history of mankind.”

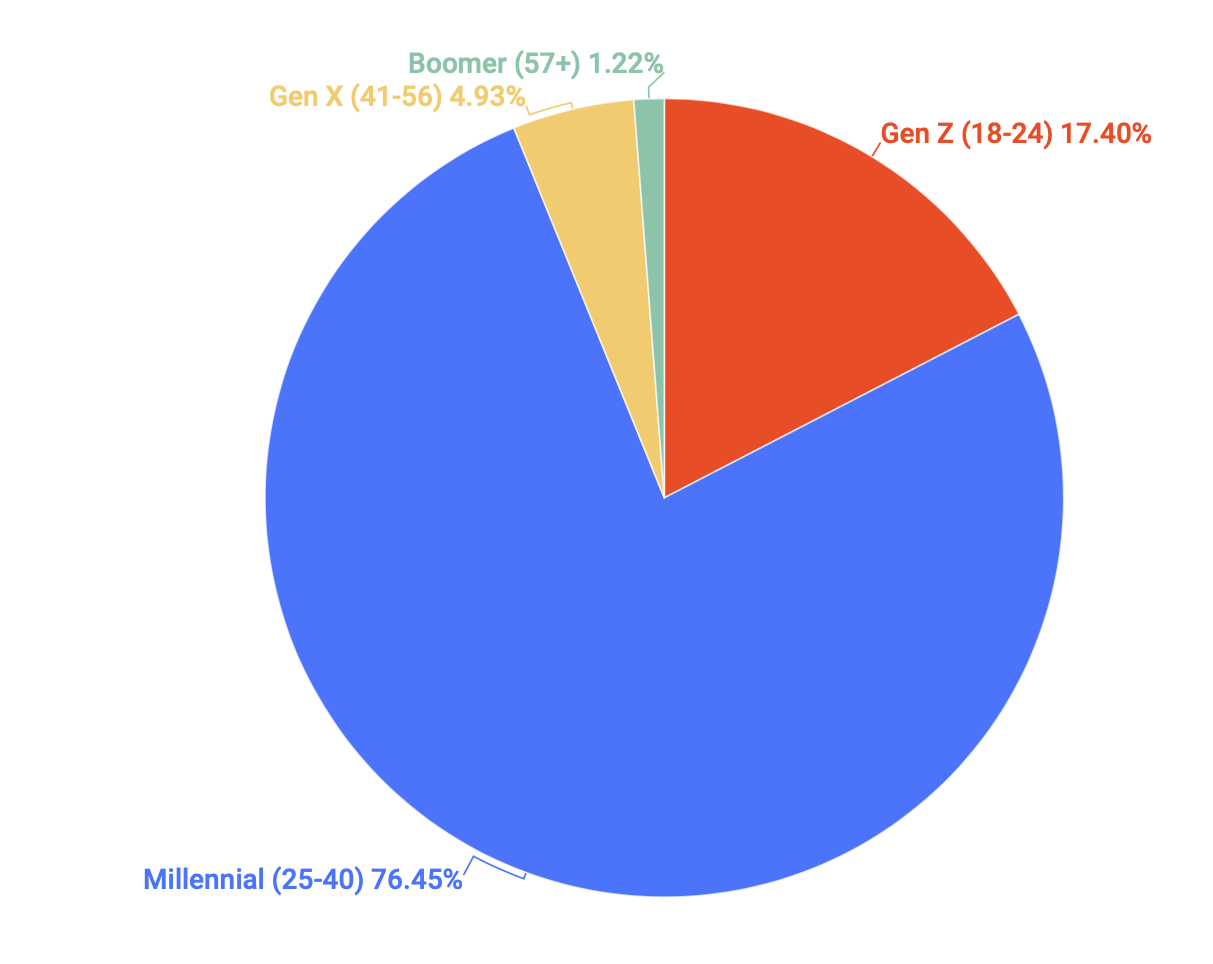

For instance, look at the following insights for reference (94% of Crypto Buyers were Gen Z/Millennial).

Source: Stilt

Now, the question that remains is this – Is the cryptocurrency market still in its nascent stages? We’ll have to wait and watch.