Bitcoin drops to $25K after Binance lawsuit

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

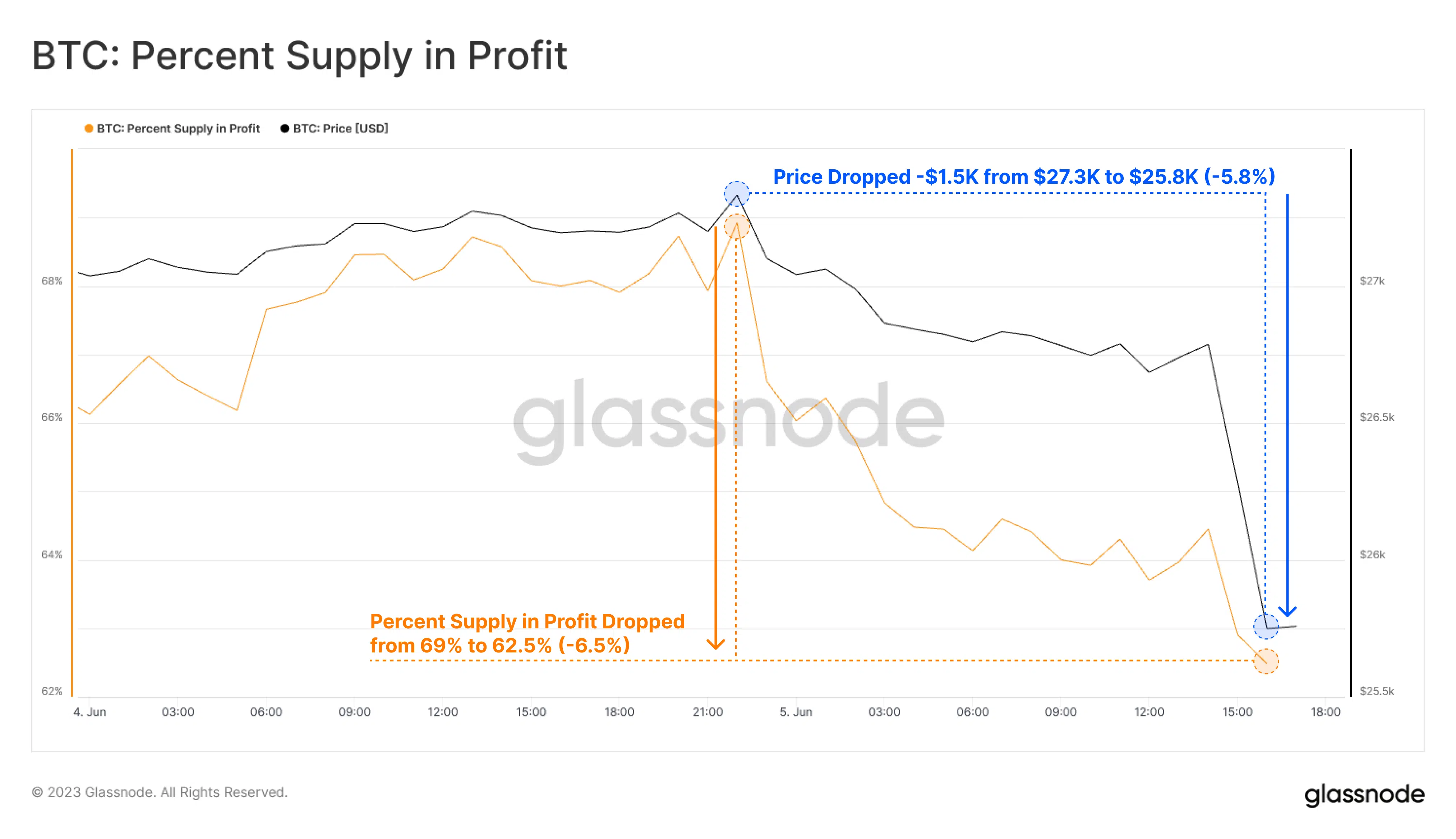

- Binances’ legal woes saw BTC plunge to the $25k level.

- The downswing has cut supply on profit from 69% to 62.5%.

The US continued to pile regulatory pressure on cryptocurrencies, with Binance Exchange on the radar again. After a previous CFTC filing in March, the US SEC filed 13 new charges on 5 June against Binance – the world’s largest crypto exchange.

Is your portfolio green? Check out the BTC Profit Calculator

Bitcoin [BTC] reacted negatively to the development, dropping below $26k and setting a new low in Q2.

Recent price fluctuations below $27k have seen more BTC transactions in loss as uncertainty makes holders uneasy. At press time, the crypto “Fear and Greed” index was “Fear,” denoting that investors were worried about the market.

BTC retreats towards 50% Fib level

A Fibonacci retracement tool (yellow) was placed between the recent swing high ($31k) and the swing low ($19.5k). Since hitting a new high of $31k in mid-April, BTC’s price action has been below a trendline resistance line (white), highlighting the increasing downtrend momentum in Q2.

The golden pocket of 61.8% Fib level ($26.6k) has been a crucial support from late March. It has been retested several times but eventually cracked on Monday following the Binance lawsuit.

However, sellers could further dent prevailing bullish sentiment if they clear the hurdle at the 50% Fib level ($25.27k). Below it, likely support levels lay at $23.9k and $22k.

But bulls could regain leverage if BTC reclaims the golden 61.8% Fib level ($26.6k). Nevertheless, bulls can only push forward and hit $28.5k if they clear the trendline resistance roadblock. The next key resistance level after $28.5k is $29.8k.

Meanwhile, the OBV has remained eerily stagnant since late March, denoting unchanged and limited trading volumes. Similarly, the RSI edged to the lower ranges, highlighting intensified selling pressure.

BTC’s supply in profit shredded by 5%

How much are 1,10,100 BTCs worth today?

As per Glassnode, the sharp BTC’s drop from $27k to $25k saw the percent of supply in profit decline from 69% to about 62.5%. It’s worth noting that the huge volume of supply in profit made it impossible for BTC to move beyond $28k as the level was a marked profit target.

It remains to be seen if BTC will inflict a corrective bounce with the focus now on the Binance lawsuit and next week’s FOMC meeting.